Notes to the financial statements

Year ended 31 March 2016

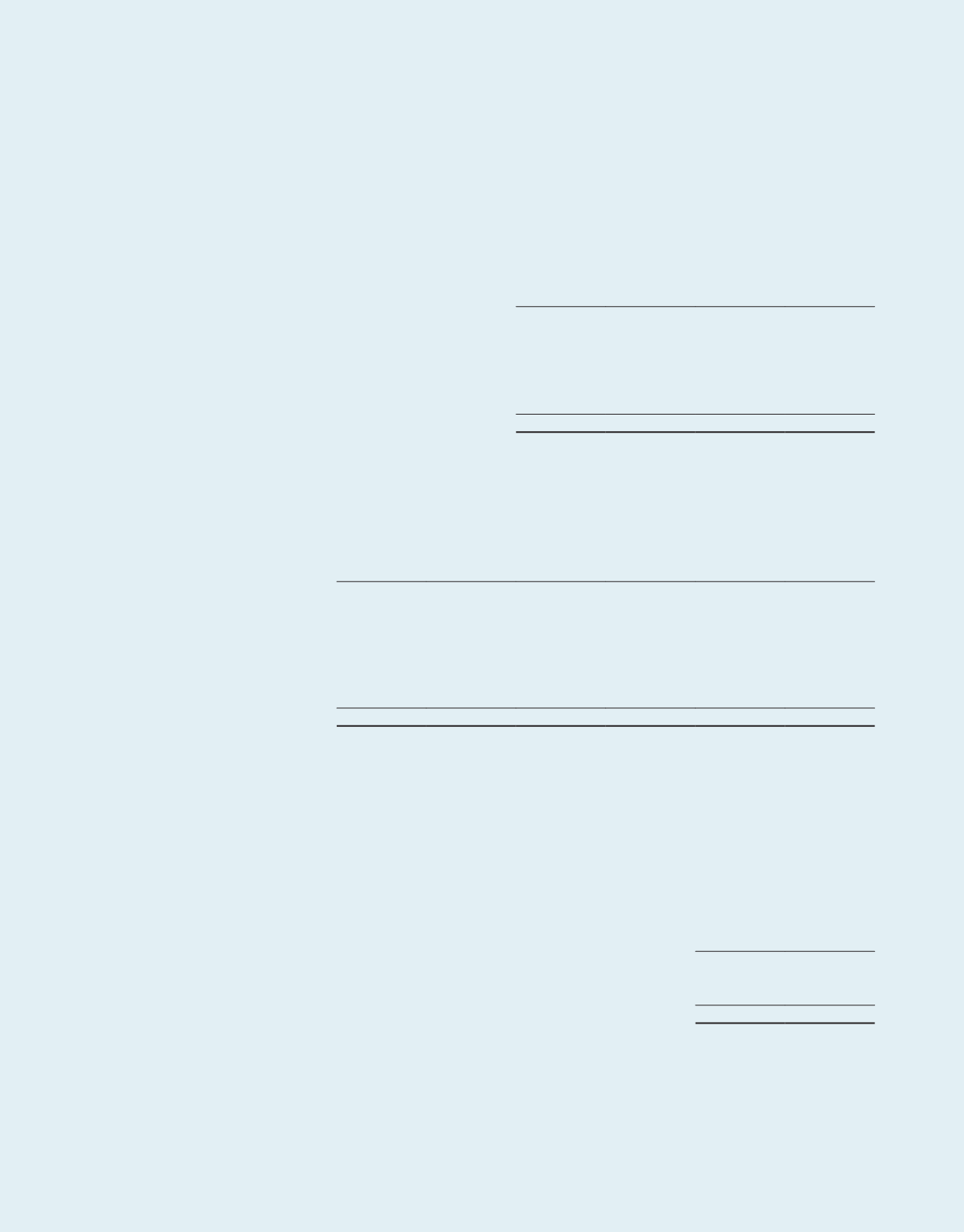

6 Finance lease receivables

2016

2015

Carrying

amount

Face

value

Carrying

amount

Face

value

$’000

$’000

$’000

$’000

Group and Trust

Finance lease receivables

– Current

35,269 159,354

1,002

9,572

– Non-current

57,731

91,054

92,842 250,408

93,000 250,408

93,844 259,980

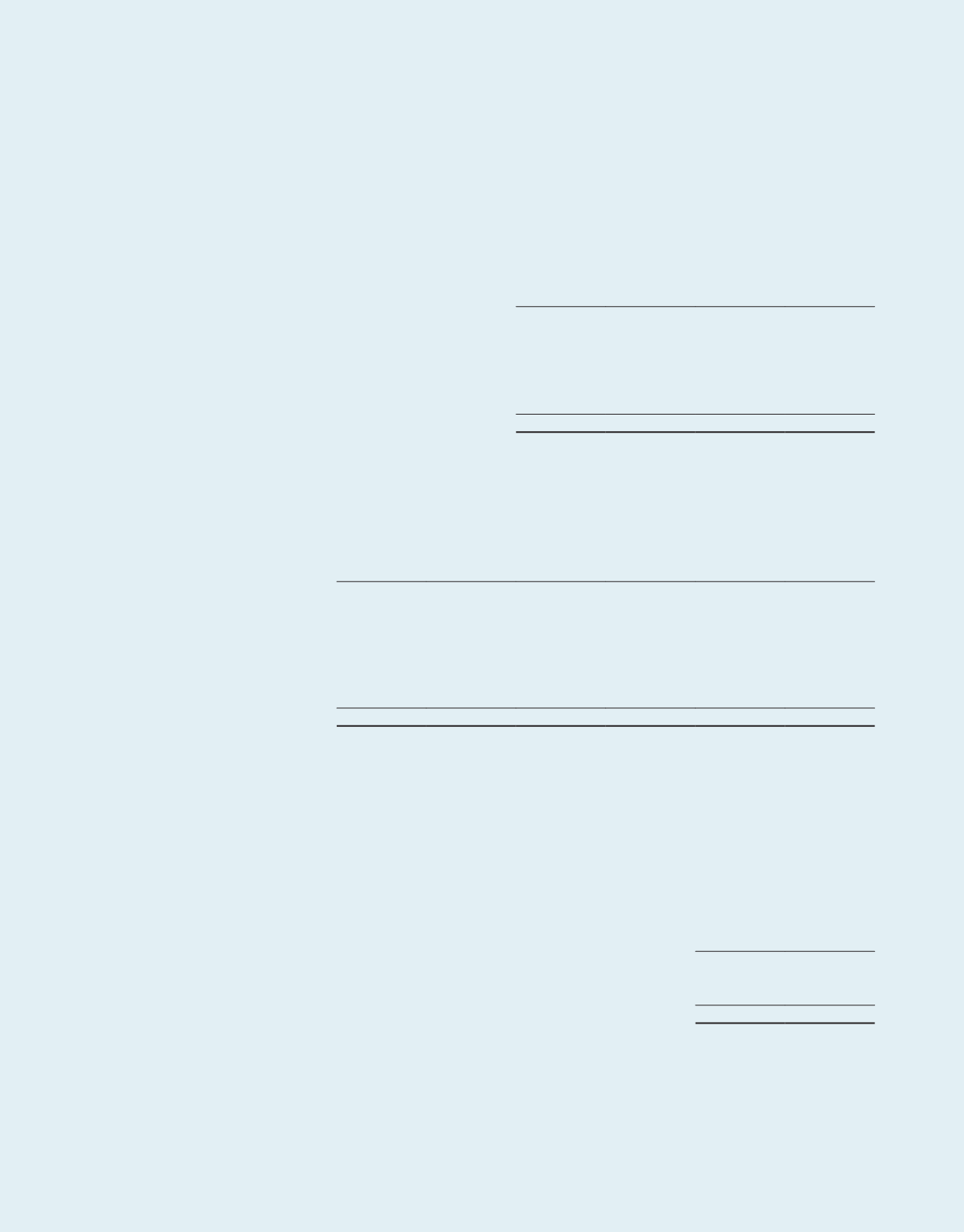

Finance lease receivables are receivable from the lessees as follows:

Gross

receivable

Unearned

interest

income

Net

receivable

Gross

receivable

Unearned

interest

income

Net

receivable

2016

2016

2016

2015

2015

2015

$’000

$’000

$’000

$’000

$’000

$’000

Group and Trust

Within 1 year

159,354 124,085

35,269

9,572

8,570

1,002

After 1 year but

within 5 years

25,259

15,065

10,194

42,259

33,203

9,056

After 5 years

65,795

18,258

47,537

208,149 124,363

83,786

250,408 157,408

93,000

259,980 166,136

93,844

For one of the lessees, the Group has a credit policy in place to monitor its credit rating on an ongoing basis. The lessee

would be required to provide a security deposit if the credit rating falls below the agreed terms. For the other lessee,

the Group had obtained sufficient security deposits to mitigate credit risk. The Manager believes that no impairment

allowance is necessary in respect of the finance lease receivables.

7 InterestS in subsidiaries

Trust

2016

2015

$’000

$’000

Equity investments, at cost

422,177

43,607

Loans to subsidiaries

282,512

135,717

704,689

179,324

.170

A-REIT ANNUAL REPORT

2015/2016