N o t e s t o t h e f i n a n c i a l s t a t e m e n t s

Year ended 31 March 2015

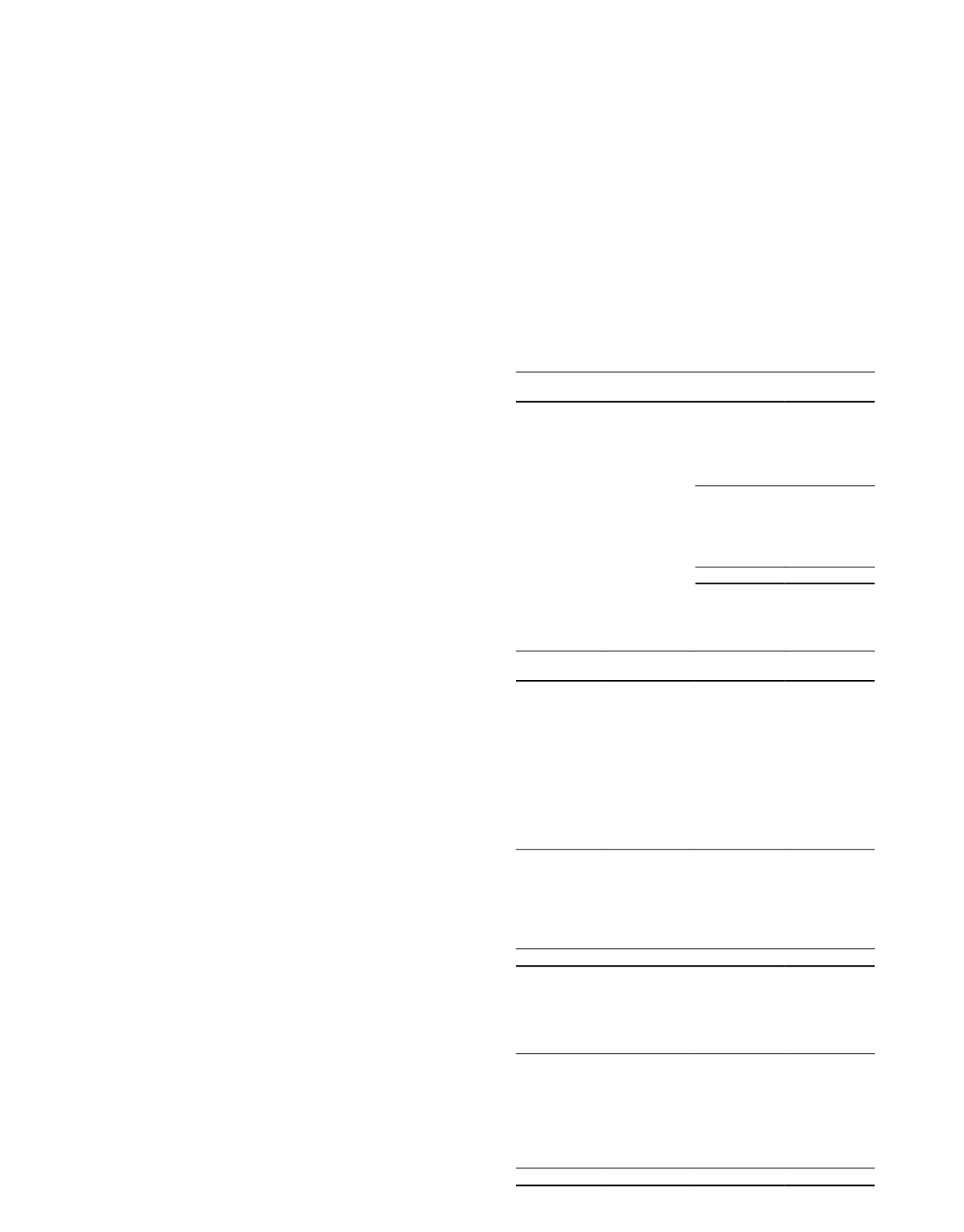

27 Earnings per unit and distribution per unit

(a) Basic earnings per unit

The calculation of basic earnings per unit is based on the total return for the year and weighted average number of

units during the year:

Group

Trust

2015

2014

2015

2014

$’000

$’000

$’000

$’000

(Restated)

Total return for the year

397,600 481,968 342,505 426,662

Group and Trust

Number of Units

2015

2014

(’000)

(’000)

Weighted average number of units:

– outstanding during the year

2,404,222 2,401,014

– to be issued as payment for management fee payable in units

3

3

– to be issued as payment for acquisition fee payable in units

1

–

2,404,226 2,401,017

Group

Trust

2015

2014

2015

2014

(Restated)

Basic earnings per unit (cents)

16.54

20.07

14.25

17.77

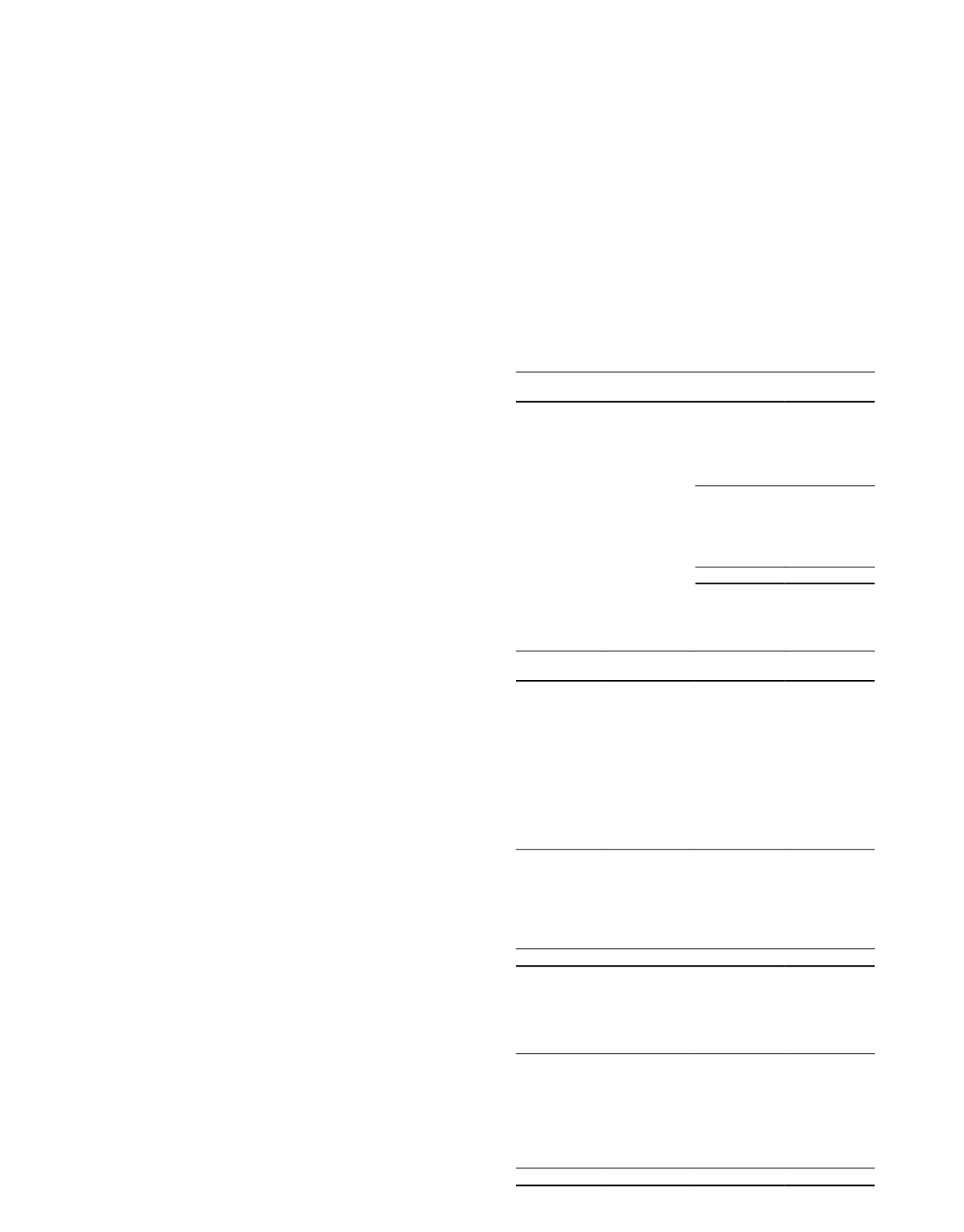

(b) Diluted earnings per unit

In calculating diluted earnings per unit, the total return for the year and weighted average number of units during

the year are adjusted for the effects of all dilutive potential units:

Group

Trust

2015

2014

2015

2014

$’000

$’000

$’000

$’000

(Restated)

Total return for the year

397,600 481,968 342,505 426,662

Interest expense on ECS

–

4,800

–

–

Interest expense on collateral loan

–

–

–

4,800

Change in fair value of ECS

–

(18,426)

–

–

Change in fair value of collateral loan

–

–

–

(18,426)

397,600 468,342 342,505 413,036

Group

Trust

Number of Units

Number of Units

2015

2014

2015

2014

(’000)

(’000)

(’000)

(’000)

Weighted average number of units

Weighted average number of units

used in calculation of basic earnings per unit

2,404,226 2,401,017 2,404,226 2,401,017

Effect of conversion of ECS

– 137,804

–

–

Effect of conversion of collateral loan

–

–

– 137,804

Weighted average number of units (diluted)

2,404,226 2,538,821 2,404,226 2,538,821

ASCENDAS REAL ESTATE INVESTMENT TRUST ANNUAL REPORT 2014/15