N o t e s t o t h e f i n a n c i a l s t a t e m e n t s

Year ended 31 March 2015

3 Significant accounting policies (continued)

(r)

New standards and interpretations

A number of new standards, amendments to standards and interpretations that have been issued as of the reporting

date but are not yet effective for the financial year ended 31 March 2015 have not been applied in preparing these

financial statements. None of these are expected to have a significant effect on the financial statements of the Group

and the Trust. The Group does not plan to adopt these standards early.

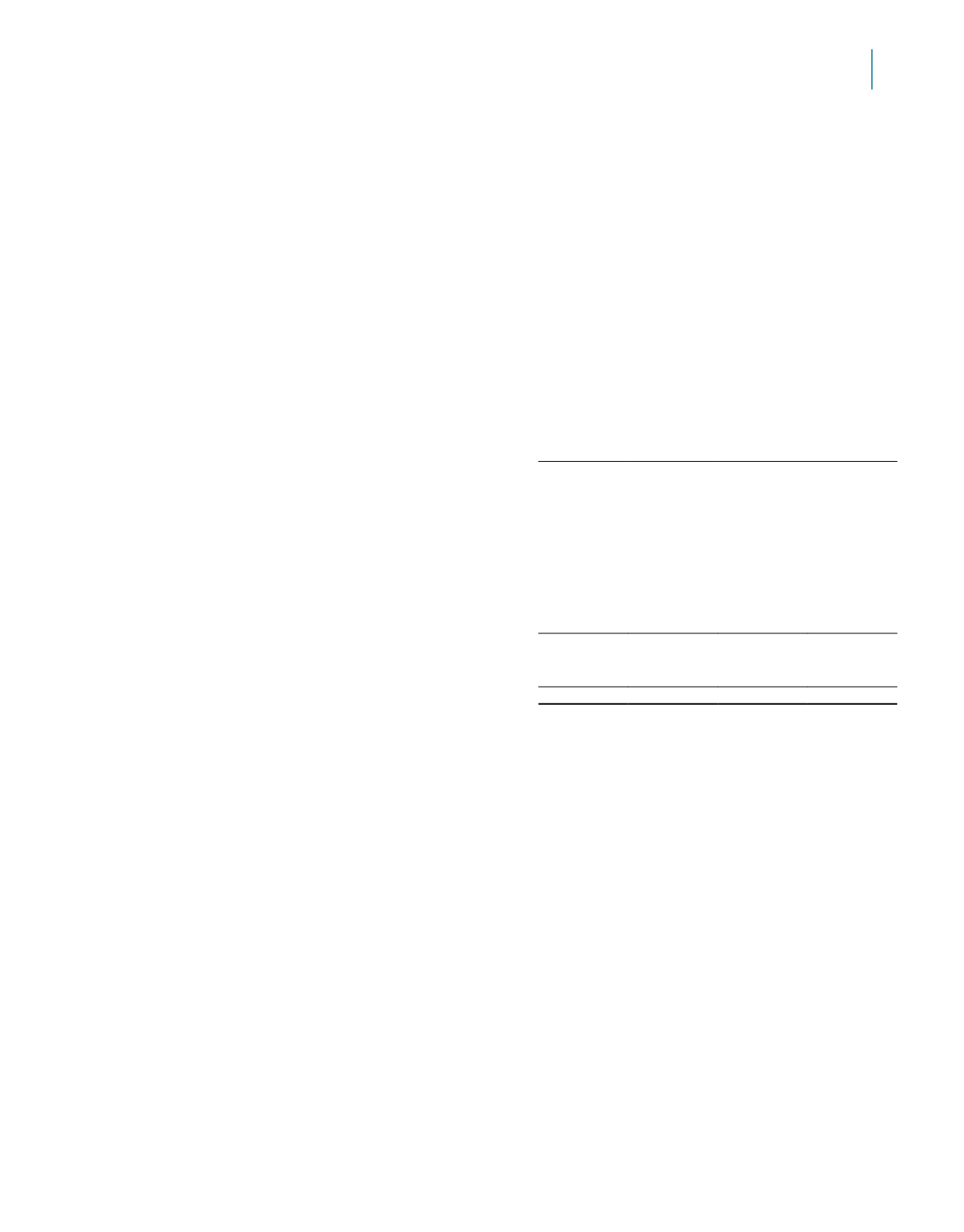

4 Investment properties

Group

Trust

Note 2015

2014

2015

2014

$’000

$’000

$’000

$’000

(Restated)

At 1 April

6,922,966 6,447,054 6,651,419 6,378,190

Acquisition of investment properties

308,190

– 801,190

–

Acquisition of a subsidiary

459,888 123,611

–

–

Transfer from investment property under development

5

– 181,313

– 181,313

Transfer to property held for sale

(24,800)

(10,500)

(24,800)

(10,500)

Capital expenditure incurred

130,967 102,933 128,260 101,244

Transfer from plant and equipment

39

–

–

–

Disposals

–

(57,100)

–

(57,100)

Effects of movement in exchange rates

23,648

4,542

–

–

7,820,898 6,791,853 7,556,069 6,593,147

Net appreciation on revaluation (unrealised) recognised

in the Statement of Total Return

47,032 131,113

2,711

58,272

At 31 March

7,867,930 6,922,966 7,558,780 6,651,419

Investment properties are stated at fair value based on valuations performed by independent professional valuers as at

31 March 2015 except for The Kendall, which was acquired on 30 March 2015 and was recorded at the costs incurred

upon acquisition.

In the current financial year, 26 Senoko Way was transferred from investment properties to property held for sale, following

the proposed divestment of the property. The carrying value of the property was $24.8 million as at 31 March 2015. The

divestment was completed in April 2015 (Note 35).

In the previous financial year, Nexus @one-north was transferred from investment property under development to investment

properties, upon completion of the development. In addition, 1 Kallang Place was transferred from investment properties

to property held for sale, following the proposed divestment of the property. The divestment was completed in May 2014.

There was no cumulative income or expense recognised in the Statement of Total Return relating to the property held for

sale for both years.

As at the reporting date, investment properties with an aggregate carrying amount of $1,093,240,000 (2014:

$2,613,870,000) have been pledged as collateral for the Exchangeable Collaterised Securities and certain term notes issued

by the Group (Note 16 and 17).

158 159