Notes to the financial statements

Year ended 31 March 2016

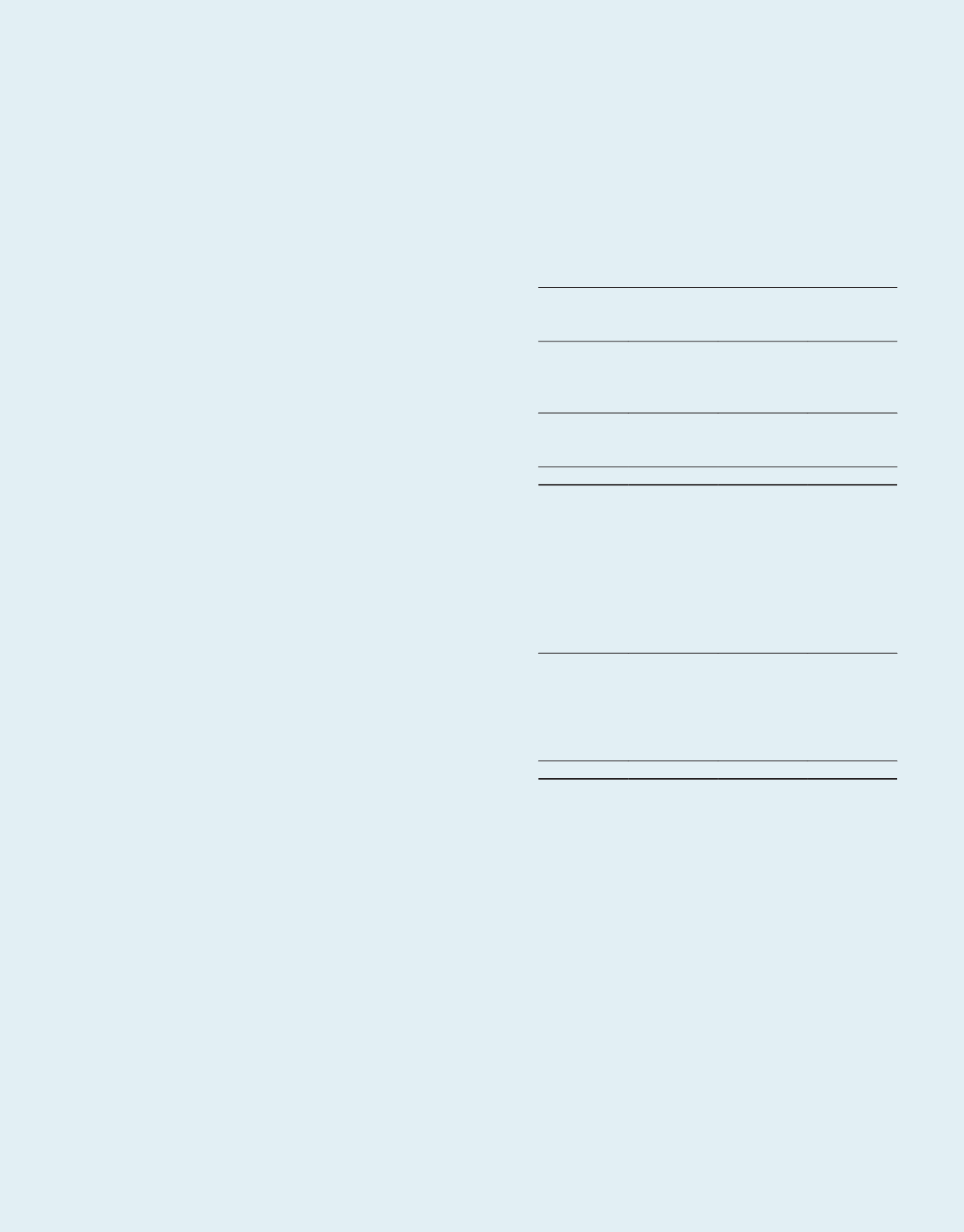

10 Trade and other receivables

Group

Trust

2016

2015

2016

2015

$’000

$’000

$’000

$’000

Trade receivables, gross

5,389

5,483

3,594

5,235

Impairment losses

(189)

(724)

(189)

(724)

Trade receivables, net

5,200

4,759

3,405

4,511

Deposits

–

1,952

–

1,952

Interest receivables

7,216

424

7,123

424

Other receivables

11,659

13,778

9,936

12,991

24,075

20,913

20,464

19,878

Lease incentives

32,858

33,132

31,634

29,949

Prepayments

32,352

36,019

31,997

33,657

89,285

90,064

84,095

83,484

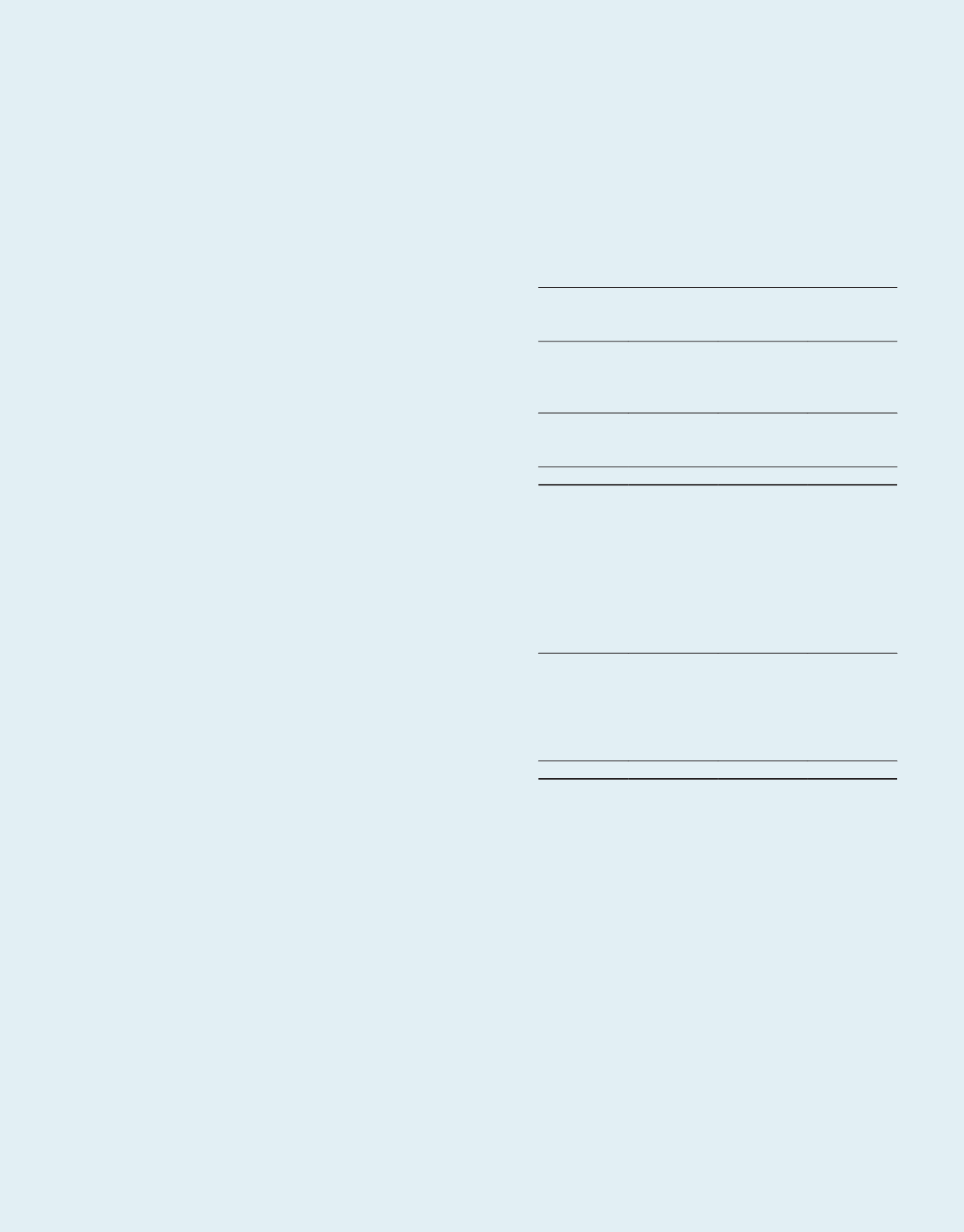

The Group’s primary exposure to credit risk arises through its trade and other receivables. The Group has a credit policy

in place and the exposure to credit risk is monitored on an ongoing basis.

The maximum exposure to credit risk for trade receivables at reporting date, by operating segments, is as follows:

Group

Trust

2016

2015

2016

2015

$’000

$’000

$’000

$’000

Business & Science Park Properties

2,483

2,571

2,281

2,323

Integrated Development, Amenities & Retail Properties

520

257

520

257

Hi-Specifications Industrial Properties & Data Centres

210

843

210

843

Light Industrial Properties & Flatted Factories

188

327

188

327

Logistics & Distribution Centres

1,799

761

206

761

5,200

4,759

3,405

4,511

The amounts represented in the table above are fully secured by way of bankers’ guarantees, insurance bonds or cash

security deposits held by the Group, except for trade receivables balance which are impaired.

During the financial year, there was no amount drawn down from bankers’ guarantees (2015: $976,000). As a result of the

default in rental by tenants, $1,399,000 (2015: $825,000) of cash security deposits were forfeited.

.175

A-REIT ANNUAL REPORT

2015/2016