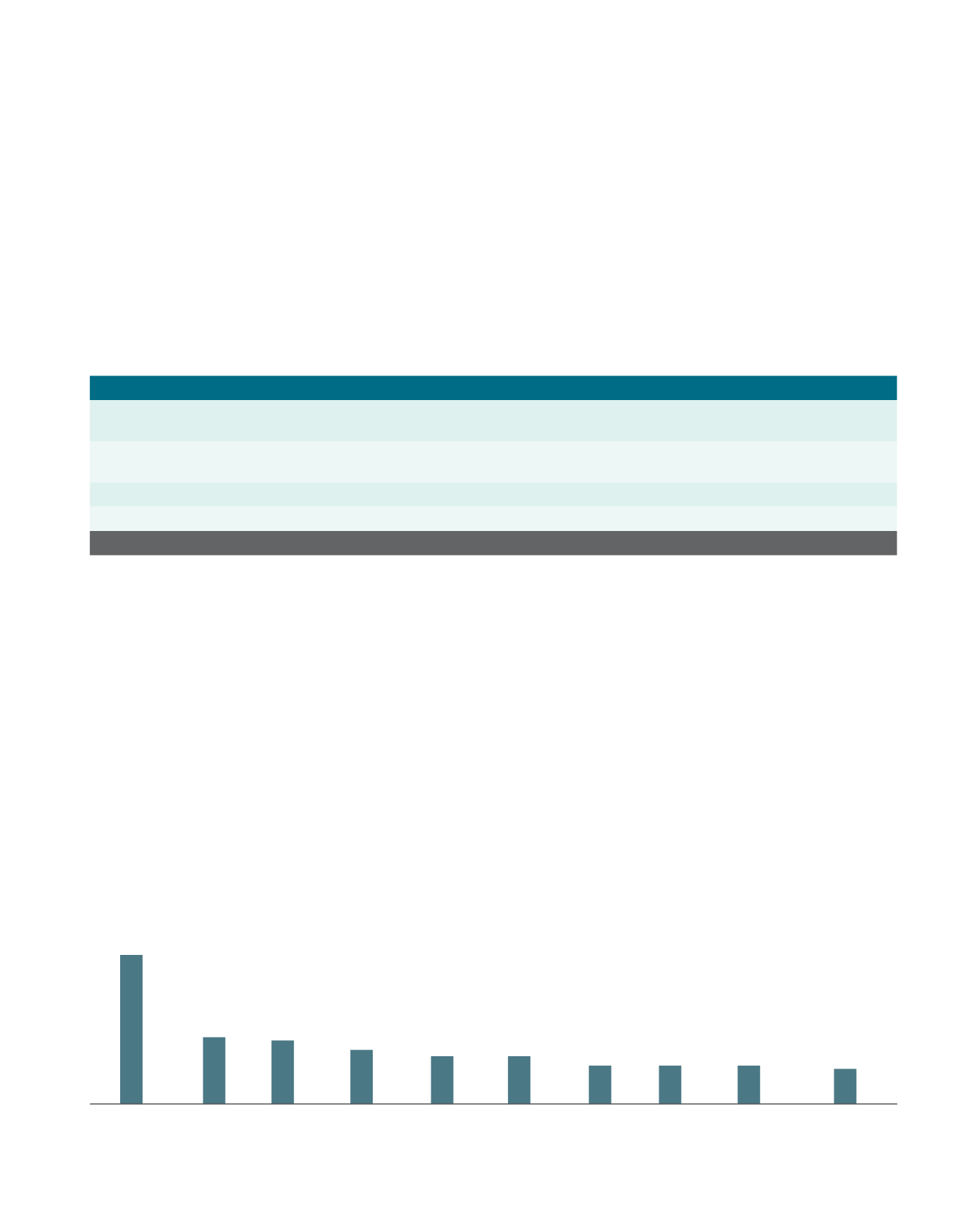

Top 10 Tenants of A-REIT by Gross Rental Income (as at 31 March 2016)

CUSTOMER CREDIT &

CONCENTRATION RISK MANAGEMENT

To minimise tenant credit risk, a credit evaluation process has

been established to assess the creditworthiness of A-REIT’s

tenants. Based on standard industry practice, one month’s

worth of gross rental is usually held as security deposit for

each year’s lease. However, for long-term leases in single-

tenant properties, a larger sum of security deposit may be

held. This is dependent on the length of the lease, the credit

risks of such tenants and commercial negotiation. Security

deposits for A-REIT’s single-tenant properties range from five

months to eleven months of rental income equivalent. The

average security deposit for the portfolio is approximately 4

months of rental income.

With a tenant base of around 1,470 local and international

companies, rigorous and conscientious effort has been put

in to manage accounts receivables. About 81.8% of rental

receipts are collected via interbank GIRO services. This

enables us to react efficiently and appropriately towards any

delinquency in payment.

Top 10 tenants accounted for not more than 18.2% of A-REIT’s

gross rental income and the majority of these tenants are either

multinational or listed companies. Furthermore, no single

property accounts for more than 5.4% of A-REIT’s monthly

gross revenue, offering income diversity within the portfolio.

Singapore

Telecommunications

Ltd

Wesfarmers Group

Hydrochem

(S) Pte Ltd

DBS Bank Ltd

Ceva Logistics

S Pte Ltd

Biomedical Sciences

Institutes (A*Star)

Citibank, N.A

Siemens Pte Ltd

JPMorgan Chase

Bank, N.A

Hewlett Packard

Singapore (Pte) Ltd

4.7%

2.1% 2.0%

1.7%

1.5%

1.5%

1.2% 1.2%

1.2%

1.1%

The Manager further strengthened A-REIT’s balance sheet

with S$854.9 million equity funds raised through perpetual

securities and new Unit issue exercises.

The S$300.0 million perpetual securities, issued in October

2015, were unsecured and subordinated, and confer the

holders a right to receive non-cumulative distribution

payments of 4.75% per annum for the first 5 years at the

Manager’s discretion. Proceeds from issue of perpetual

securities were swapped into AUD and used to fund the

acquisitions of 26 logistics properties in Australia.

During the financial year, a total of 249.8 million new Units

were issued through a) an S$200.1 million private placement

in December 2015; b) an S$144.8 million preferential offering

in January 2016; and c) an issue of S$210.0 million worth of

consideration units to Ascendas Lands (Singapore) Pte Ltd,

raising gross proceeds of S$554.9 million. Proceeds were

fully deployed in accordance with the intended use.

On 13 May 2016, Moody’s Investor Services re-affirms

A-REIT’s A3 issuer rating.

Actual use of proceeds

(S$m)

To fund the acquisition of ONE@Changi City, together with the plant and property

therein and the associated costs

434.7

To fund the acquisition of 6-20 Clunies Ross Street, Pemulwuy, located in Sydney,

Australia and the associated costs

82.0

To fund debt repayment

35.4

To pay the fees and expenses incurred by A-REIT in connection with new Unit issuances

2.8

TOTAL

554.9

.39

A-REIT ANNUAL REPORT

2015/2016