N o t e s t o t h e f i n a n c i a l s t a t e m e n t s

Year ended 31 March 2015

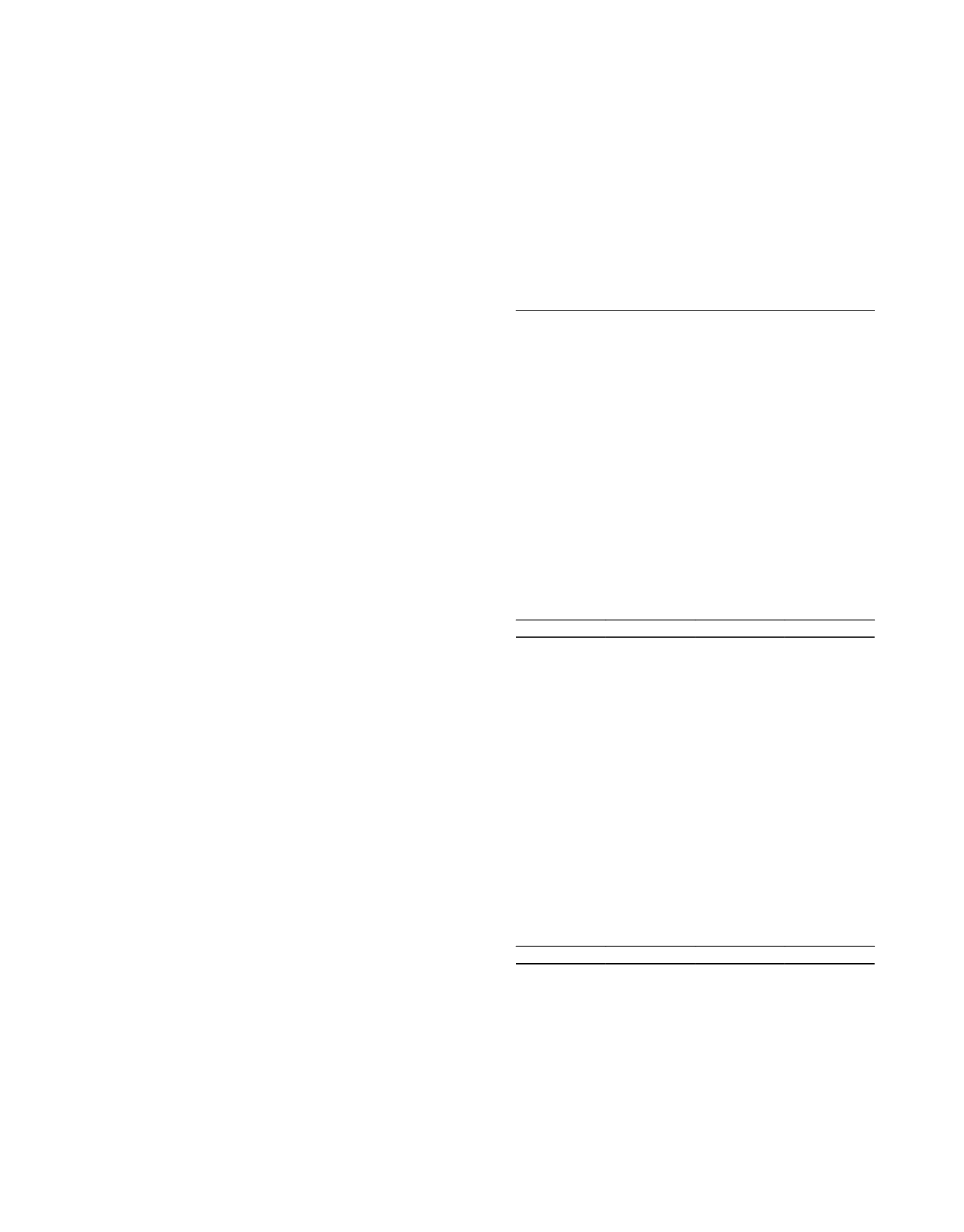

31 Financial risk management (continued)

Total

return

Unitholders’

funds

100 bp 100 bp 100 bp 100 bp

increase decrease increase decrease

$’000

$’000

$’000

$’000

Trust

2015

Fixed rate instruments

Loans and borrowings

– Finance costs

(3,191)

3,191

–

–

Collateral loan

– Finance costs

(3,000)

3,000

–

–

Variable rate instruments

Loans and borrowings

– Finance costs

(20,373)

20,373

–

–

Interest rate swaps

– Finance costs

11,382 (11,382)

–

–

– Change in fair value

24,574 (24,574)

3,244

(3,244)

Cross currency swaps

– Change in fair value

(4,290)

4,290

–

–

5,102

(5,102)

3,244

(3,244)

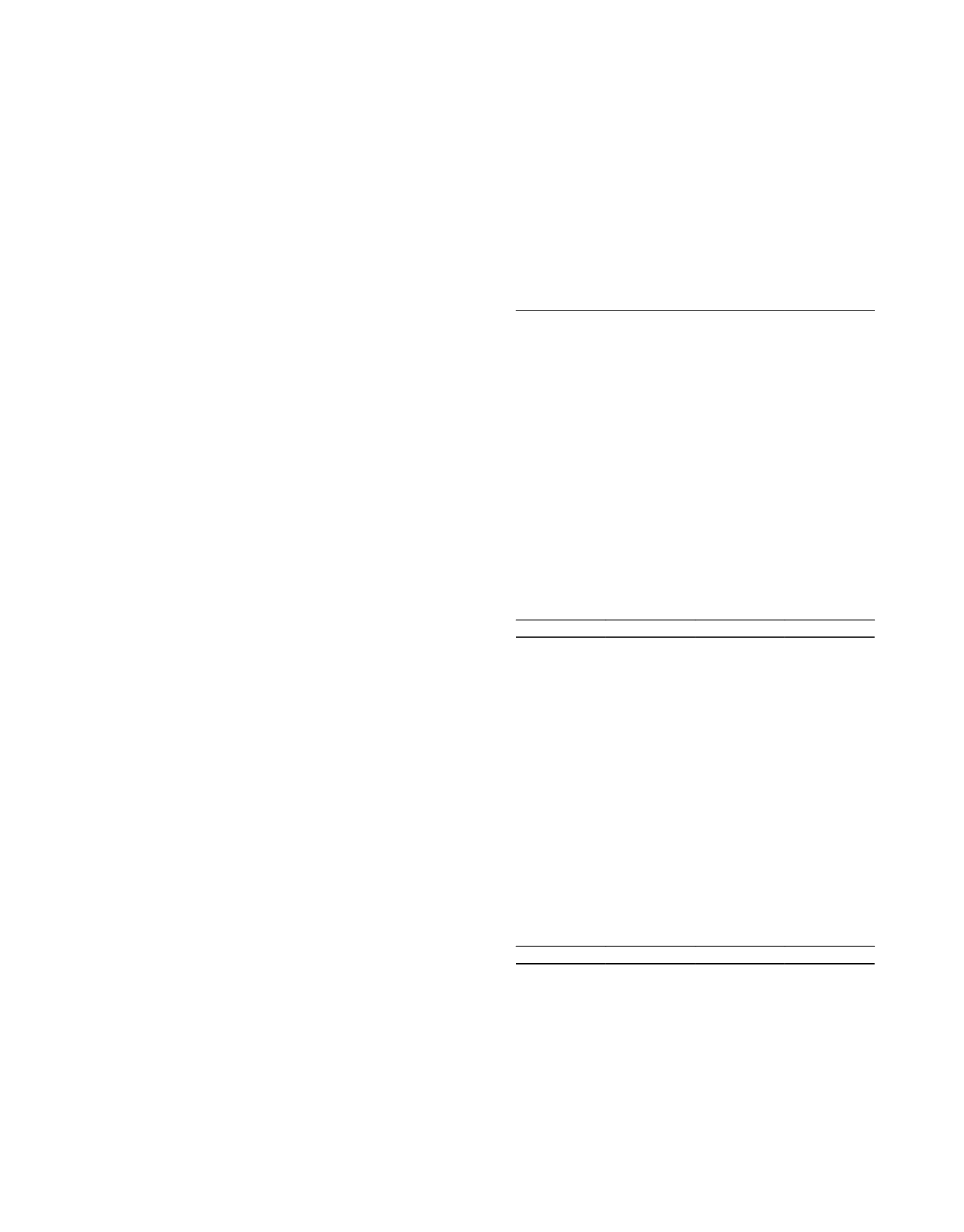

2014

Fixed rate instruments

Investment in debt securities

– Change in fair value

7

(7)

–

–

Loans and borrowings

– Finance costs

(4,399)

4,399

–

–

Collateral loan

– Finance costs

(3,000)

3,000

–

–

Variable rate instruments

Loans and borrowings

– Finance costs

(13,912)

13,912

–

–

Interest rate swaps

– Finance costs

7,882

(7,882)

–

–

– Change in fair value

11,517

(11,517)

5,651

(5,651)

Cross currency swaps

– Change in fair value

(5,564)

5,564

–

–

(7,469)

7,469

5,651

(5,651)

Market price risk

Market price risk arises from the Group’s ECS and Trust’s collateral loan which are accounted for as a financial liability at

fair value through profit or loss. The fair value of the collateral loan is determined based on the method described in Note

33. Changes in the market price of the ECS will result in changes in the fair value of the collateral loan. As at the reporting

date, a 1% increase in the ECS market price will result in a decrease on the total return (before any tax effects) of the Group

and the Trust of $3,660,000 (2014: $3,411,000). A 1% decrease in the market price of the ECS would have an equal but

opposite effect on the total return of the Group and the Trust. The analysis was performed on the same basis for 2014 and

assumes that all other variables remain the same.

ASCENDAS REAL ESTATE INVESTMENT TRUST ANNUAL REPORT 2014/15