Notes to the financial statements

Year ended 31 March 2016

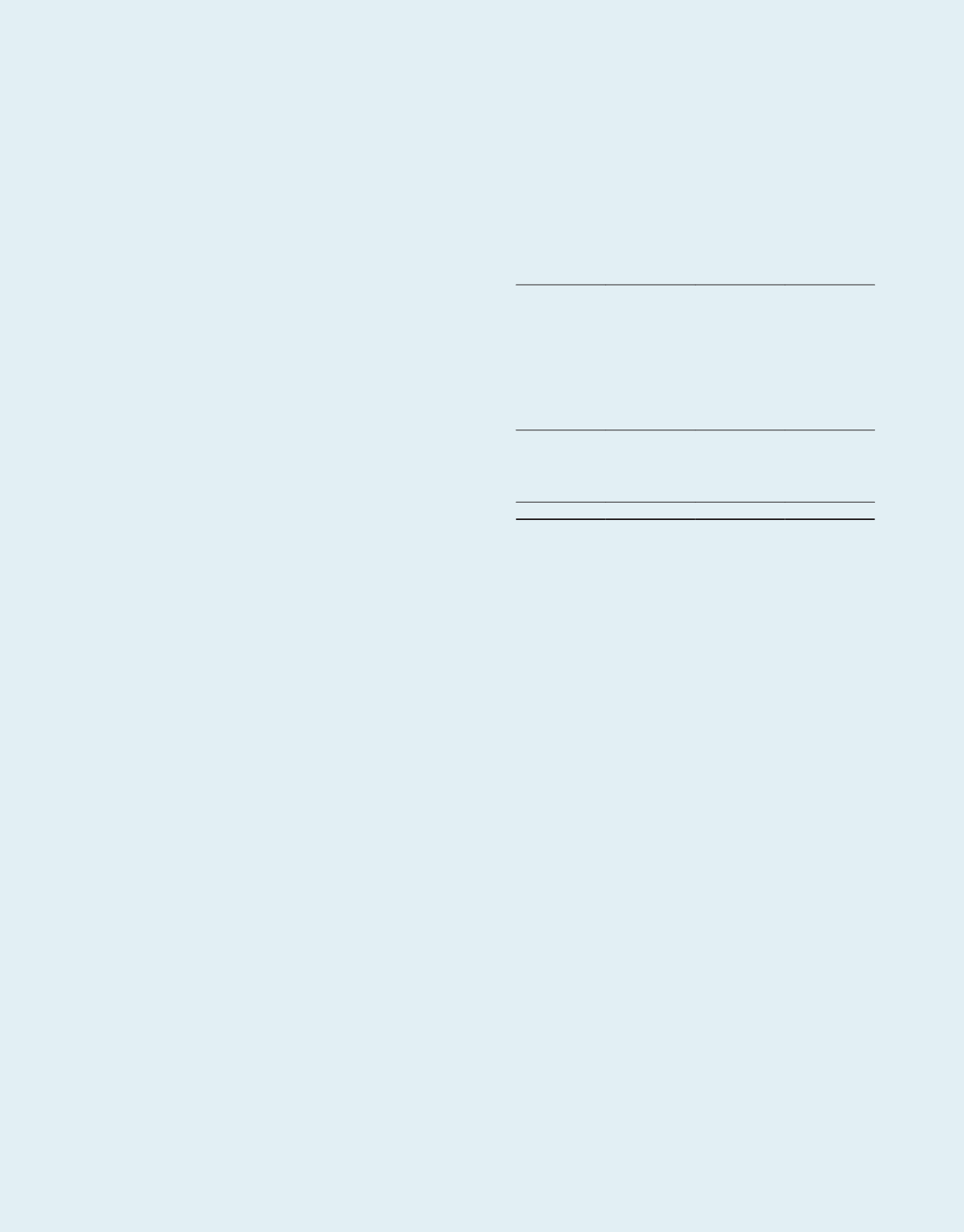

4 Investment properties

Group

Trust

2016

2015

2016

2015

$’000

$’000

$’000

$’000

At 1 April

7,867,930

6,922,966

7,558,780

6,651,419

Acquisition of investment properties

961,360

308,190

437,329

801,190

Acquisition of a subsidiary

646,901

459,888

–

–

Transfer to property held for sale

–

(24,800)

–

(24,800)

Capital expenditure incurred

132,670

130,967

108,734

128,260

Transfer from plant and equipment

–

39

–

–

Disposal of investment properties

(13,900)

–

(13,900)

–

Effects of movement in exchange rates

6,042

23,648

–

–

9,601,003

7,820,898

8,090,943

7,556,069

Net fair value (losses)/gains on investment

properties recognised in the Statement

of Total Return (unrealised)

(2,349)

47,032

51,707

2,711

At 31 March

9,598,654

7,867,930

8,142,650

7,558,780

During the current financial year, the Group and the Trust divested BBR Building. In the previous financial year, 26 Senoko

Way was transferred from investment properties to property held for sale, following the proposed divestment of the

property. The carrying value of the property was $24.8 million as at 31 March 2015. The divestment was completed in

April 2015.

As at the reporting date, investment properties with an aggregate carrying amount of $1,104,500,000 (2015:

$1,093,240,000) have been pledged as collateral for the Exchangeable Collateralised Securities and certain term notes

issued by the Group (Note 15 and 16).

Measurement of fair value

Investment properties are stated at fair value based on valuations performed by independent professional valuers as at

31 March 2016. As at 31 March 2015, the investment properties were stated at fair value based on valuations performed

by independent valuers, except for The Kendall, which was acquired on 30 March 2015 and was recorded at the cost

incurred upon acquisition.

Critical judgements made in accounting for acquisitions

The Group acquires subsidiaries that own real estate, and individual real estate. At the time of acquisition, the Group

considers whether each acquisition represents the acquisition of business or the acquisition of an asset. The Group

accounts for an acquisition as a business combination where an integrated set of activities is acquired, in addition to

the property. In determining whether an integrated set of activities is acquired, the Group considers whether significant

processes such as strategic management and operational processes are acquired. Where significant processes are

acquired, the acquisition is considered an acquisition of a business. Where the acquisition of the subsidiary or real estate

does not represent a business, it is accounted for as an acquisition of group of assets and liabilities.

The Group assessed the acquisition of the subsidiaries for the financial years presented as acquisitions of assets as no

strategic management function and operational processes were acquired along with the investment properties.

.168

A-REIT ANNUAL REPORT

2015/2016