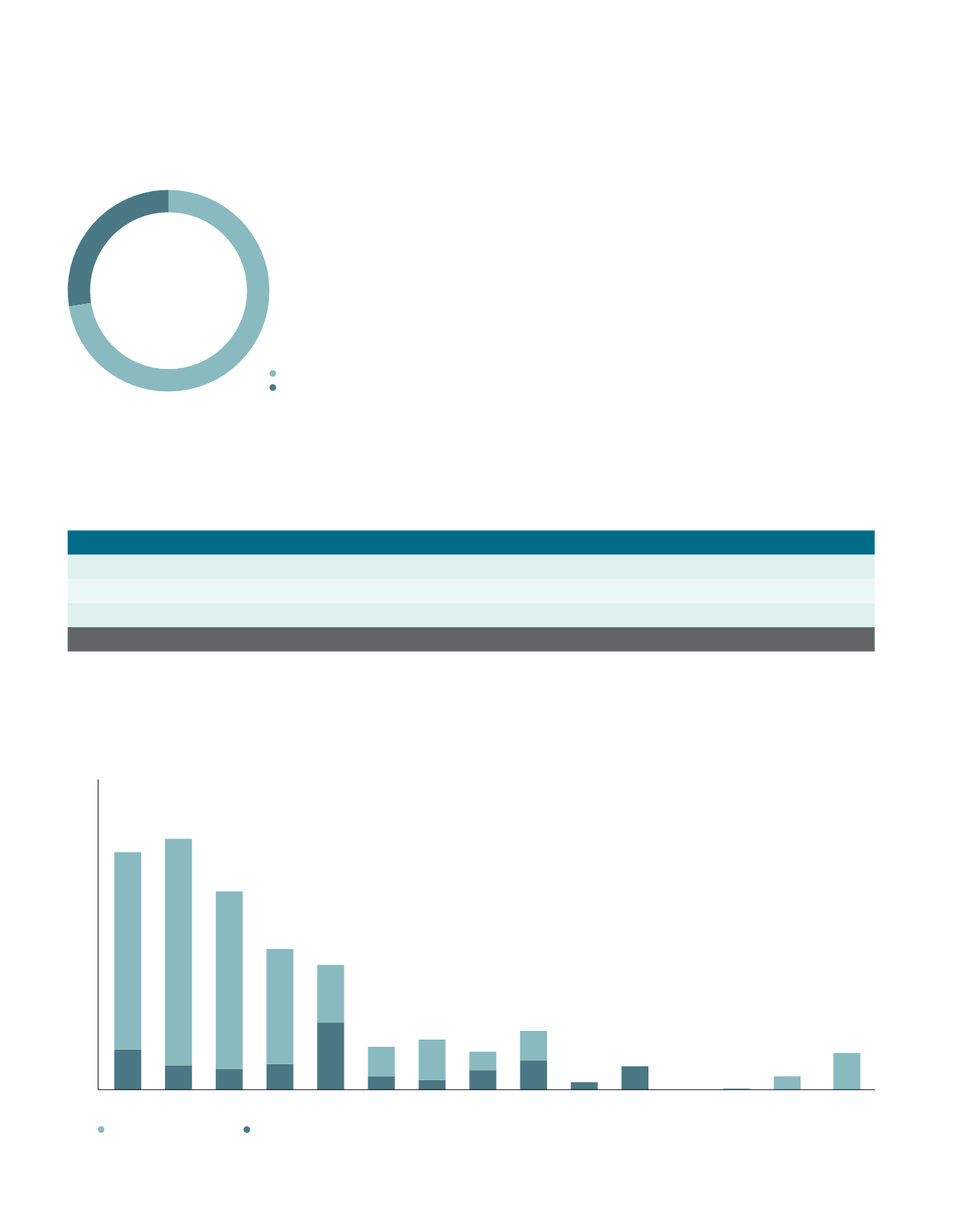

Split of Single-tenant Buildings and Multi-tenant Buildings by Asset Value (as at 31 March 2016)

MANAGER’S REPORT

The weighted average lease to expiry (WALE) for the portfolio is 3.7 years as at 31 March 2016. In Australia, leases tenures

are generally longer than those in Singapore at 5.2 years. Weighted average lease term of new leases signed in FY15/16 was

3.4 years and they accounted for 7.9% of total gross rental income for FY15/16.

Weighted Average Lease to Expiry by Gross Rental Income (as at 31 March 2016)

WALE (in years)

31 March 2016

31 March 2015

Singapore

3.5

3.8

Australia

5.2

–

China

2.6

3.1

Portfolio

3.7

3.8

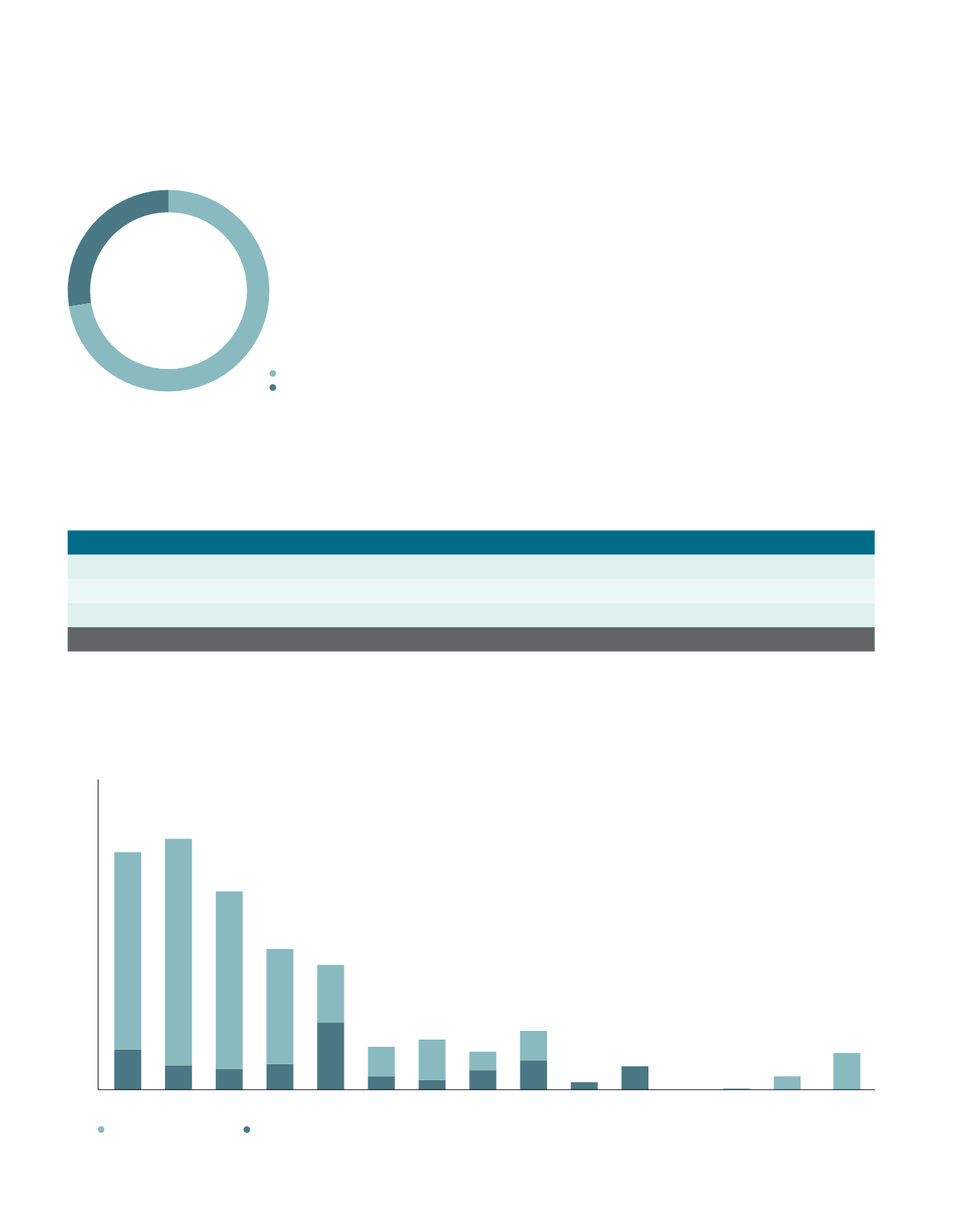

About 19.4% of A-REIT’s gross rental income is due for renewal in FY16/17. 3.3% are leases of single-tenant buildings and

16.1% are leases of multi-tenant buildings. The Manager is proactively working on the renewal of these leases.

A-REIT’s Portfolio Lease Expiry Profile (as 31 March 2016)

Multi-tenant Buildings

Single-tenant Buildings

72.6%

27.4%

FY16/17

FY19/20

FY22/23

FY26/27

FY17/18

FY20/21

FY23/24

FY27/28

FY18/19

FY21/22

FY25/26

FY24/25

FY28/29 FY29/30 >FY29/30

0%

25%

5%

15%

10%

20%

% of A-REIT Gross Rental Income

Multi-tenant Buildings

Single-tenant Buildings

3.3%

2.0% 1.7% 2.1%

5.5%

1.1% 0.8% 1.6% 2.4%

2.4%

1.5%

3.3%

2.4%

4.7%

9.4%

14.5%

18.5%

16.1%

19.4%

20.5%

16.2%

11.5%

10.2%

3.5%

4.1%

3.1%

4.8%

0.6%

1.9%

0.1%

1.1%

3.0%

.42

A-REIT ANNUAL REPORT

2015/2016