Notes to the financial statements

Year ended 31 March 2016

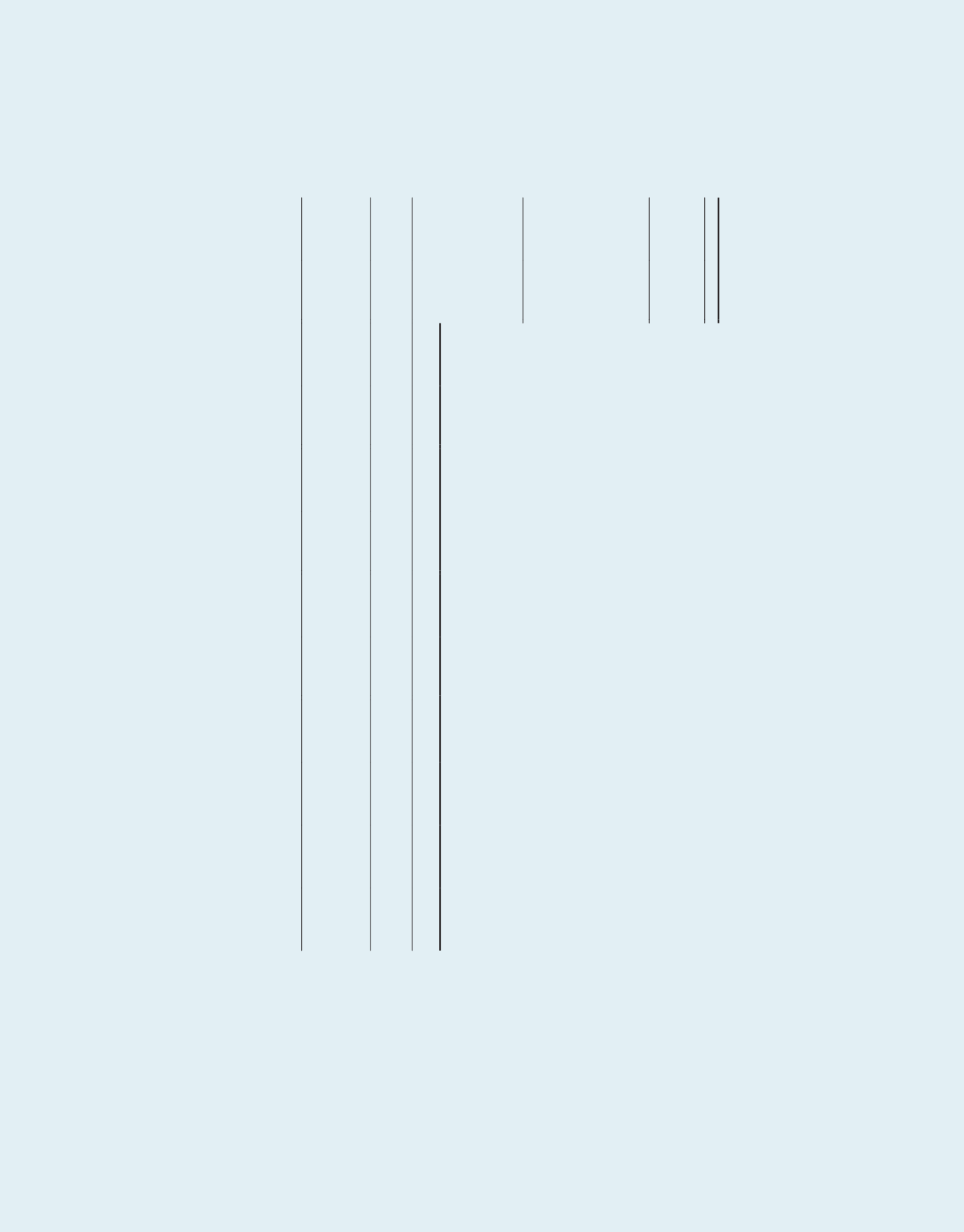

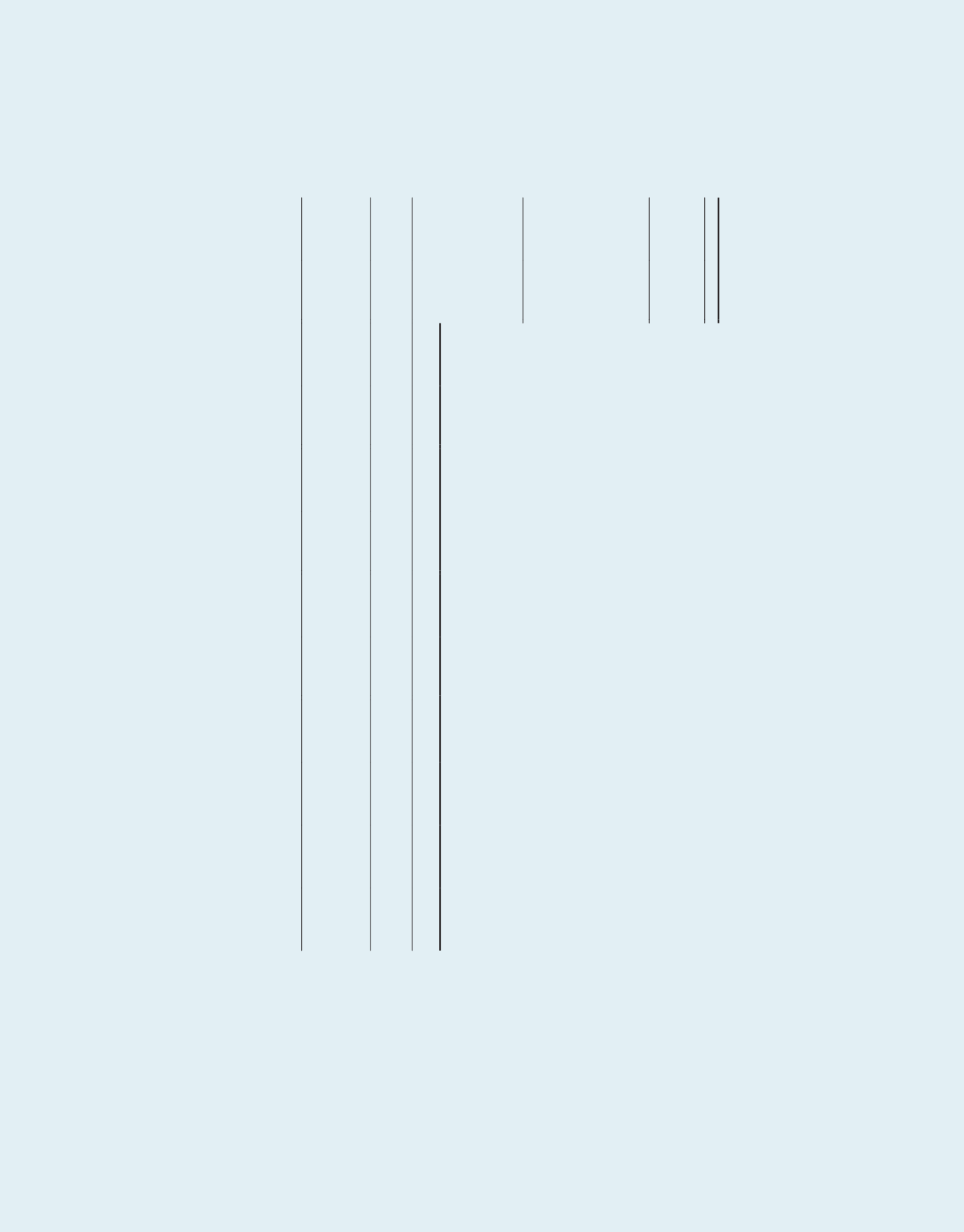

34 Operating segments (continued)

Information regarding the Group’s reportable segments is presented in the tables below.

Operating segments

Property income and expenses

Business &

Science Park

Properties

Integrated

Development, Amenities

&

Retail Properties

Hi–Specifications

Industrial

Properties &

Data Centres

Light Industrial

Properties &

Flatted Factories

Logistics &

Distribution

Centres

Total

2016

2015

2016

2015

2016

2015

2016

2015

2016

2015

2016

2015

$’000

$’000

$’000

$’000

$’000

$’000

$’000

$’000

$’000

$’000

$’000

$’000

Group

Gross rental income

234,358

209,301

54,438

28,593

153,822

147,970

89,783

92,445

149,452

117,836

681,853

596,145

Other income

38,834

38,308

3,543

1,107

22,967

25,045

3,675

3,709

10,116

9,173

79,135

77,342

Gross revenue

273,192

247,609

57,981

29,700

176,789

173,015

93,458

96,154

159,568

127,009

760,988

673,487

Property operating

expenses

(88,385)

(83,773)

(13,889)

(9,260)

(53,882)

(53,749)

(26,486)

(25,918)

(44,645)

(38,060)

(227,287)

(210,760)

Segment net

property income

184,807

163,836

44,092

20,440

122,907

119,266

66,972

70,236

114,923

88,949

533,701

462,727

Gain on disposal

of investment properties

–

–

–

–

–

–

–

2,023

–

–

–

2,023

Unallocated finance income

16,150

8,273

Unallocated finance costs

(93,603)

(113,651)

Unallocated net expenses

(83,433)

(91,419)

Net income

372,815

267,953

Unallocated net change

in fair value of financial

derivatives

(1,236)

89,363

Net appreciation/

(depreciation) on

revaluation of investment

properties

63,409

19,722

39,733

45,311

21,692

3,644

(4,174)

16,654

(123,009)

(38,299)

(2,349)

47,032

Share of joint venture’s result

43

–

Total return for the year

before tax

369,273

404,348

Tax expense

(16,424)

(6,228)

(5,841)

–

–

(295)

–

–

(979)

–

(23,244)

(6,523)

Unallocated tax expense

(1,896)

(220)

Total return for the year

344,133

397,605

.214

A-REIT ANNUAL REPORT

2015/2016