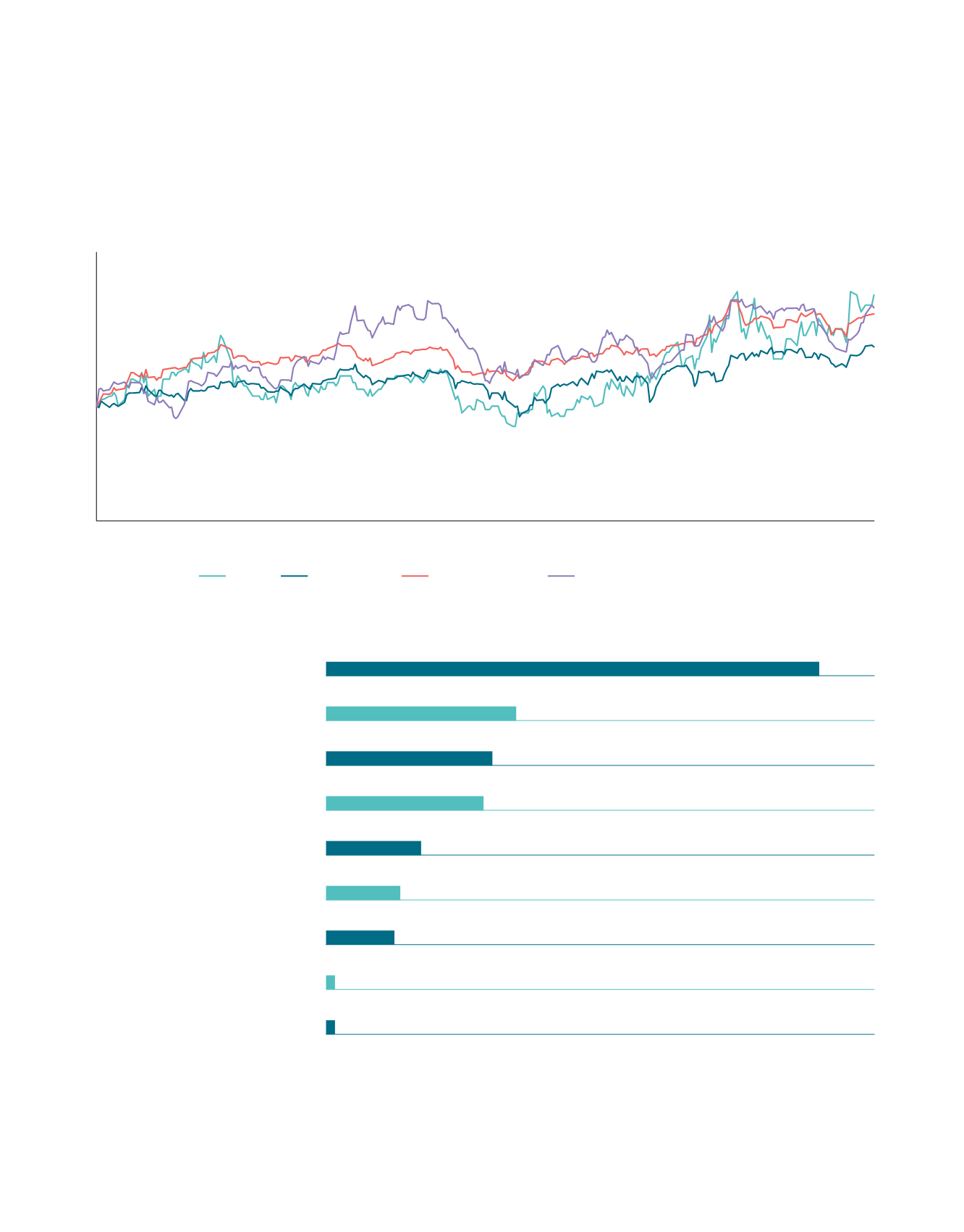

5.3%

5.6%

6.4%

16.6%

2.5%

3.2%

2.3%

0.3%

0.3%

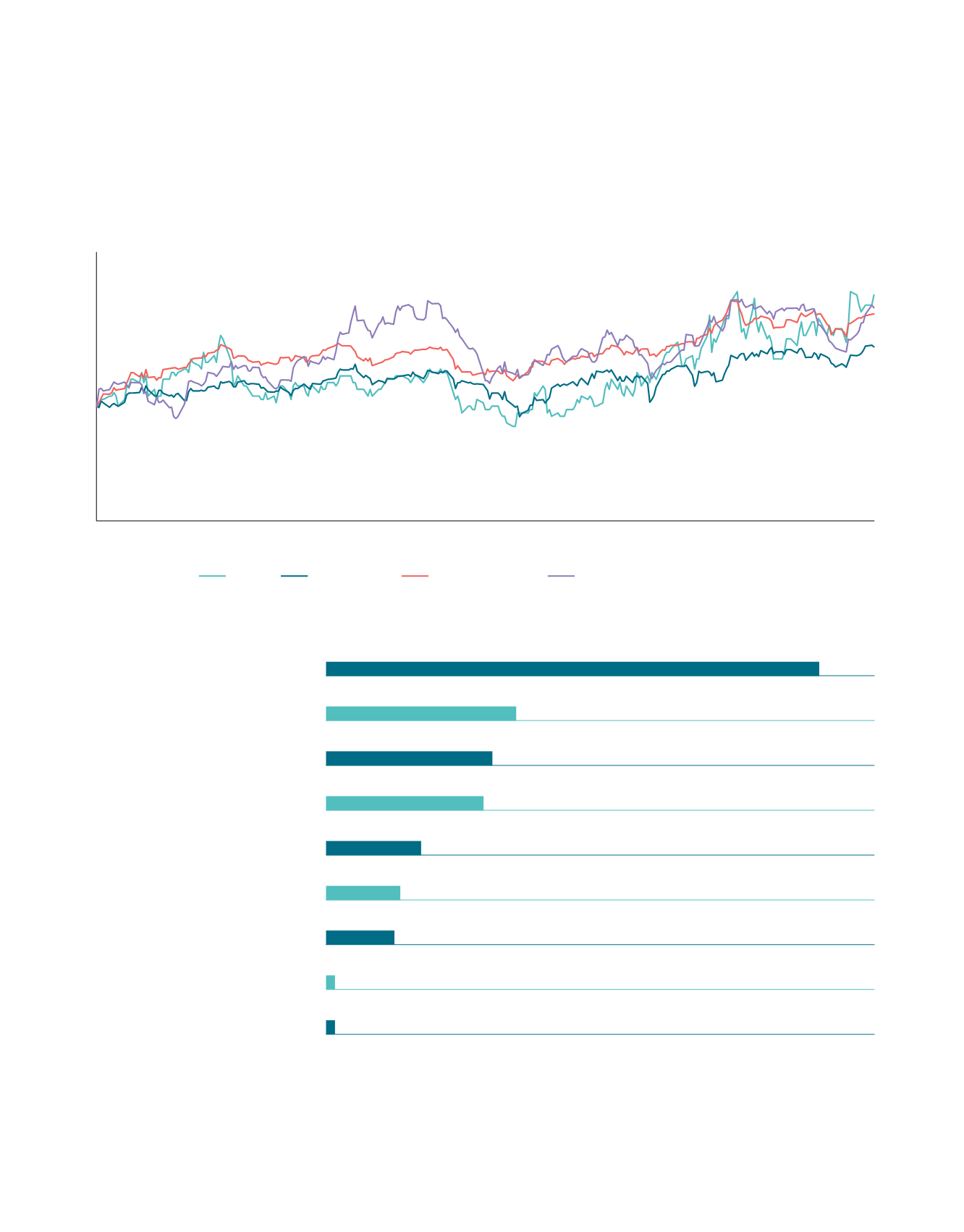

A-REIT UNIT PRICE PERFORMANCE IN FY14/15 VS MAJOR INDICES

85

95

105

115

90

100

110

120

Apr-14

Sep-14

May-14

Oct-14

Jun-14

Nov-14

Jul-14

Dec-14

Feb-15

Aug-14

Jan-15

Mar-15

A-REIT

FTSE ST Index

FTSE ST REIT Index

MSCI Asia ex-Japan Real Estate Index

COMPETITIVE YIELD RETURNS

A-REIT yield for IPO Investors

(1)

Weighted Average Industrial S-REIT yield

(2)

A-REIT yield as at 31 Mar 15

(3)

FTSE S-REIT Index

(4)

FTSE Straits Times Index

(4)

CPF (ordinary) account

(5)

10 year Singapore government bond

(6)

Bank fixed deposit (12 months)

(6)

Interbank overnight interest rate

(6)

NOTES:

(1) Based on A-REIT’s IPO price of S$0.88 per unit and DPU of 14.60 cents for FY14/15.

(2) Based on A-REIT’s internal research and Bloomberg.

(3) Based on A-REIT’s closing price of S$2.59 per unit as at 31 Mar 2015 and DPU of 14.60 cents for FY14/15.

(4) Based on dividend yield computed by Bloomberg as at 31 March 2015.

(5) Based on interest paid on Central Provident Fund (“CPF”) ordinary account from 1 Jan to 31 Mar 15. Source: CPF Website.

(6) Based on bond yields and rates published on the Monetary Authority of Singapore website as at 31 Mar 2015. Source: MAS Website.

I N V E S T O R R E L A T I O N S

ASCENDAS REAL ESTATE INVESTMENT TRUST ANNUAL REPORT 2014/15