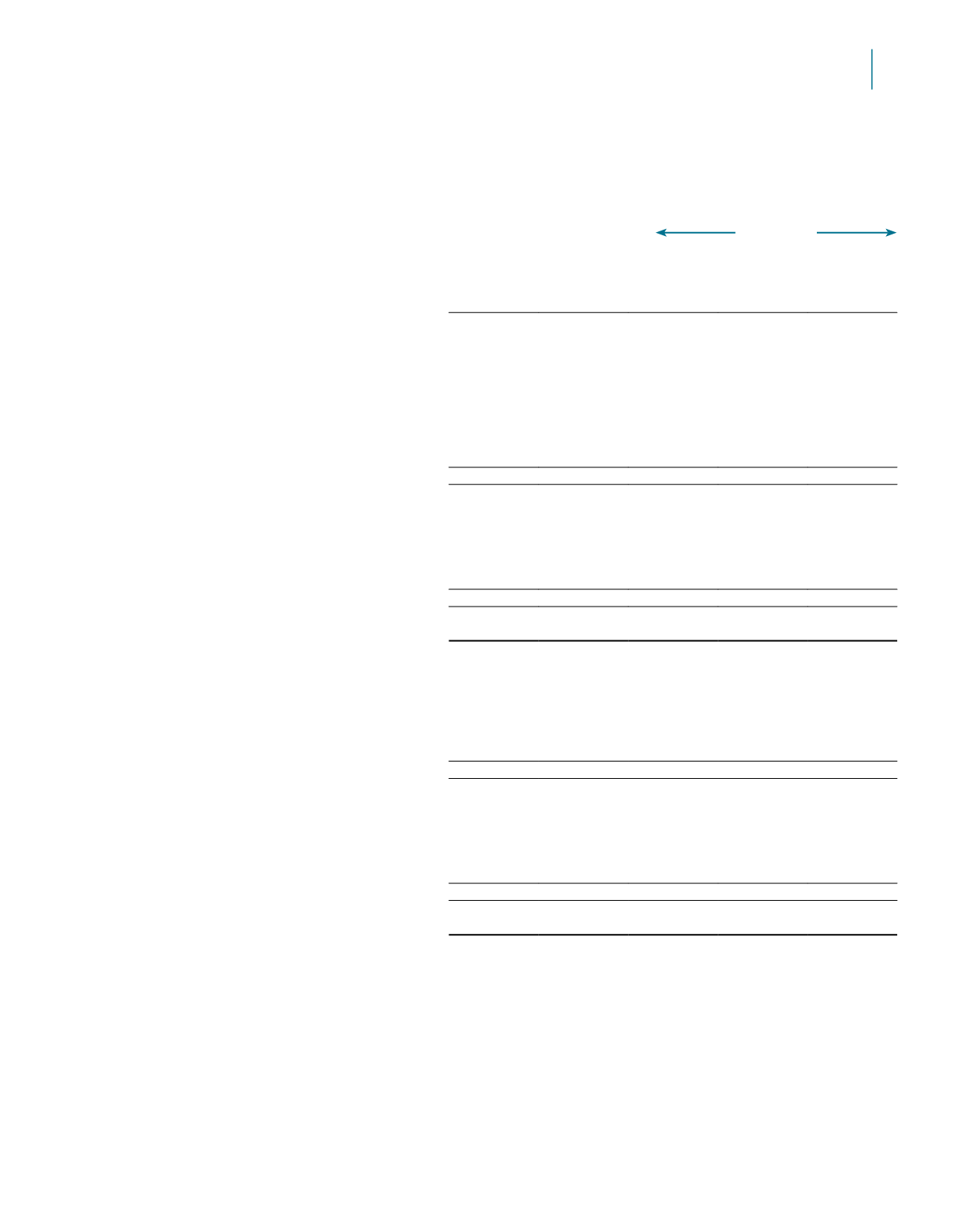

N o t e s t o t h e f i n a n c i a l s t a t e m e n t s

Year ended 31 March 2015

31 Financial risk management (continued)

Cash flows

Carrying

amount

Total

contractual

cash flows

Within

1 year

After 1 year

but within

5 years

After

5 years

$’000

$’000

$’000

$’000

$’000

Group

2015

Non-derivative financial liabilities

Loans and borrowings

2,361,700 2,661,581 330,238 1,745,405 585,938

Exchangeable collateralised securities

366,024 308,850

4,800 304,050

–

Trade and other payables

(1)

174,576 174,576 172,401

2,175

–

Security deposits

107,314 115,030

30,189

72,850

11,991

3,009,614 3,260,037 537,628 2,124,480 597,929

Derivative financial liabilities

Interest rate swaps designated as cash flow

hedges (net-settled)

2,585

2,710

1,625

1,085

–

Interest rate swaps (net-settled)

11,489

13,061

4,848

5,089

3,124

Cross currency swaps (net-settled)

74,701

82,591

5,744

55,333

21,514

88,775

98,362

12,217

61,507

24,638

3,098,389 3,358,399 549,845 2,185,987 622,567

2014 (Restated)

Non-derivative financial liabilities

Loans and borrowings

1,783,330 2,114,967 585,001 1,062,682 467,284

Exchangeable collateralised securities

341,091 304,037 304,037

–

–

Trade and other payables

(1)

103,544 103,544 103,544

–

–

Security deposits

85,962

91,622

28,812

53,593

9,217

2,313,927 2,614,170 1,021,394 1,116,275 476,501

Derivative financial liabilities

Interest rate swaps designated as cash flow

hedges (net-settled)

8,548

9,365

7,085

2,280

–

Interest rate swaps (net-settled)

26,680

29,437

7,867

12,150

9,420

Cross currency swaps (net-settled)

110,173 114,874

56,866

46,858

11,150

145,401 153,676

71,818

61,288

20,570

2,459,328 2,767,846 1,093,212 1,177,563 497,071

(1)

Excludes rental received in advance.

184 185