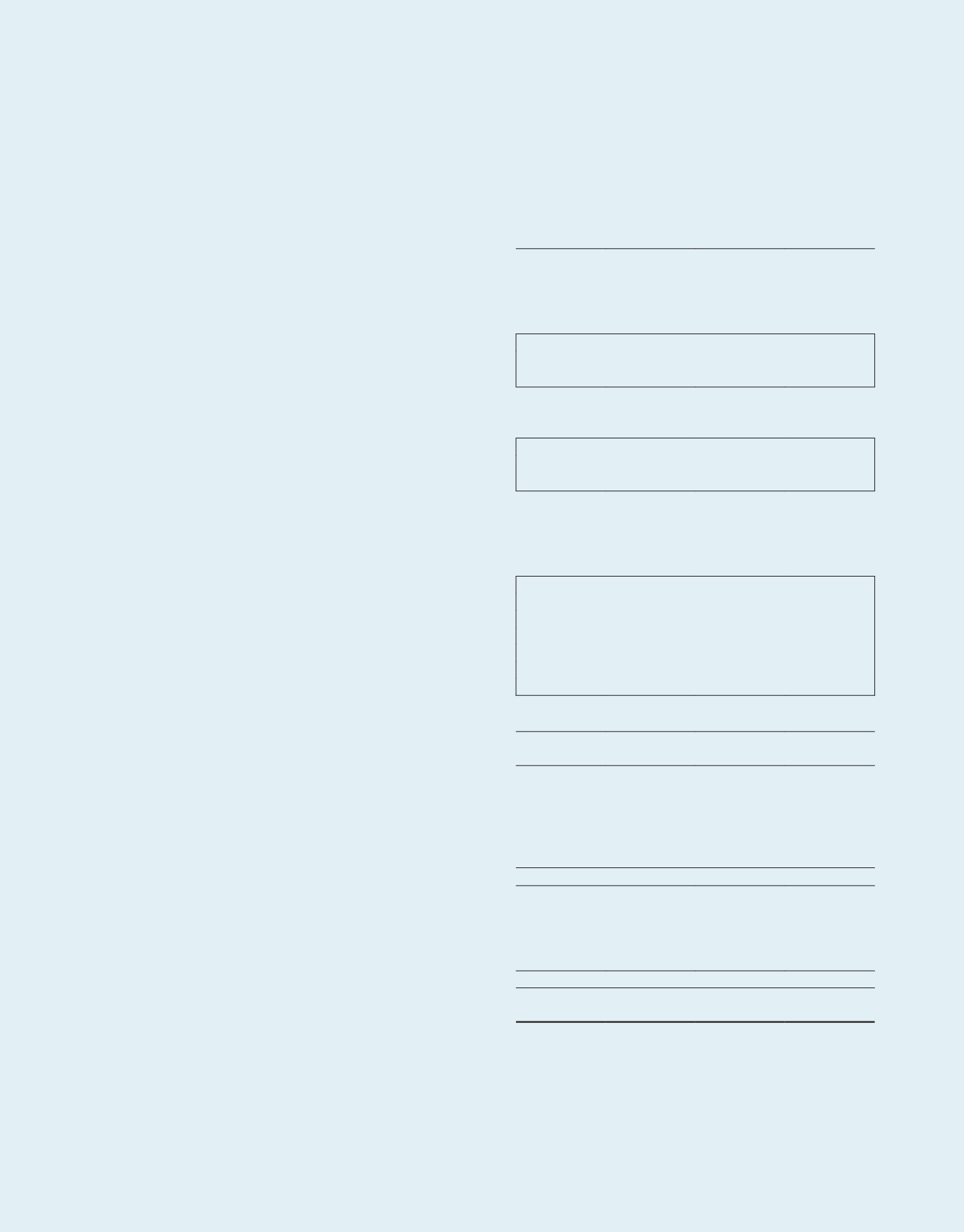

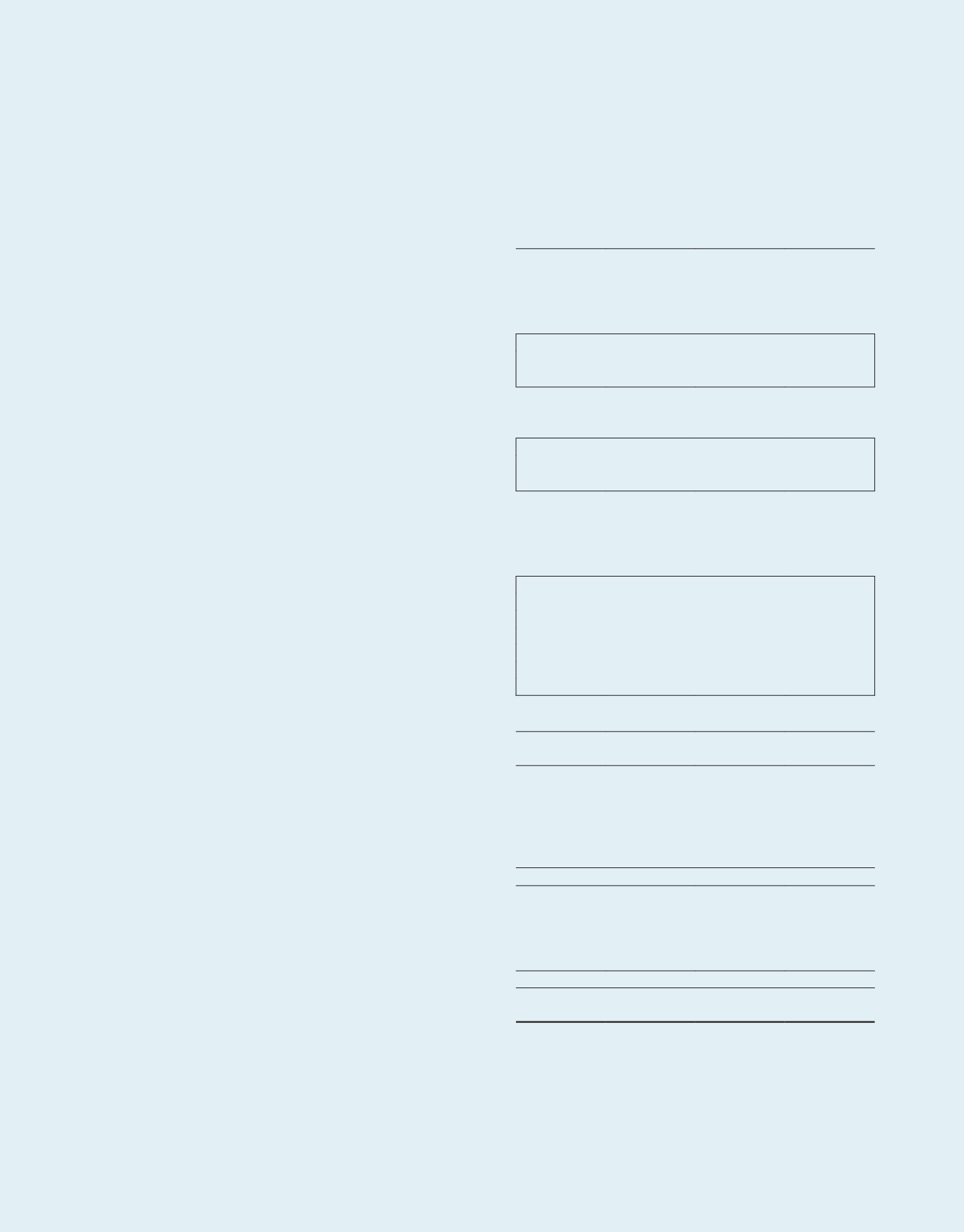

Group

Trust

2016

2015

2016

2015

$’000

$’000

$’000

$’000

Unitholders’ Funds

Balance at beginning of the financial year

5,013,551

4,848,566

4,875,873

4,782,093

Operations

Total return for the year attributable to Unitholders of the Trust

344,151

397,600

409,106

342,505

Less: Amount reserved for distribution to perpetual

securities holders

(6,637)

–

(6,637)

–

Net increase in net assets resulting from operations

337,514

397,600

402,469

342,505

Hedging transactions

Effective portion of changes in fair value of financial derivatives

220

5,582

220

5,582

Changes in fair value of financial derivatives transferred to the

Statements of Total Return

(218)

(2,275)

(218)

(2,275)

Net increase in net assets resulting from hedging transactions

2

3,307

2

3,307

Movement in foreign currency translation reserve

(3,287)

16,110

–

–

Unitholders’ transactions

Units issued through equity fund raising

344,892

–

344,892

–

Consideration units for acquisition of property

210,000

–

210,000

–

Divestment fees paid in units

124

–

124

–

Acquisition fees paid/payable in units

14,419

1,120

14,419

1,120

Management fees paid/payable in units

8,600

7,627

8,600

7,627

Unit issue costs

(2,851)

7

(2,851)

7

Distributions to Unitholders

(442,085)

(260,786)

(442,085)

(260,786)

Net increase/(decrease) in net assets resulting

from Unitholders’ transactions

133,099

(252,032)

133,099

(252,032)

Balance at end of the financial year

5,480,879

5,013,551

5,411,443

4,875,873

Perpetual Securities Holders’ Funds

Balance at beginning of the financial year

–

–

–

–

Issue of perpetual securities

300,000

–

300,000

–

Issue costs

(2,216)

–

(2,216)

–

Amount reserved for distribution to perpetual securities holders

6,637

–

6,637

–

Balance at end of the financial year

304,421

–

304,421

–

Non-controlling interests

Balance at beginning of the financial year

39

34

–

–

Total return for the year attributable to non-controlling interests

(18)

5

–

–

Balance at end of the financial year

21

39

–

–

Total

5,785,321

5,013,590

5,715,864

4,875,873

Statements of Movements in Unitholders’ Funds

Year ended 31 March 2016

The accompanying notes form an integral part of these financial statements.

.130

A-REIT ANNUAL REPORT

2015/2016