Notes to the financial statements

Year ended 31 March 2016

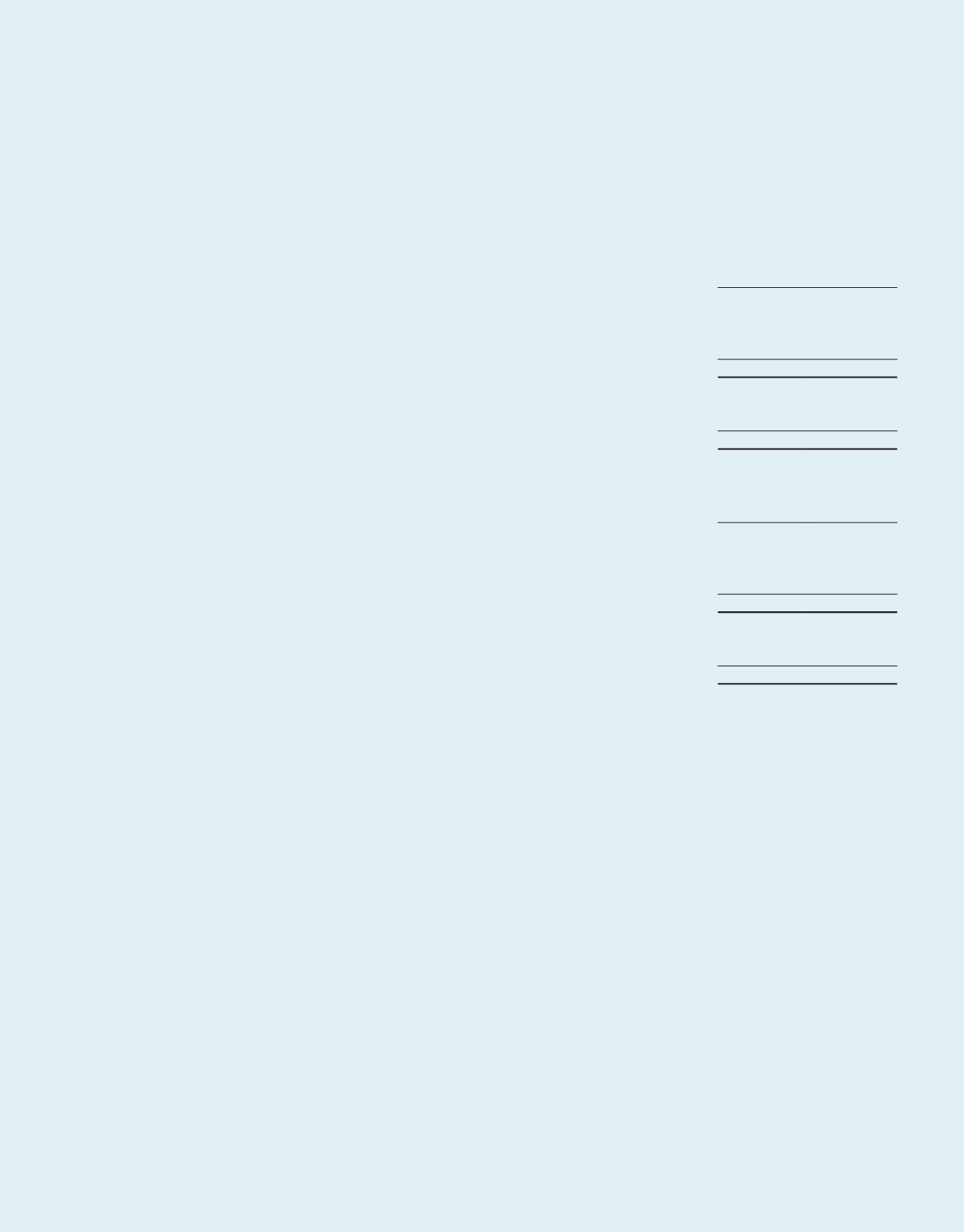

16 Exchangeable Collateralised Securities and collateral loan

Group

2016

2015

$’000

$’000

Exchangeable Collateralised Securities (“ECS”)

At 1 April

366,024

341,091

Change in fair value of ECS

(12,024)

24,933

At 31 March

354,000

366,024

Current

354,000

–

Non-current

–

366,024

354,000

366,024

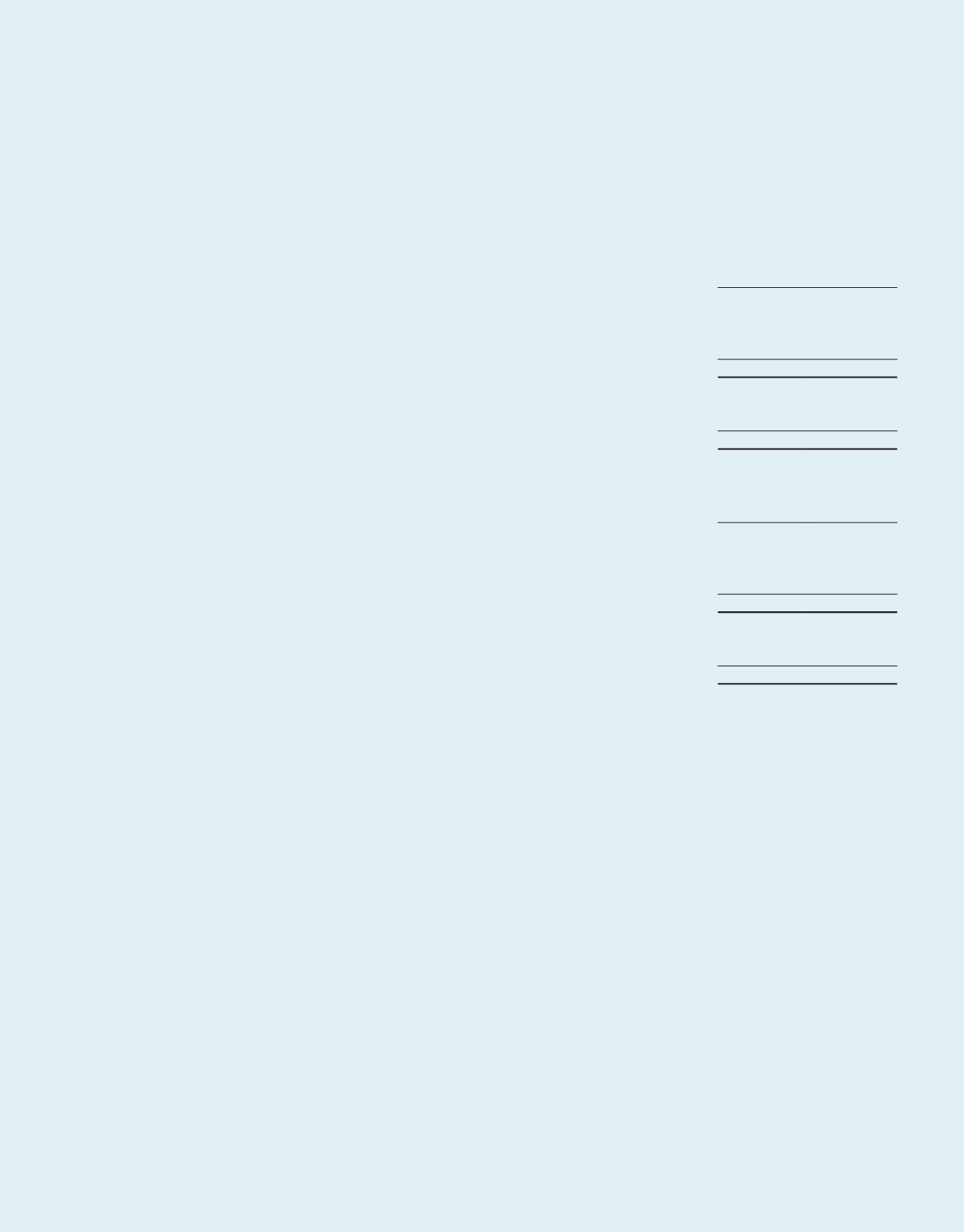

Trust

2016

2015

$’000

$’000

Collateral loan

At 1 April

366,024

341,091

Change in fair value of collateral loan

(12,024)

24,933

At 31 March

354,000

366,024

Current

354,000

–

Non-current

–

366,024

354,000

366,024

In March 2010, a collateral loan of $300.0 million (“Collateral Loan”) was granted by Ruby Assets Pte. Ltd. (“Ruby

Assets”) to the Trust. The maturity date of the Collateral Loan is 1 February 2017 and it bears a fixed interest rate of

1.60% per annum.

As collateral for the Collateral Loan granted by Ruby Assets, the Trustee has granted in favour of Ruby Assets the

following:

•

a mortgage over 19 properties in the Trust portfolio;

•

an assignment and charge of the rental proceeds and tenancy agreements of the above mentioned properties;

•

an assignment of the insurance policies relating to the above mentioned properties; and

•

a fixed and floating charge over certain assets of the Trust relating to the above mentioned properties.

In order to fund the Collateral Loan to the Trust, Ruby Assets issued $300.0 million ECS on 26 March 2010. The ECS bear

a fixed coupon of 1.60% per annum and have an expected maturity date of 1 February 2017. The Collateral Loan has the

same terms mirroring that of the ECS.

The ECS are exchangeable by the ECS Holders into new Units at the adjusted exchange price of $2.0505 (FY14/15:

$2.1394) per Unit, at any time on and after 6 May 2010 up to the close of business on 23 January 2017 (subject to

satisfaction of certain conditions). The Group has the option to pay cash in lieu of delivering the Units.

.185

A-REIT ANNUAL REPORT

2015/2016