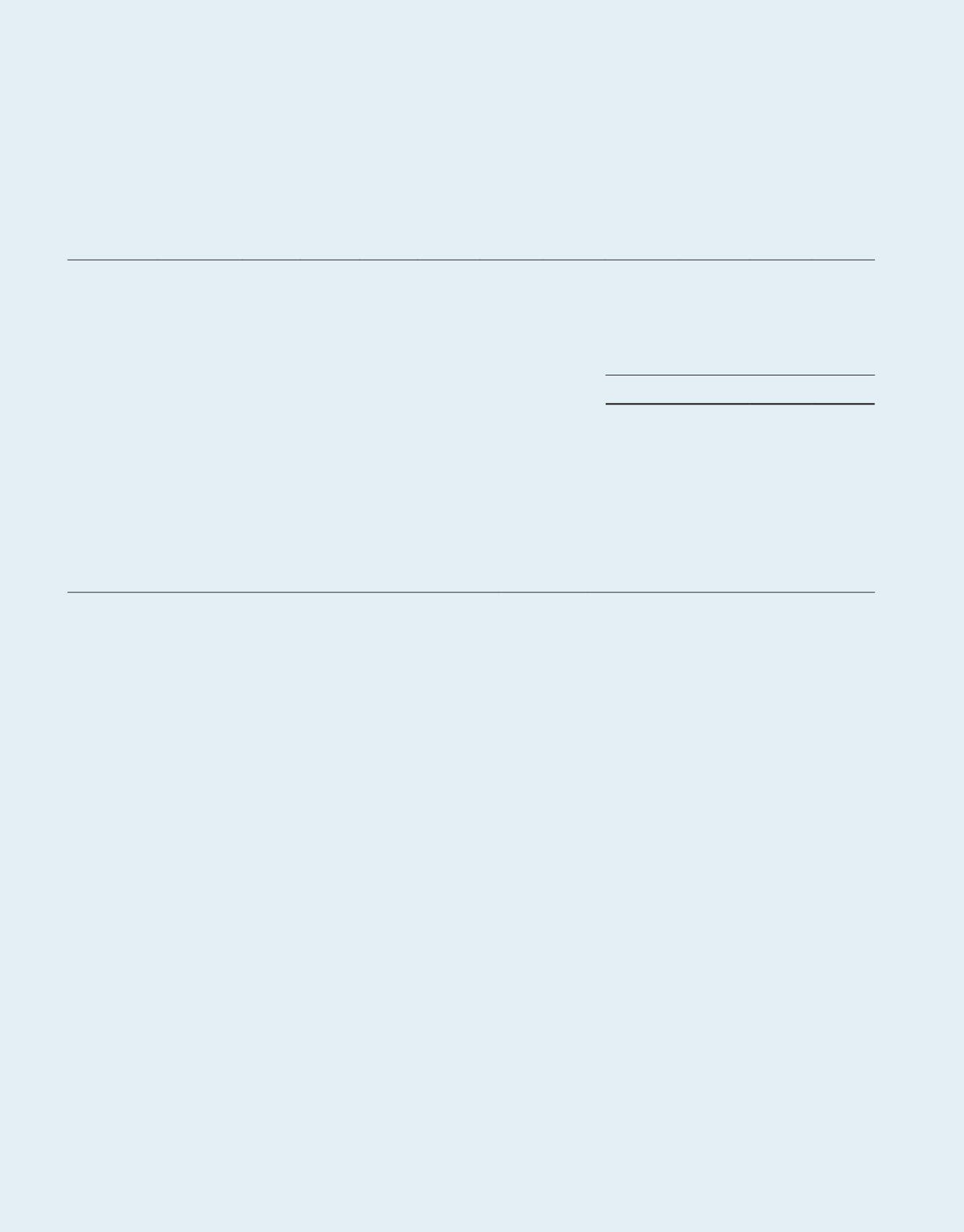

Percentage of

Description Acquisition

Term of

Lease

Latest

Valuation

Carrying Amount

Net Assets

of Property

Date

Tenure Lease Expiry Location Valuation Date

2016

2015

2016

2015

$’000

$’000

$’000

%

%

Total Group’s

investment

properties

9,598,654

7,867,930

165.91

156.94

Property held for

sale

–

24,800

–

0.49

Other assets and

liabilities (net)

(3,813,333)

(2,879,140)

(65.91)

(57.43)

Net assets of the

Group

5,785,321

5,013,590

100.00

100.00

Investment properties comprise a diverse portfolio of industrial properties that are leased to customers. Most of the leases

for multi-tenant buildings contain an initial non-cancellable period ranging from one to three years. Subsequent renewals are

negotiated with the respective lessees.

Independent valuations for all 133 (2015: 105 out of 107) properties were undertaken by the following valuers on the dates

stated below:

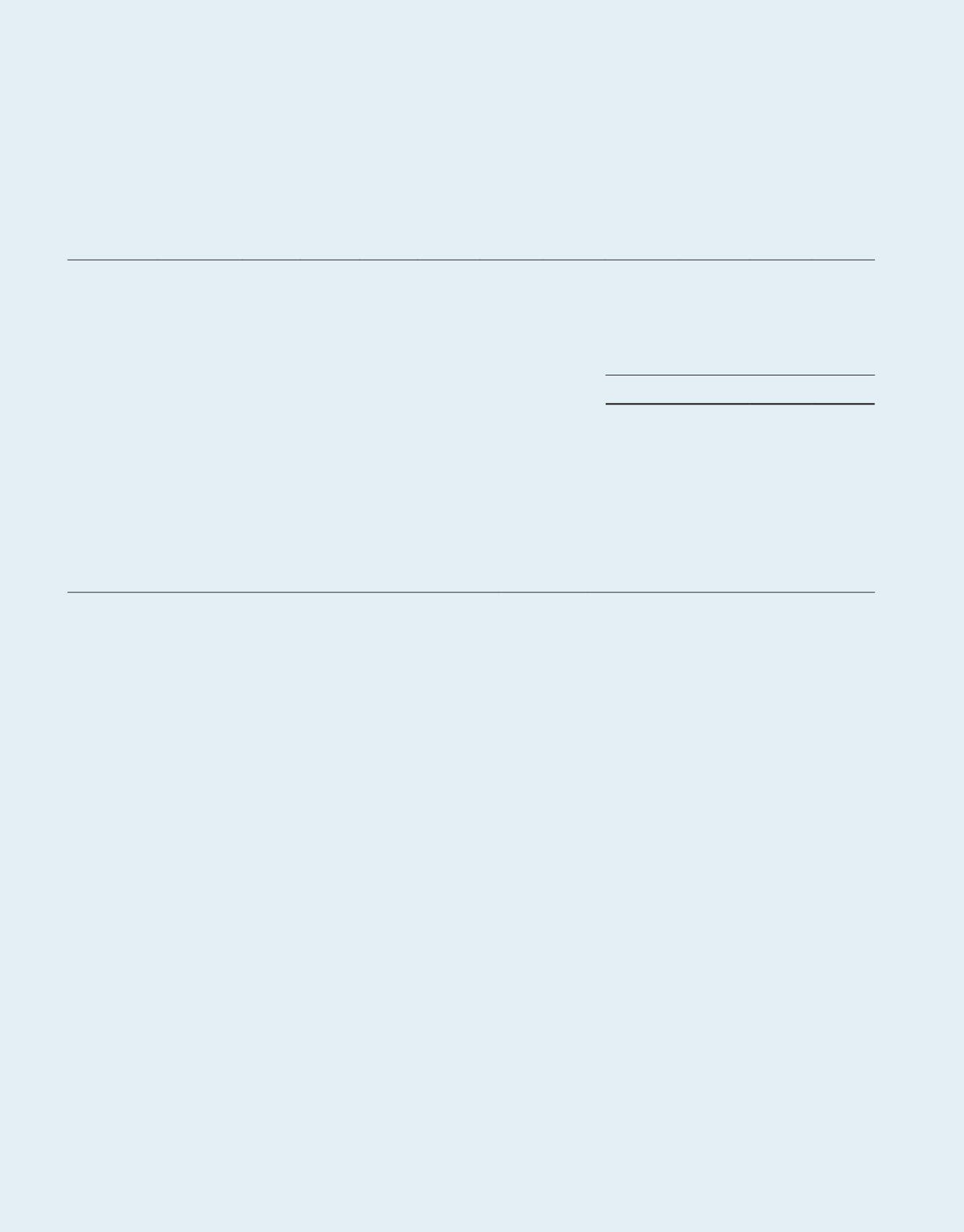

2016

2015

Valuers

Valuation date

Valuation date

Savills Valuation and Professional Services (S) Pte Ltd

31 March 2016

–

CBRE Valuations Pty Limited

31 March 2016

–

CBRE Limited

31 March 2016

–

CBRE Pte. Ltd.

31 March 2016

31 March 2015

DTZ Debenham Tie Leung (SEA) Pte Ltd

Colliers International Consultancy & Valuation (Singapore) Pte Ltd

31 March 2016

31 March 2016

31 March 2015

31 March 2015

Cushman & Wakefield VHS Pte Ltd

31 March 2016

31 March 2015

Knight Frank Pte Ltd

31 March 2016

31 March 2015

Jones Lang LaSalle Property Consultants Pte Ltd

31 March 2016

31 March 2015

Cushman & Wakefield Valuation Advisory Services (HK) Ltd

–

31 March 2015

These firms are independent valuers having appropriate professional qualifications and recent experience in the location and

category of the properties being valued. The valuations for these properties were based on the direct comparison method,

capitalisation approach and discounted cash flow analysis. As at 31 March 2016, the valuations adopted for investment properties

and property held for sale amounted to $9,598.7 million (2015: $7,754.2 million) and $Nil (2015: $24.8 million) respectively. The

net decrease in valuation of $2.3 million (2015: increase of $47.0 million) of the Group has been recognised in the Statement of

Total Return.

Investment Properties Portfolio Statement

As at 31 March 2016

The accompanying notes form an integral part of these financial statements.

.140

A-REIT ANNUAL REPORT

2015/2016