Figure 7: Shanghai Business Parks Vacancy Rate

(2008 to 2014)

Source: Colliers International

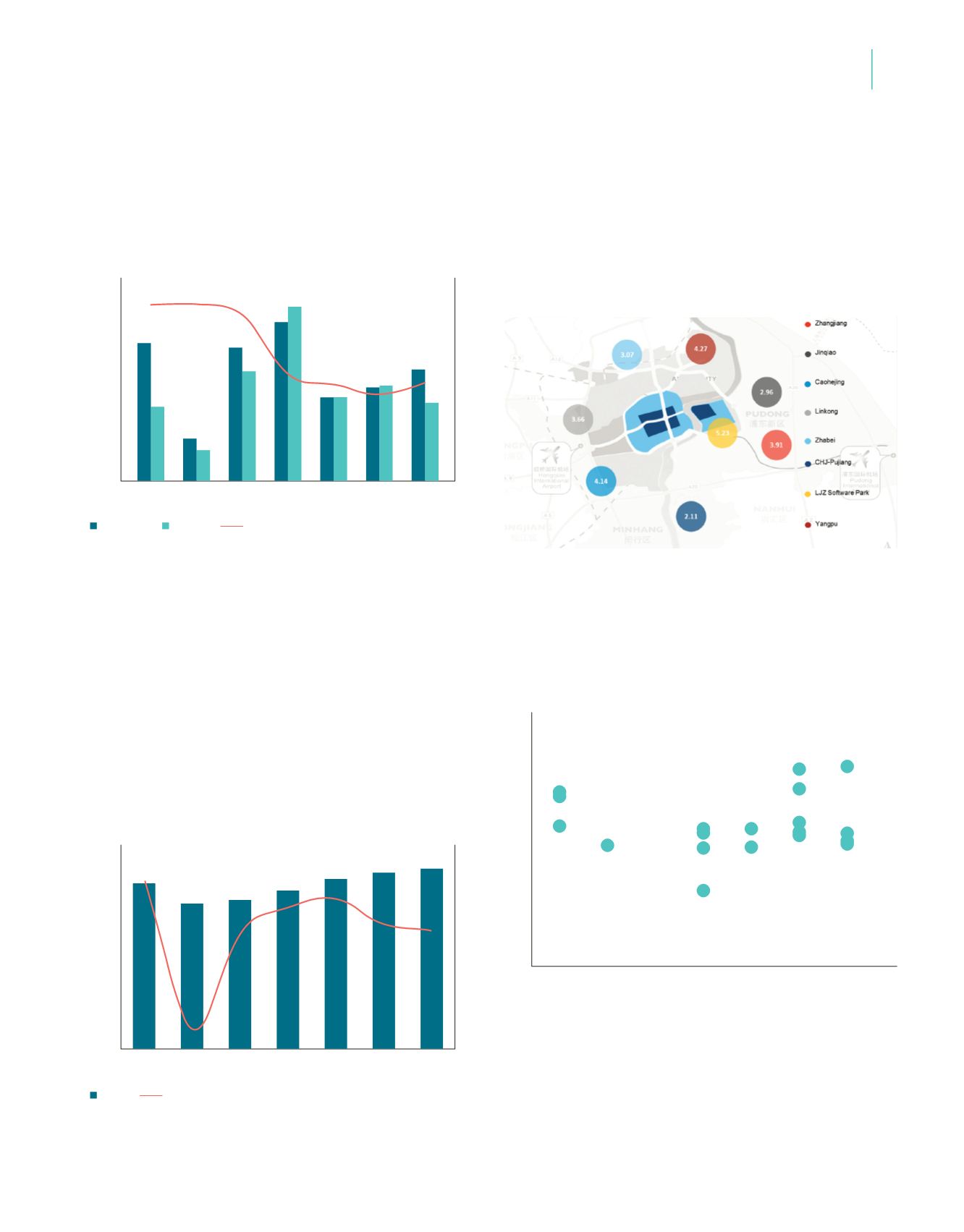

5. Rental

Currently, new supply of higher than average quality premises

is supporting general market rental increases with average

leasing rates for space in Shanghai’s business parks reaching

approximately RMB 3.6 per square metre per day by the end

of 2014. Rental growth has decelerated since 2012 given the

increasing amount of new supply and correspondingly stronger

competition; the compound annual rental growth rate over the

past three years (2011 to 2014) is around 5 percent.

Figure 8: Shanghai Business Parks Average Rental

and Rental Growth (2008 to 2014)

Source: Colliers International

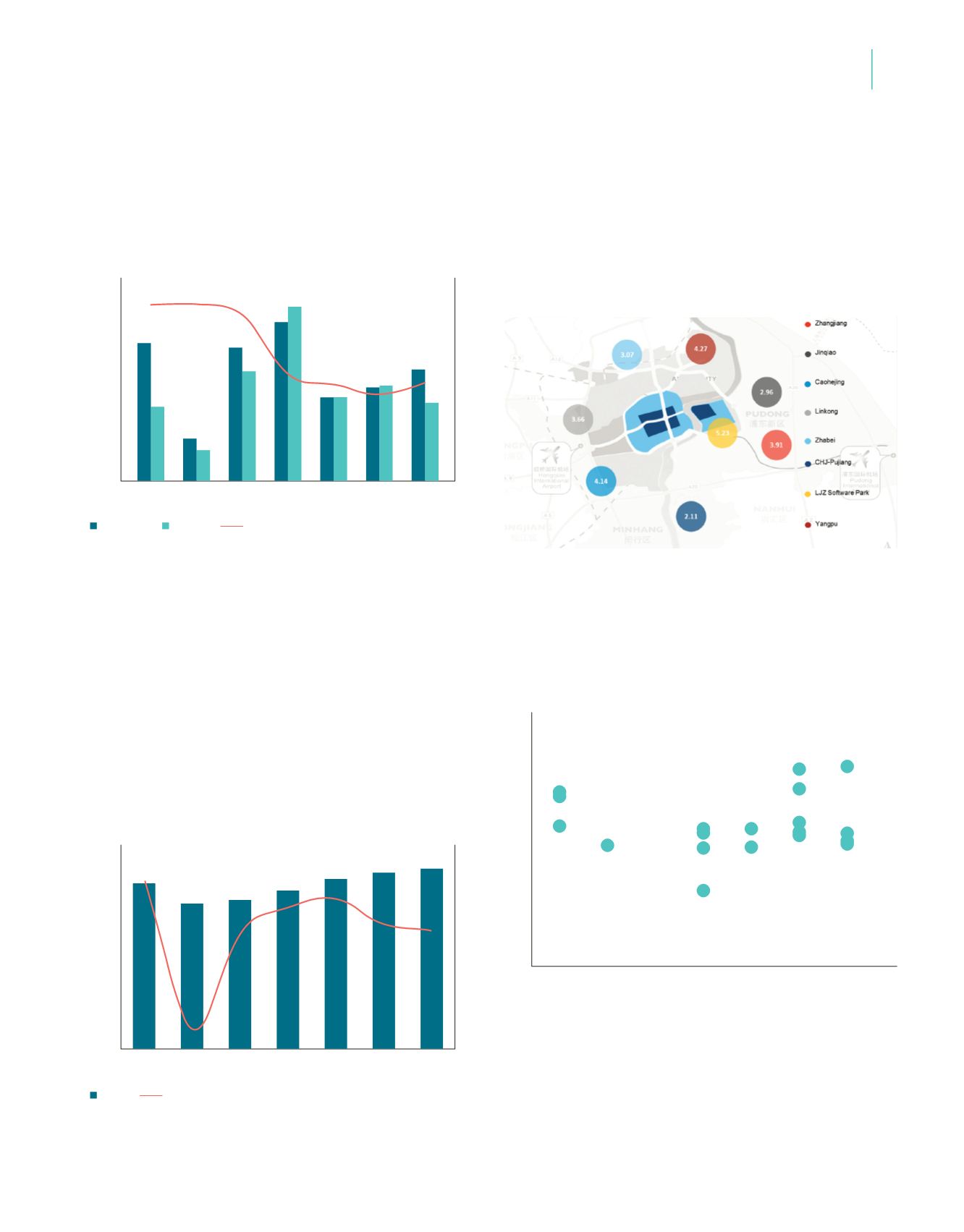

In terms of submarket, LJZ Software Park records the highest

rentals, followed by Yangpu and Caohejing areas. Currently

the lowest rental levels are seen in Caohejing Pujiang.

Map 2: Shanghai Business Parks Average Rental by Area

(2H2014)

Unit: RMB per sqm per day rental of last quarter/RMB psm per day rental of

this quarter (%) refers to vacancy rate

Source: Colliers International Shanghai Research

6. Gross Yield

Figure 9: Shanghai Business Parks Gross Yield

(2008 to 2014)

Source: Colliers International

The gross yields in business parks generally ranged between 6

percent and 9 percent as of the end of 2014, approximately 1

to 2 percentage points higher than downtown in some cases;

however yields vary dramatically on a location and project basis.

831

448

186

661

1,048

258

805

505

566 576

674

472

957

Thousand square metres

RMB per square metre per day

New Supply

Rental

Demand

1,200

4.00

15%

12%

8%

10%

6%

4%

2%

0%

3.00

5%

1.50

-10%

0.50

3.50

10%

2.00

-5%

2.50

0%

1.00

0.00

-15%

30%

0%

10%

20%

5%

15%

25%

1,000

800

600

400

200

0

2008

2010

2012

2009

2011

2013

2014

26.5%

10.0%

6.1%

-12.1%

7.4%

2.4%

3.7% 2.6%

26.6% 25.0% 16.0% 14.6% 13.1% 14.8%

Vacancy

Rental Growth

2008

2010

2012

2009

2011

2013

2014

3.30

2.90

2.97

3.15

3.38

3.51

3.60

2008

2010

2012

2009

2011

2013

2014

8.4%

8.1%

6.7%

5.8%

6.4% 6.6%

9.4% 9.6%

6.4%

5.8%

6.0%

8.5%

6.9%

6.3%

6.2%

5.7%

6.5%

5.7%

3.6%

506

72 73