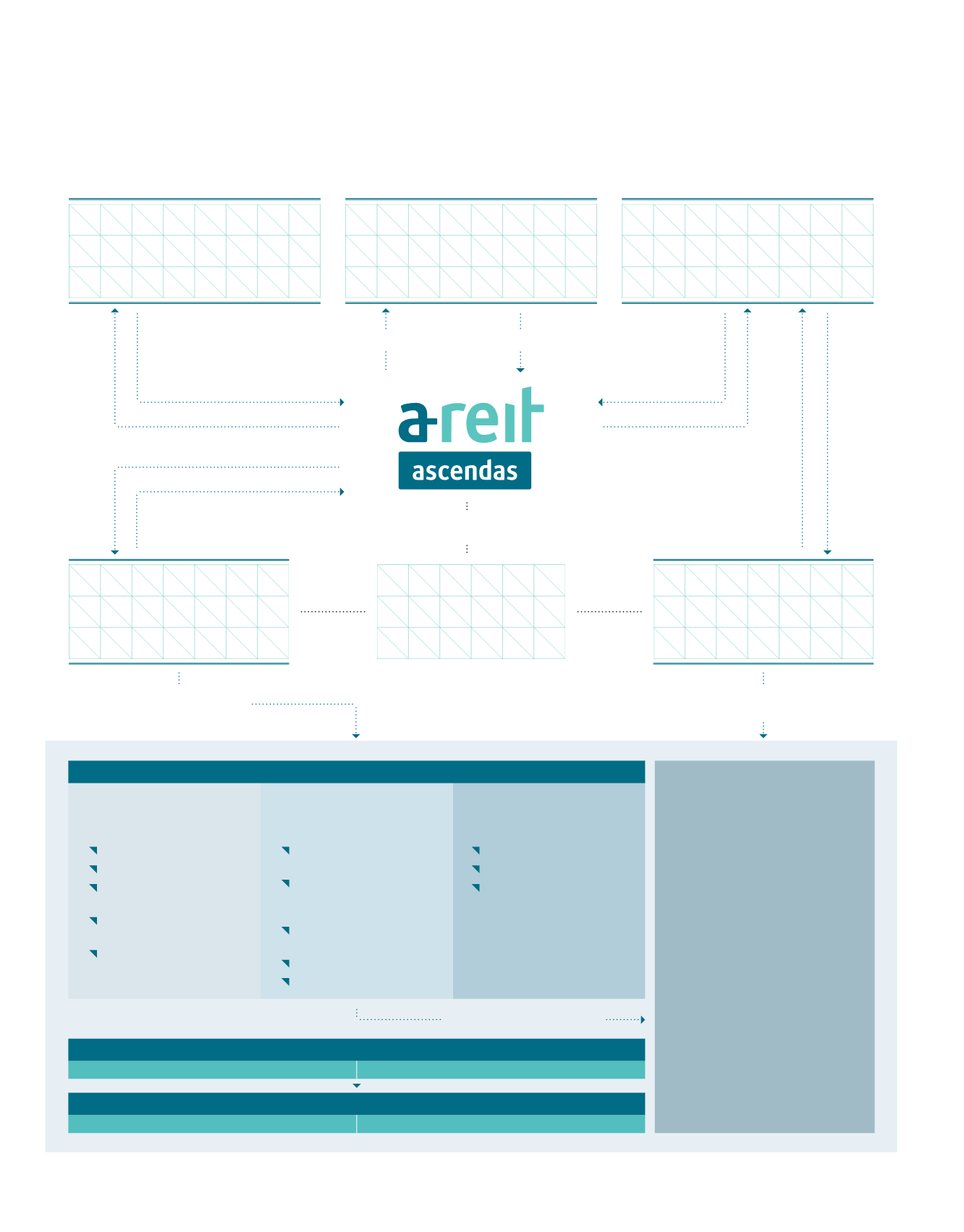

A-R E I T ’ S S T R U C T U R E

UNITHOLDERS

HSBC INSTITUTIONAL TRUST

SERVICES (SINGAPORE)

LIMITED (TRUSTEE)

PROPERTIES/PROPERTY-

HOLDING COMPANIES

(1)

ASCENDAS SERVICES

PTE LTD (“ASPL”)

(1)

(Reports to ASPL Board of Directors)

ASCENDAS FUNDS

MANAGEMENT (S) LIMITED

(A-REIT MANAGER)

(Reports to AFM Board of Directors)

Trustee’s Fees

Acts on behalf of Unitholders

Net Property Income

Ownership of Assets

Distributions

Investment in A-REIT

Management Fees

Management Services

ASCENDAS

GROUP

17.24%

100%

100%

Property Management Fees

Property Management Services

Responsible for strategy

formulation in relation to

Responsible

for execution of

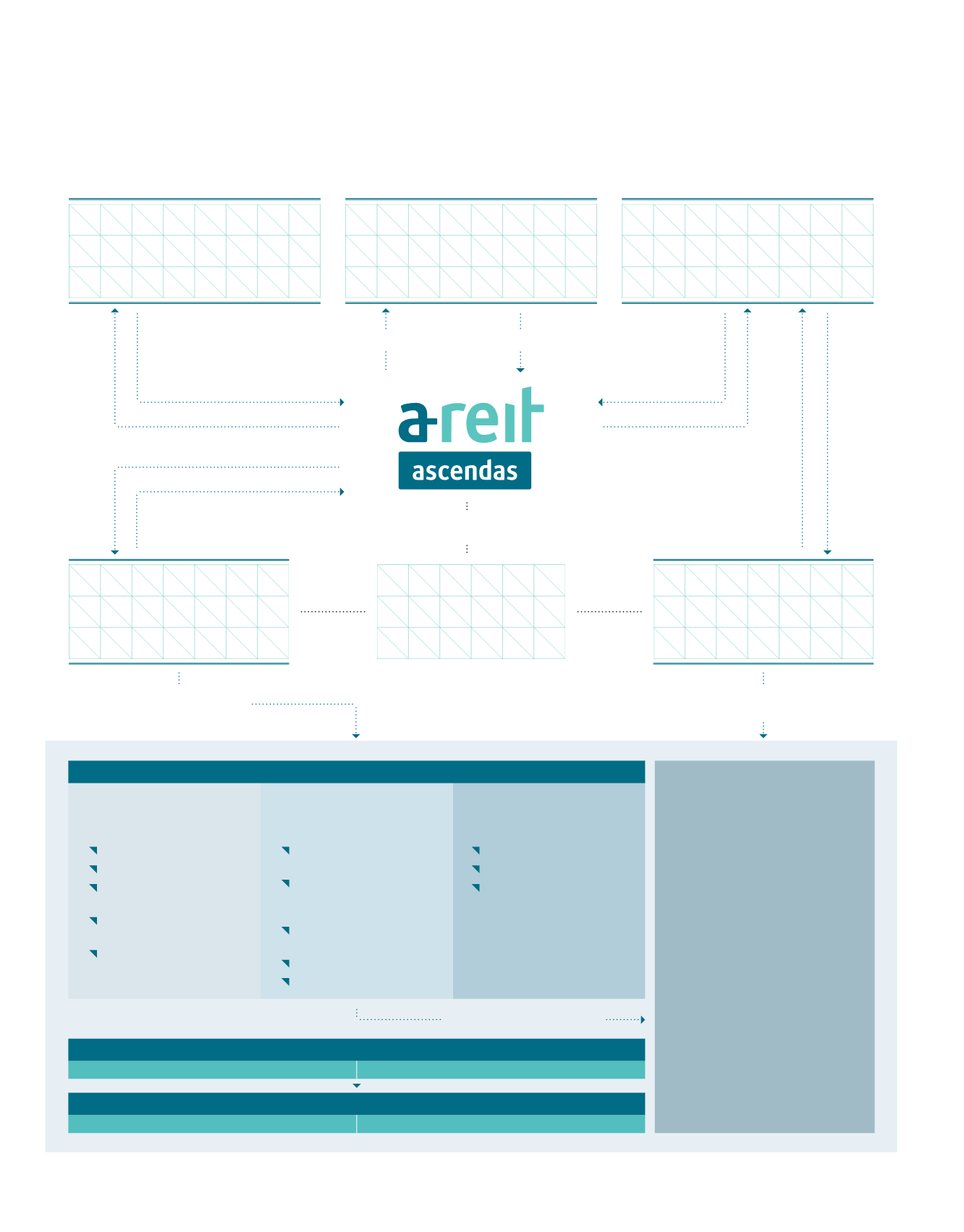

TOTAL RETURNS

OUTCOME

STABILITY

PREDICTABLE INCOME

GROWTH

CAPITAL STABILITY

Execution of strategies & plans

STRATEGIES

VALUE-ADDING

INVESTMENT

Yield accretive acquisitions

Built-to-suit projects

Developments

CAPITAL & RISK

MANAGEMENT

Equity funding

Debt funding

Interest rate risk

management

Foreign exchange risk

management

Optimise capital structure

PORTFOLIO

MANAGEMENT

Portfolio positioning and

strategies

Supervise execution

of asset management

activities

Customer retention and

statisfaction

Occupancy improvements

Rental rates improvements

MARKETING AND

LEASING

PROPERTY

MANAGEMENT AND

SERVICES

COST MANAGEMENT

PROJECT

MANAGEMENT

(1) A-REIT’s two properties located in China are held through wholly owned subsidiaries of A-REIT and are managed by property managers other than ASPL under separate

property management agreements.

ASCENDAS REAL ESTATE INVESTMENT TRUST ANNUAL REPORT 2014/15