CAPITAL & RISK MANAGEMENT

As at 31 March 2015, A-REIT’s balance sheet remained strong with its aggregate leverage at 33.5%. With a debt headroom of

around S$1.7 billion before aggregate leverage reaches 45%, A-REIT is well-positioned to seize investment opportunities when

they arise.

In March 2013, the Manager raised S$406.4 million through a private placement to fund its investments. The proceeds had since

been fully deployed for the acquisition of The Galen in March 2013 and to part-fund the acquisition of Aperia and its related

transaction costs in August 2014.

A-REIT’s weighted average term of debt is 3.6 years as at 31 March 2015 with a weighted average all-in borrowing cost of 2.7%

per annum. Interest rate swaps are used to manage or hedge the interest rate exposure of its debts. About 68.2% of A-REIT’s

borrowing is hedged with a weighted average term of 3.7 years.

In FY14/15, A-REIT fully redeemed its

€

197.5 million (S$395 million equivalent) Commercial Mortgage Backed Securities (“CMBS”)

issued in 2007 via debt issues and bank debt. The proportion of unencumbered investment properties increased to 86.1% as at

31 March 2015 from 62.2% one year ago.

During the year, the Manager issued about S$298 million worth of Notes (comprising of HKD620 million 3.5-year Notes, S$95

million 5-year Notes, and HKD640 million 15-year Notes) under its Medium Term Note Programme. The Manager also secured

two S$100 million 5–year Term Loan Facilities. All the notes and loans were competitively priced and they further diversified

A-REIT’s source of funds. The funds were used to refinance short-term borrowings and the CMBS, and to partially or fully fund the

acquisitions of Hyflux Innovation Centre, Aperia and The Kendall.

As at 31 March 2015, none of the investors of the S$300 million Exchangeable Collateralised Securities (“ECS”) exercised their

option to convert their ECS holdings into A-REIT units. The ECS will mature on 1 February 2017.

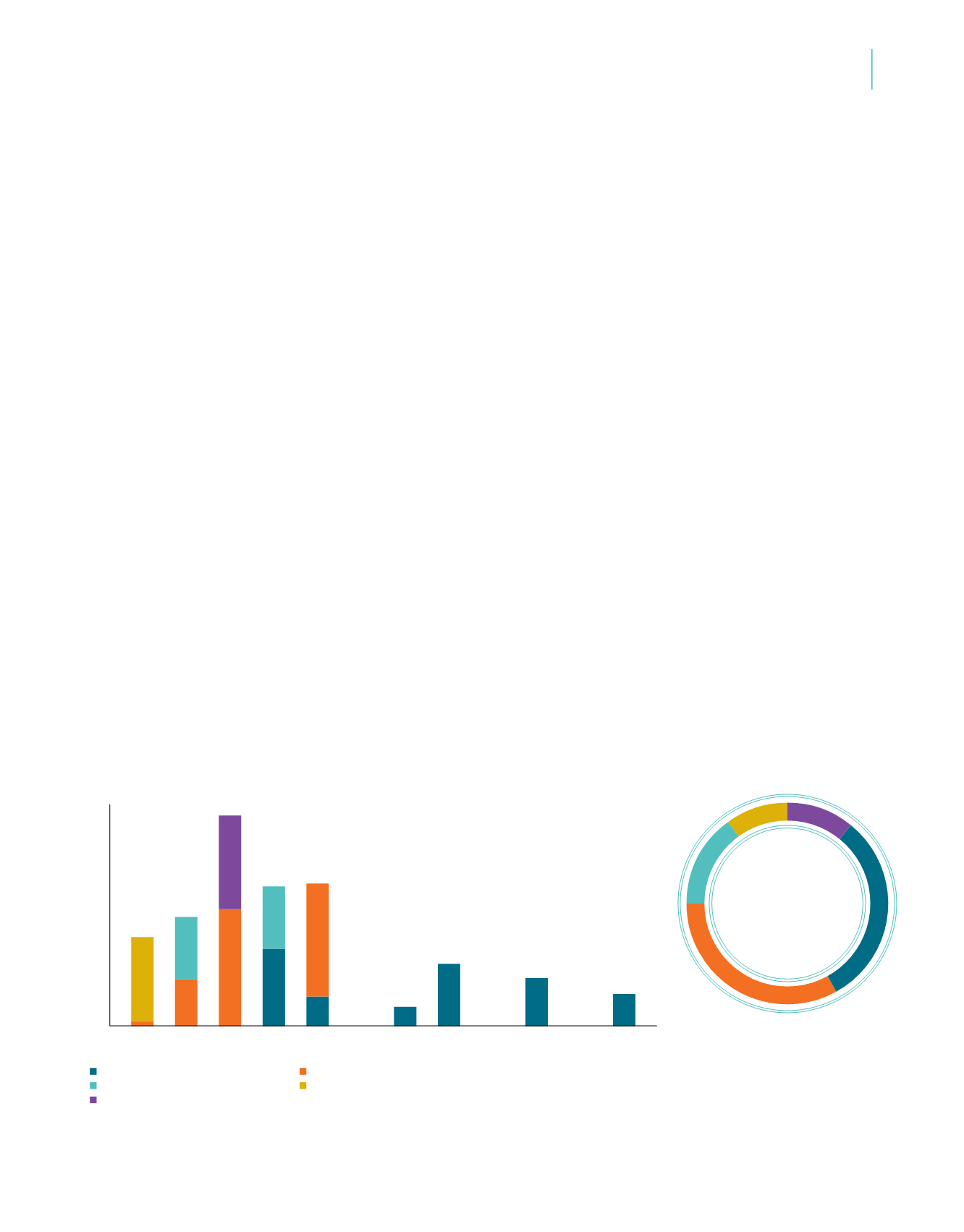

To minimise refinancing risk, the Manager intends to continue to keep a well-spread debt maturity profile.

Debt Maturity Profile and Sources of Debt (as at 31 March 2015)

S$’m

700

600

500

0

300

100

400

200

2015

2019

2017

2021

2023

2016

2020

2018

2022

2024

//

2029

270

150

200

375

248

362

95

62

200

154

103

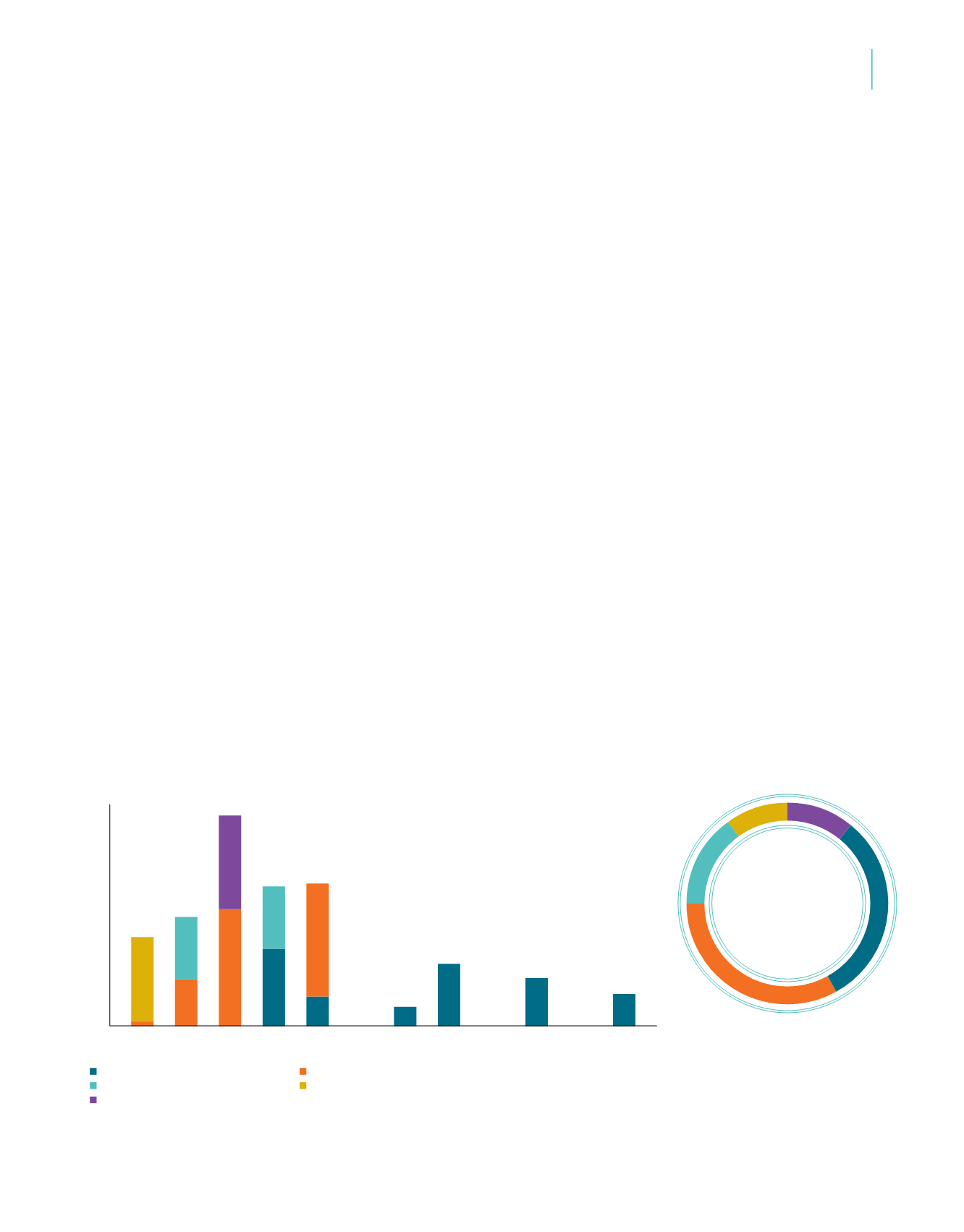

11%

33%

15%

10%

31%

200

300

16

Medium Term Notes

Committed Revolving Credit Facilities

Exchangeable Collateralised Securities (ECS)

Term Loan Facilities

Revolving Credit Facilities

36 37