Notes to the financial statements

Year ended 31 March 2016

32 Classification and fair value of financial instruments (continued)

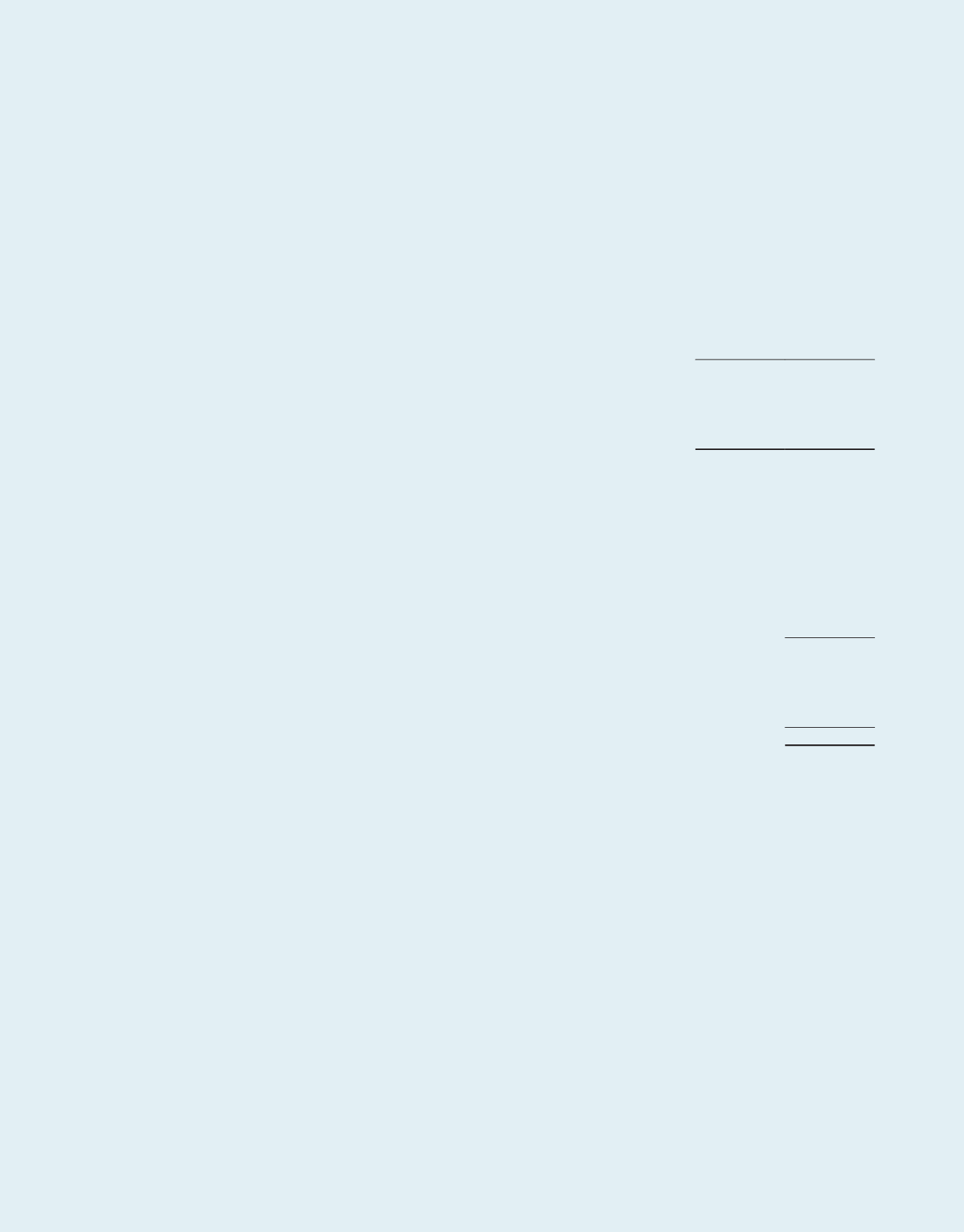

Interest rates used in determining fair values

The interest rates used to discount the estimated cash flows were as follows:

Group and Trust

2016

2015

%

%

Finance lease receivables

2.18

2.47

Trade and other payables

2.05

1.21

Security deposits

1.39

1.67

Medium term notes

1.02 – 3.10

1.00 – 3.29

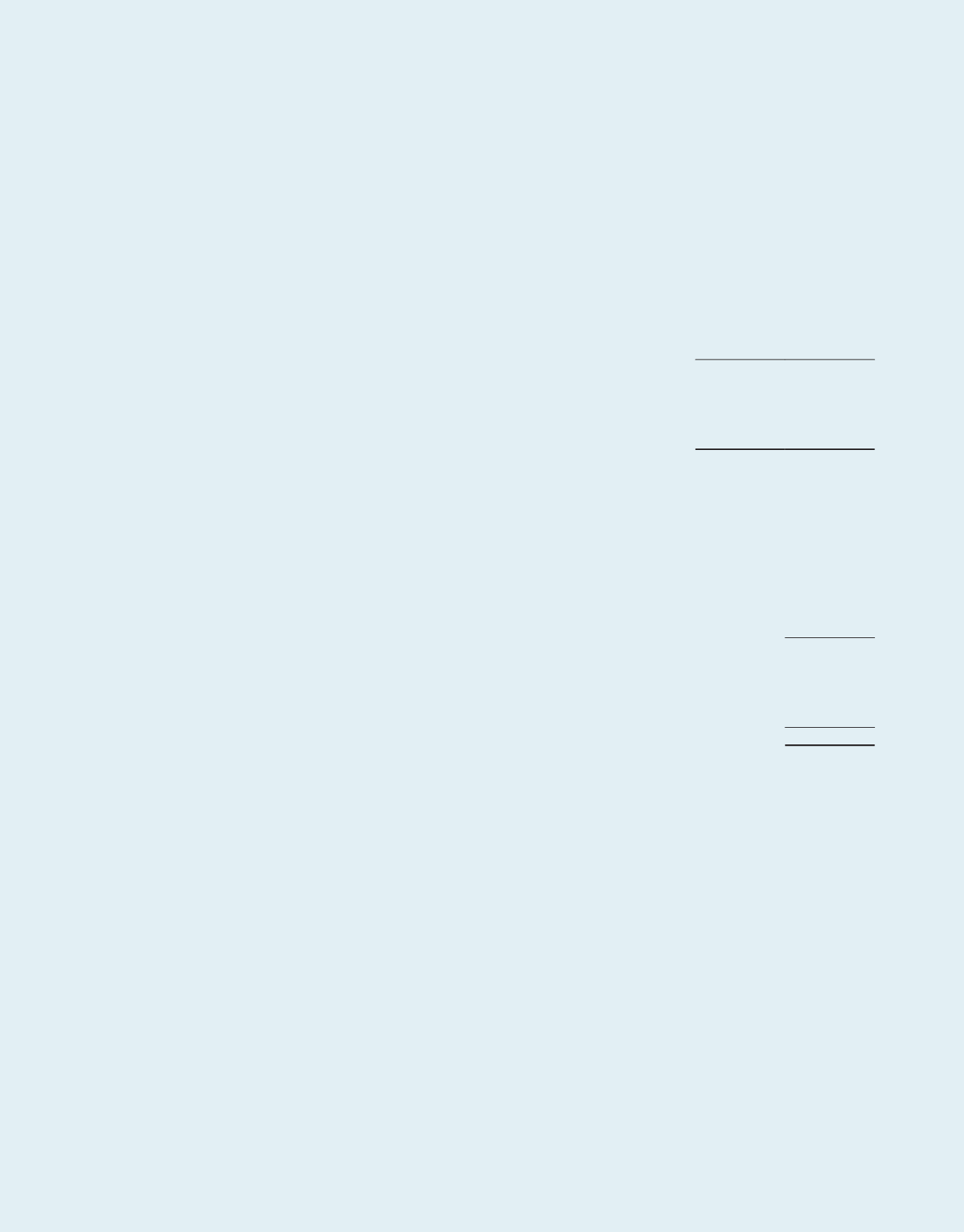

Level 3 fair values

The following table shows reconciliation from the beginning balance to the ending balance for fair value measurement

in Level 3 of the fair value hierarchy:

Investment

in debt

securities

Group and Trust

$’000

2015

At 1 April 2014

194,574

Change in fair value (unrealised) recognised in Statement of Total Return

(16,574)

Redemption

(178,000)

At 31 March 2015

–

.210

A-REIT ANNUAL REPORT

2015/2016