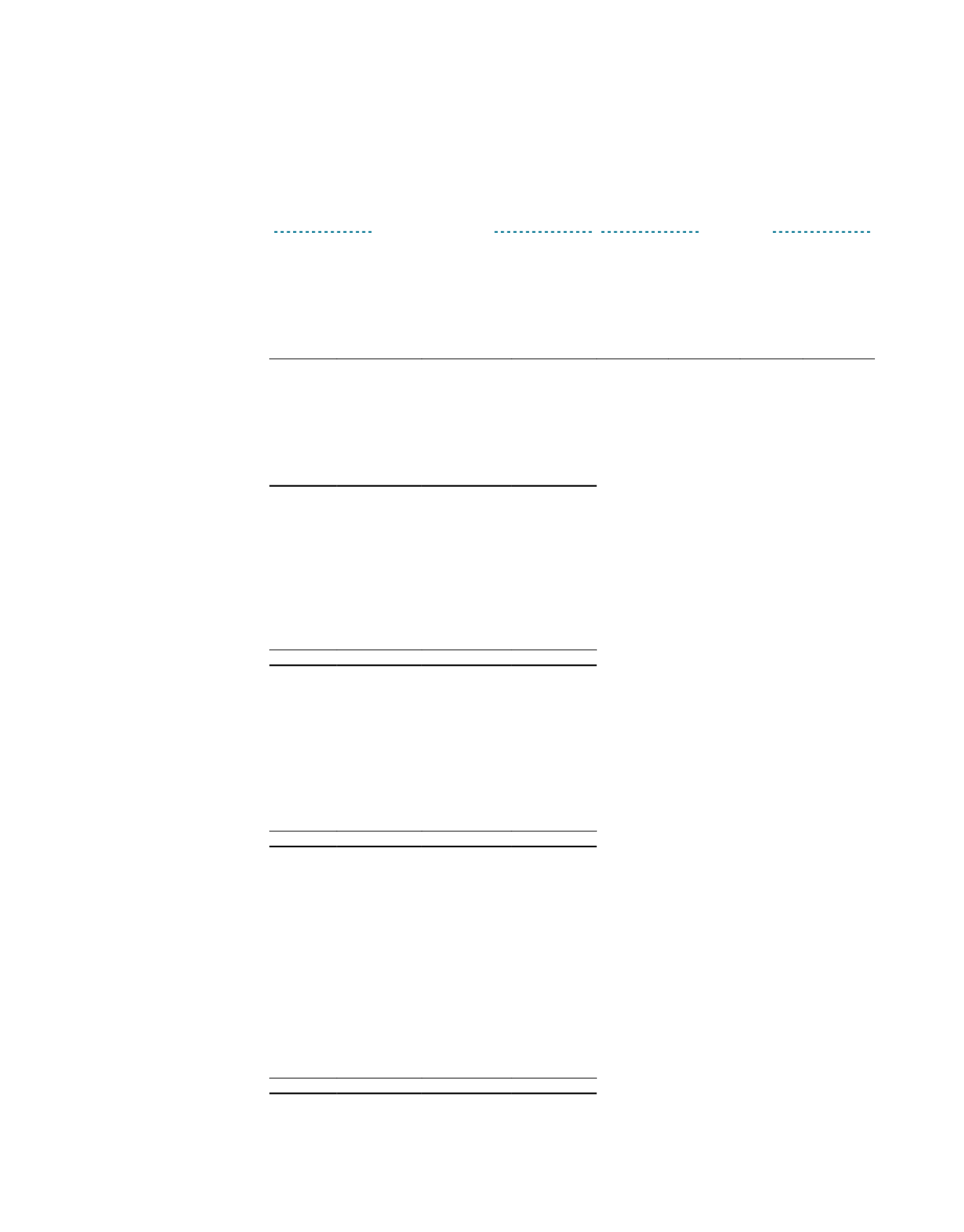

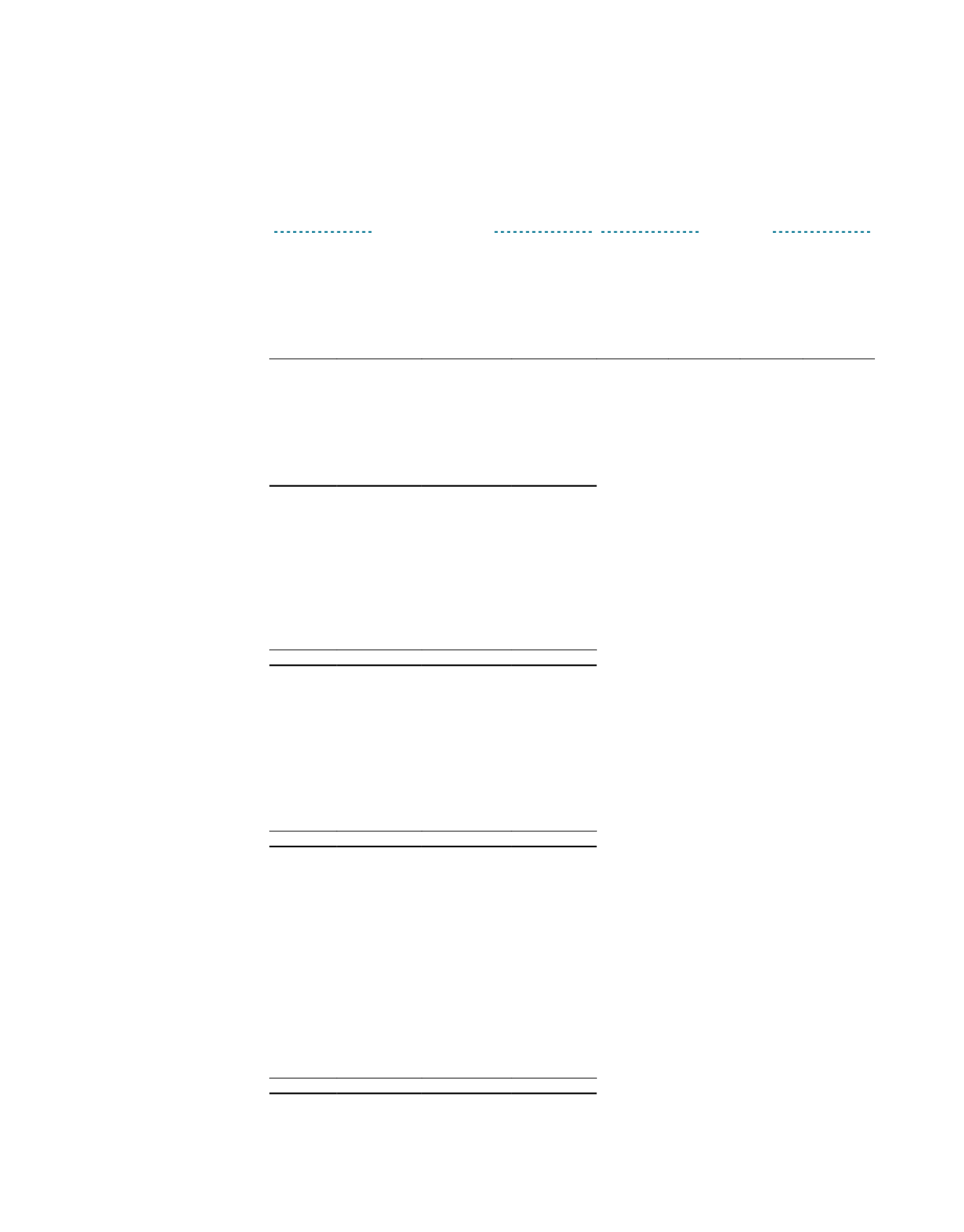

N o t e s t o t h e f i n a n c i a l s t a t e m e n t s

Year ended 31 March 2015

32 Classification and fair value of financial instruments (continued)

Carrying amount

Fair value

Note

Fair

value

through

profit

or loss

Loans

and

receivables

Other

financial

liabilities

within the

scope of

FRS 39

Total

Level 1 Level 2 Level 3 Total

$’000 $’000

$’000

$’000

$’000 $’000 $’000 $’000

Group

2015

Financial assets

measured at

fair value

Derivative assets 15 38,736

–

–

38,736

– 38,736

– 38,736

Financial assets

not measured

at fair value

Finance lease

receivables

8

–

93,844

–

93,844

–

– 145,478 145,478

Trade and other

receivables

11

–

20,913

–

20,913

Cash and cash

equivalents

12

–

41,590

–

41,590

– 156,347

– 156,347

Financial

liabilities

measured at

fair value

Derivative

liabilities

15 (88,775)

–

– (88,775)

– (88,775)

– (88,775)

Exchangeable

collateralised

securities

17 (366,024)

–

– (366,024) (366,024)

–

– (366,024)

(454,799)

–

– (454,799)

Financial

liabilities not

measured at

fair value

Trade and other

payables

(1)

13

–

– (174,576) (174,576)

– (174,499)

– (174,499)

Security deposits 14

–

– (107,314) (107,314)

– (124,283)

– (124,283)

Term loans

and short

term bank

borrowings

16

–

– (1,564,571) (1,564,571)

Medium term

notes

16

–

– (797,129) (797,129)

– (860,439)

– (860,439)

–

– (2,643,590) (2,643,590)

(1)

Excludes rental received in advance.

ASCENDAS REAL ESTATE INVESTMENT TRUST ANNUAL REPORT 2014/15