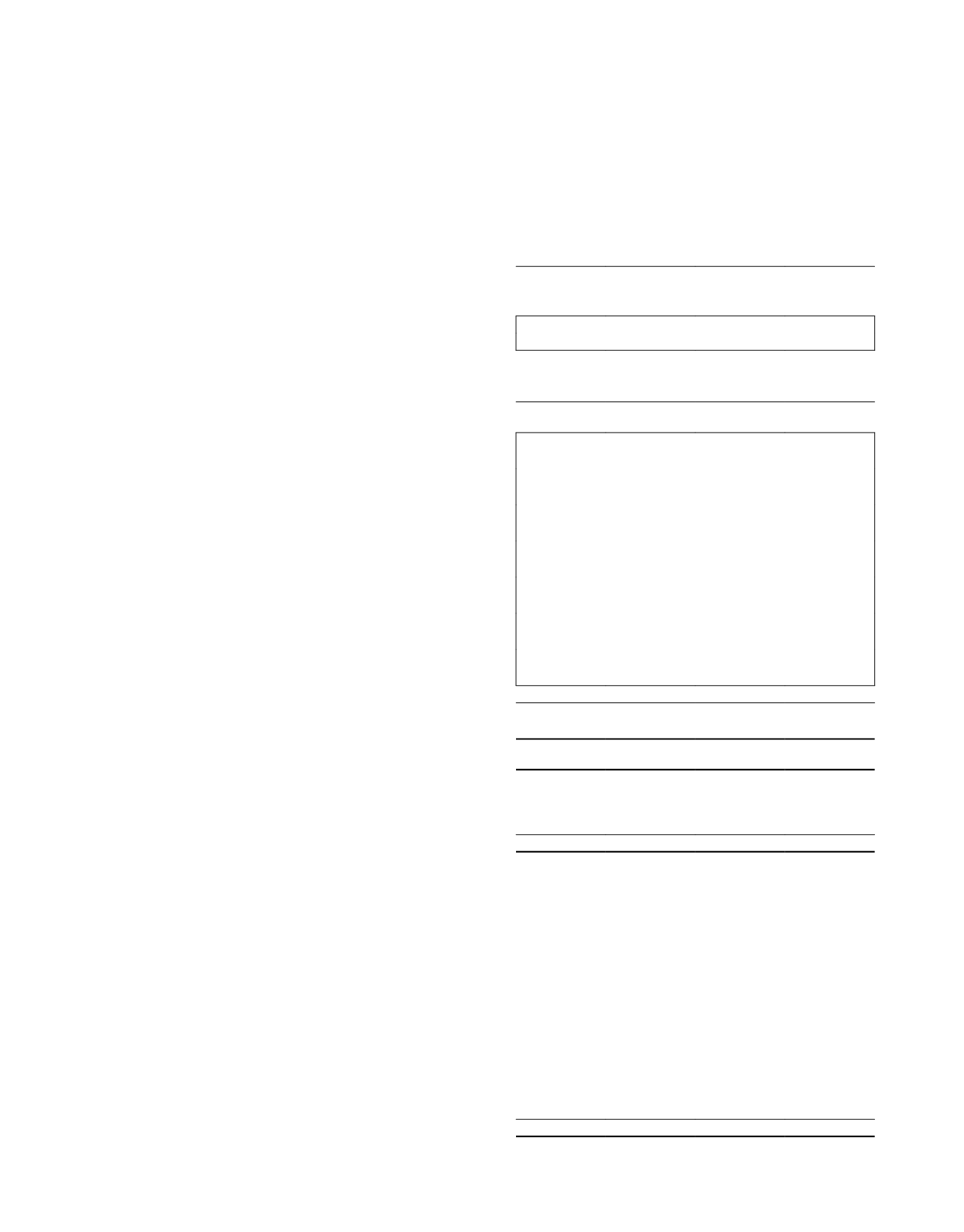

Group

Trust

2015

2014

2015

2014

$’000

$’000

$’000

$’000

(Restated)

Total amount available for distribution to

Unitholders at beginning of the year

85,693

69,503

85,693

69,503

Total return for the year

397,600 481,968 342,505 426,662

Distribution adjustments (Note A)

(50,086)

(142,612)

5,009

(87,306)

347,514

(1)

339,356

(1)

347,514

(1)

339,356

(1)

Tax-exempt income (prior periods)

2,166

1,245

2,166

1,245

Distribution from capital (prior periods)

1,460

1,404

1,460

1,404

Total amount available for distribution to Unitholders for the year

351,140 342,005 351,140 342,005

Distribution of 7.30 cents per unit for the

period from 01/04/14 to 30/09/14

(175,496)

–

(175,496)

–

Distribution of 3.55 cents per unit for the

period from 01/01/14 to 31/03/14

(85,290)

– (85,290)

–

Distribution of 3.54 cents per unit for the

period from 01/10/13 to 31/12/13

–

(85,049)

–

(85,049)

Distribution of 3.60 cents per unit for the

period from 01/07/13 to 30/09/13

–

(86,431)

–

(86,431)

Distribution of 3.55 cents per unit for the

period from 01/04/13 to 30/06/13

–

(85,231)

–

(85,231)

Distribution of 0.37 cents per unit for the

period from 19/03/13 to 31/03/13

–

(8,876)

–

(8,876)

Distribution of 2.69 cents per unit for the

period from 01/01/13 to 18/03/13

–

(60,228)

–

(60,228)

(260,786)

(325,815)

(260,786)

(325,815)

Total amount available for distribution to

Unitholders at end of the year

176,047

85,693 176,047

85,693

Distribution per unit (cents)

14.60

14.24

14.60

14.24

(1)

Comprises:

– Taxable income

344,823 336,907 344,823 336,907

– Tax-exempt income

2,691

2,449

2,691

2,449

347,514 339,356 347,514 339,356

Note A - Distribution adjustments comprise:

Net change in fair value of financial derivatives

(36,805)

16,934 (36,805)

16,934

Net appreciation on revaluation of investment properties

(47,032)

(131,113)

(2,711)

(58,272)

Change in fair value of exchangeable collateralised securities

24,933

(18,426)

–

–

Change in fair value of collateral loan

–

–

24,933

(18,426)

Change in fair value of debt securities

16,574

(1,289)

16,574

(1,289)

Unrealised foreign exchange loss/(gain)

492

(19,730)

492

(19,556)

Management fee paid/payable in units

7,627

7,118

7,627

7,118

Trustee fee

2,323

2,146

2,323

2,146

(Income)/loss from subsidiaries

(10,431)

17,816

–

–

Transfer to general reserves

(343)

(107)

–

–

Gain on disposal of investment properties

(2,023)

(12,057)

(2,023)

(12,057)

Tax-exempt income

(8,905)

(6,110)

(8,905)

(6,110)

Others

3,504

2,206

3,504

2,206

Total distribution adjustments

(50,086)

(142,612)

5,009

(87,306)

The accompanying notes form an integral part of these financial statements.

D i s t r i b u t i o n S t a t e m e n t s

Year ended 31 March 2015

ASCENDAS REAL ESTATE INVESTMENT TRUST ANNUAL REPORT 2014/15