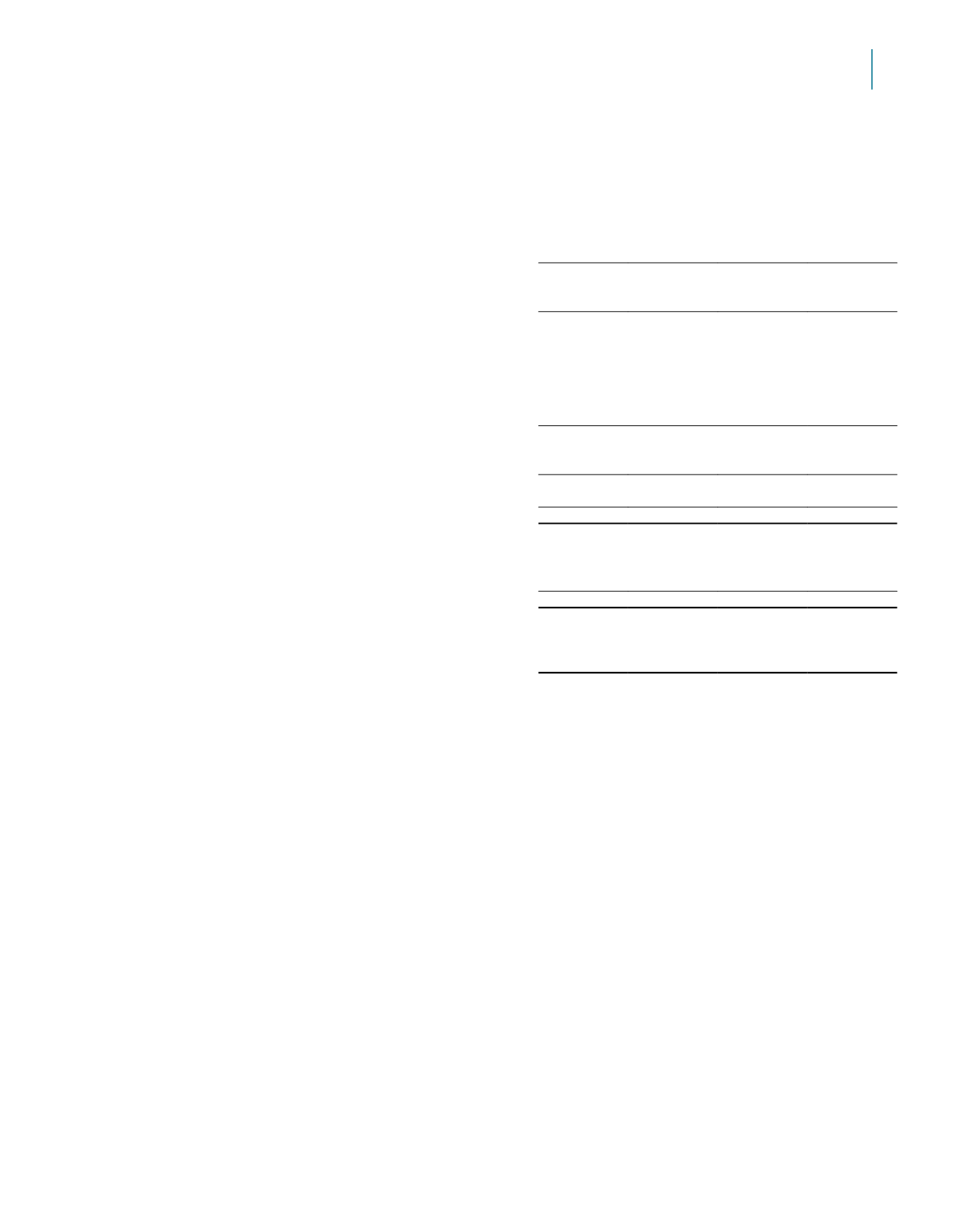

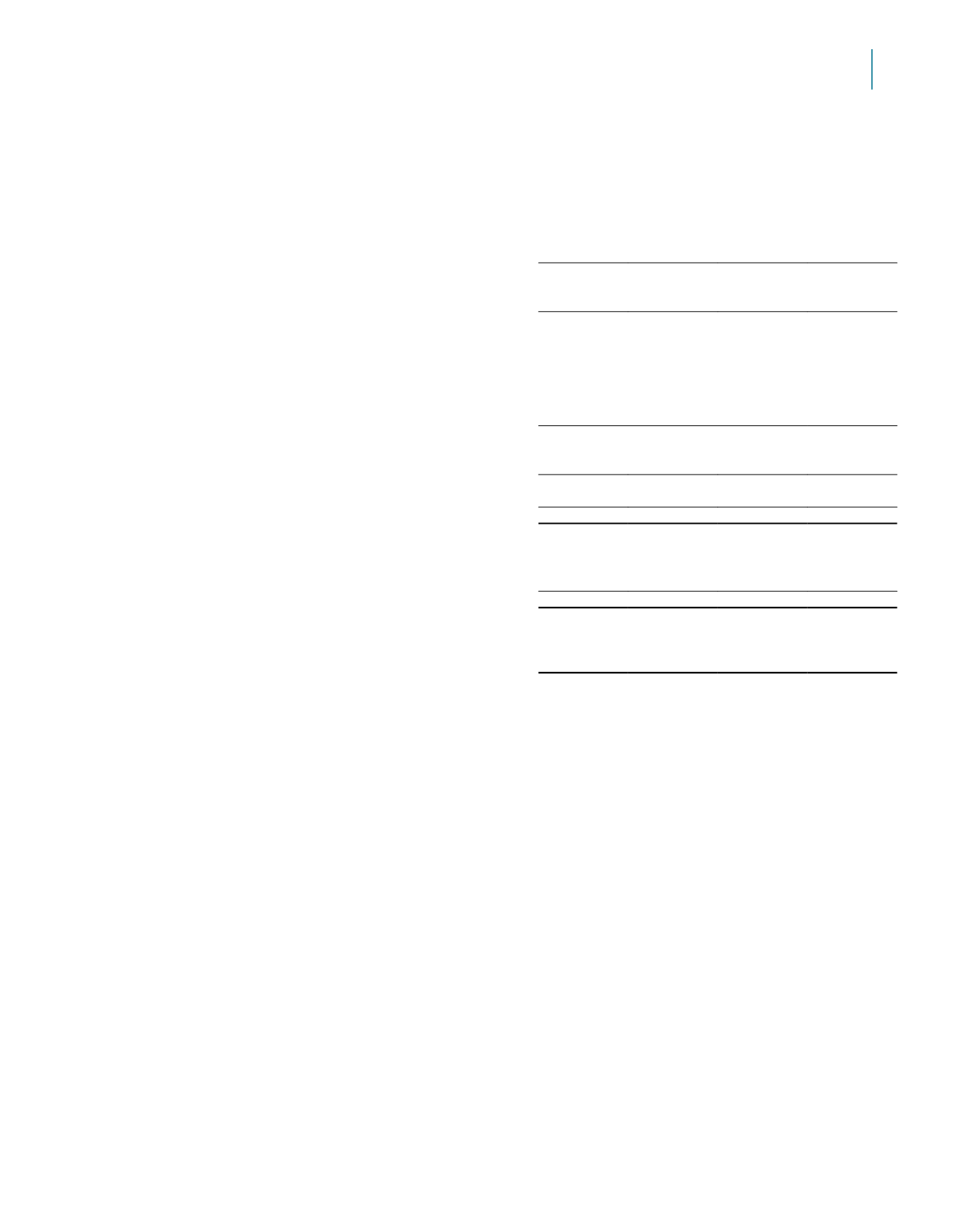

Group

Trust

Note 2015

2014

2015

2014

$’000

$’000

$’000

$’000

(Restated)

Gross revenue

21

673,487 613,592 655,370 605,692

Property operating expenses

22

(210,760)

(177,619)

(204,405)

(174,418)

Net property income

462,727 435,973 450,965 431,274

Management fee

23

(38,137)

(35,594)

(38,137)

(35,594)

Trust expenses

24

(5,629)

(5,188)

(4,441)

(4,885)

Finance income

25

8,273

30,459

8,362

30,353

Finance costs

25

(113,651)

(66,398)

(112,857)

(65,734)

Net foreign exchange (loss)/gain

(47,653)

(8,908)

(492)

19,556

Gain on disposal of investment properties

2,023

12,057

2,023

12,057

Net income

267,953 362,401 305,423 387,027

Net change in fair value of financial derivatives

89,363

11,574

36,805

(16,934)

Net appreciation on revaluation of investment properties

47,032 131,113

2,711

58,272

Total return for the year before tax

404,348 505,088 344,939 428,365

Tax expense

26

(6,743)

(23,244)

(2,434)

(1,703)

Total return for the year

397,605 481,844 342,505 426,662

Attributable to:

Unitholders of the Trust

397,600 481,968 342,505 426,662

Non-controlling interests

5

(124)

–

–

397,605 481,844 342,505 426,662

Earnings per unit (cents)

– Basic

27

16.54

20.07

14.25

17.77

– Diluted

27

16.54

18.45

14.25

16.27

S t a t e m e n t s o f T o t a l R e t u r n

Year ended 31 March 2015

The accompanying notes form an integral part of these financial statements.

122 123