Sustainability Achievements

- The Green Bond and Green Perpetual Securities were issued under a newly established Green Finance Framework. Please refer to https://ir.ascendas-reit.com/green_financing.html for details.

- Building and Construction Authority, Singapore

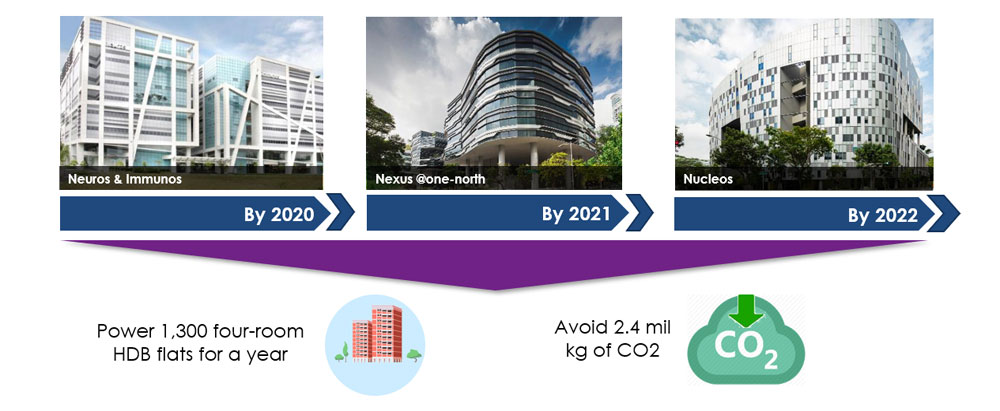

Powering Properties with Renewable Energy

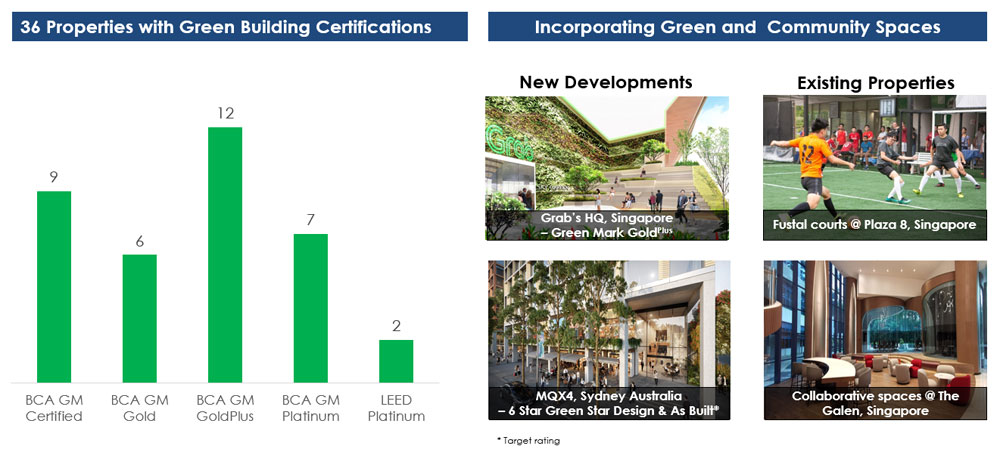

Moving Towards a Green and Sustainable Portfolio

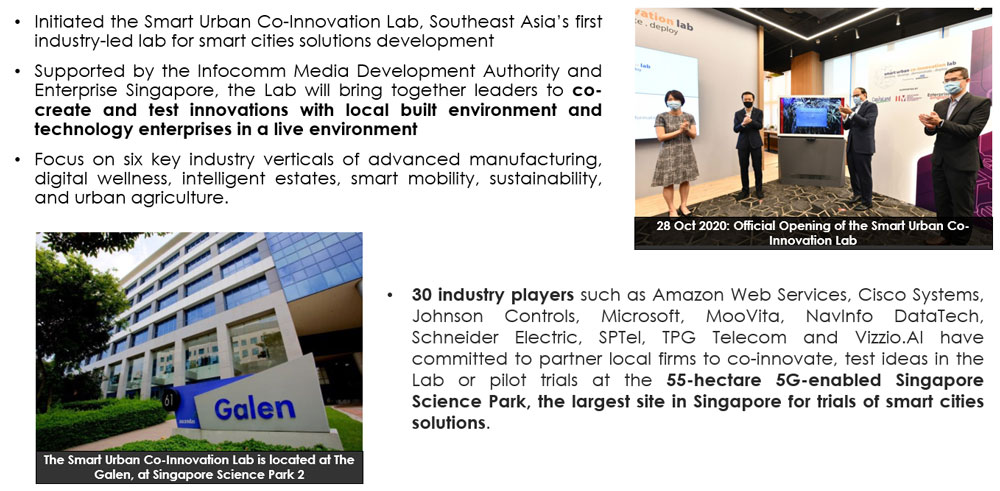

Embracing Innovation and Technology

Integrated Sustainability Report FY2019

-

Sustainability Highlights

-

Board Statement & Board Message

Board Statement

Ascendas Real Estate Investment Trust (Ascendas Reit or the Group) is committed to sustainability and incorporates the key principles of environment, social and governance factors in setting out its business strategies and operations.

The Board considers Economic, Environment, Social and Governance (EESG) issues such as fraud, corruption and bribery, environment, health and safety, when determining the nature and extent of material risks that Ascendas Reit is willing to take to achieve its strategic and business objectives.

The Board also approves the executive compensation framework based on the principle of linking pay to performance. Ascendas Reit’s business plans are translated to both quantitative and qualitative performance targets, including sustainable corporate practices, and are cascaded throughout the organisation.

Board Message

In this report, we elaborate on our EESG performance for FY2019, as we continue the journey of delivering long-term value to our stakeholders.

On 1 July 2019, Ascendas-Singbridge was officially integrated with CapitaLand Limited (CapitaLand). With this milestone, Ascendas Reit’s Manager1 and Asset/Property Managers2 are now wholly-owned subsidiaries of CapitaLand. As a CapitaLand-sponsored REIT, Ascendas Reit will be progressively implementing policies and strategies of CapitaLand on EESG issues.

The Board has incorporated EESG issues in its strategic formulation, having reviewed the nine key issues identified in the previous year and determined their continued relevance to Ascendas Reit. We will manage and monitor all EESG issues and conduct a reassessment of key issues in the coming financial year, taking into consideration the business environment and strategy.

In FY2019, Ascendas Reit completed over S$1.7 billion of acquisitions. This included its maiden entry into the United States (US), which further diversifies its portfolio geographically and strengthens its customer base. Overseas assets made up 28% of Ascendas Reit’s portfolio compared to 21% as at our last report. Overall, our portfolio has more freehold land (29.3% as at 31 December 2019 from 22.1% as at 31 March 2019) and its top 10 tenant concentration risk has been reduced (17.9% as at 31 December 2019 from 20.2% as at 31 March 2019).

Other investments during the year included a suburban office (254 Wellington Road) in Melbourne, Australia, which is expected to achieve NABERS Energy Rating of Five Star and Green Star Design rating of Five Star upon its completion in 3Q 2020, as well as the redevelopment of iQuest@IBP in Singapore, which is designed to the highest BCA Green Mark accolade of Platinum.

To create better efficiencies within the enlarged CapitaLand Group, some functions within the Manager were consolidated under CapitaLand, resulting in a drop in the number of employees within the Manager in FY2019. Multiple integration workshops were conducted to ensure a smooth transition for the employees of the two entities. Various workstreams came together to collaborate, harmonise and transition into new processes and systems. A celebration event and annual dinner was also held in October 2019, attended by over 2,300 CapitaLand employees.

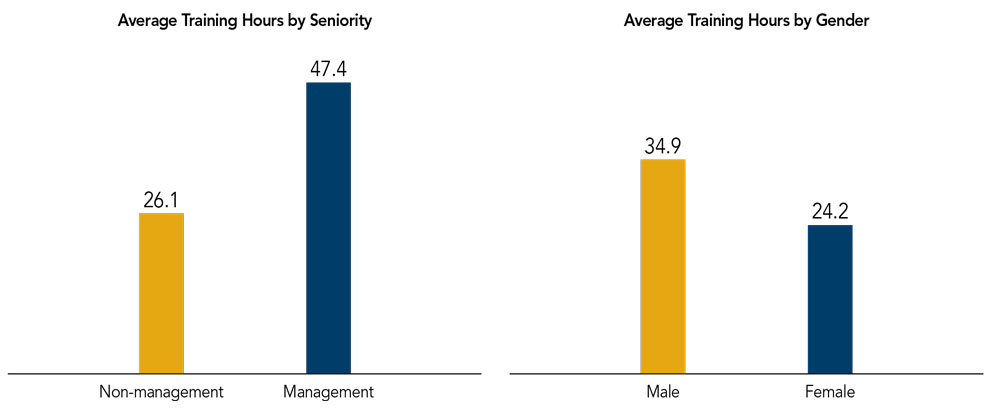

Apart from orientation programmes to help onboard the Manager’s employees, CapitaLand has committed S$5 million towards its ‘Building Capability Framework’ to improve the digital skills of its employees over the next two years to prepare them for the future economy. The framework was launched in Singapore in August 2019 with the target for all employees to attend at least one digital training course by 2020.

To promote employees’ health and wellbeing, wellness initiatives such as weekly group physical exercise sessions, health talks and bazaar have been organised throughout the year.

In FY2019, Ascendas Reit was recognised for its sustainability reporting efforts, clinching the runnerup Award for Sustainability (REITs and Business Trusts category) by the Securities Investors Association (Singapore) (SIAS) at the Investors’ Choice Award 2019. We are encouraged by this result and will continue to enhance our disclosures to our stakeholders.

We stepped up our efforts to reduce Ascendas Reit’s environmental footprint. On a like-for-like basis for the Singapore portfolio, our energy intensity improved for the reporting period by 4.3% while water intensity increased by 2.2% over the same comparable time period in the previous financial year. To increase our commitment towards sustainability, we partnered with Sembcorp Industries to install more than 21,000 rooftop solar panels atop six Ascendas Reit properties in Singapore. These panels can generate more than 10,000 megawatt hours of energy annually, which is equivalent to powering about 2,300 four-room Housing & Development (HDB) flats each year. We are exploring more opportunities to generate and deploy more clean energy from our properties.

In August 2019, the employees of the Manager, together with its Chief Executive Officer, visited the Foundation of Slum orphanage (FSCC) in Bangkok, Thailand, which provides care and education for children aged from four months to five years old. In the spirit of giving back to the community, the Manager donated groceries and spent time interacting with the children in the orphanage.

We would like to express our gratitude to our stakeholders for their continued trust in and support for Ascendas Reit. We remain committed to working closely with all our stakeholders to grow our business in a responsible and sustainable manner.

- Ascendas Funds Management (S) Limited

- Refers to Ascendas Services Pte Ltd, Ascendas Funds Management (Australia) Pty Ltd, CL International Management (UK) Ltd and CapitaLand International (USA) LLC.

-

About this Report

This is Ascendas Reit’s third Integrated Sustainability Report. The report provides updates on its EESG performance. Between 2013 and 2017, Ascendas Reit has published five sustainability reports.

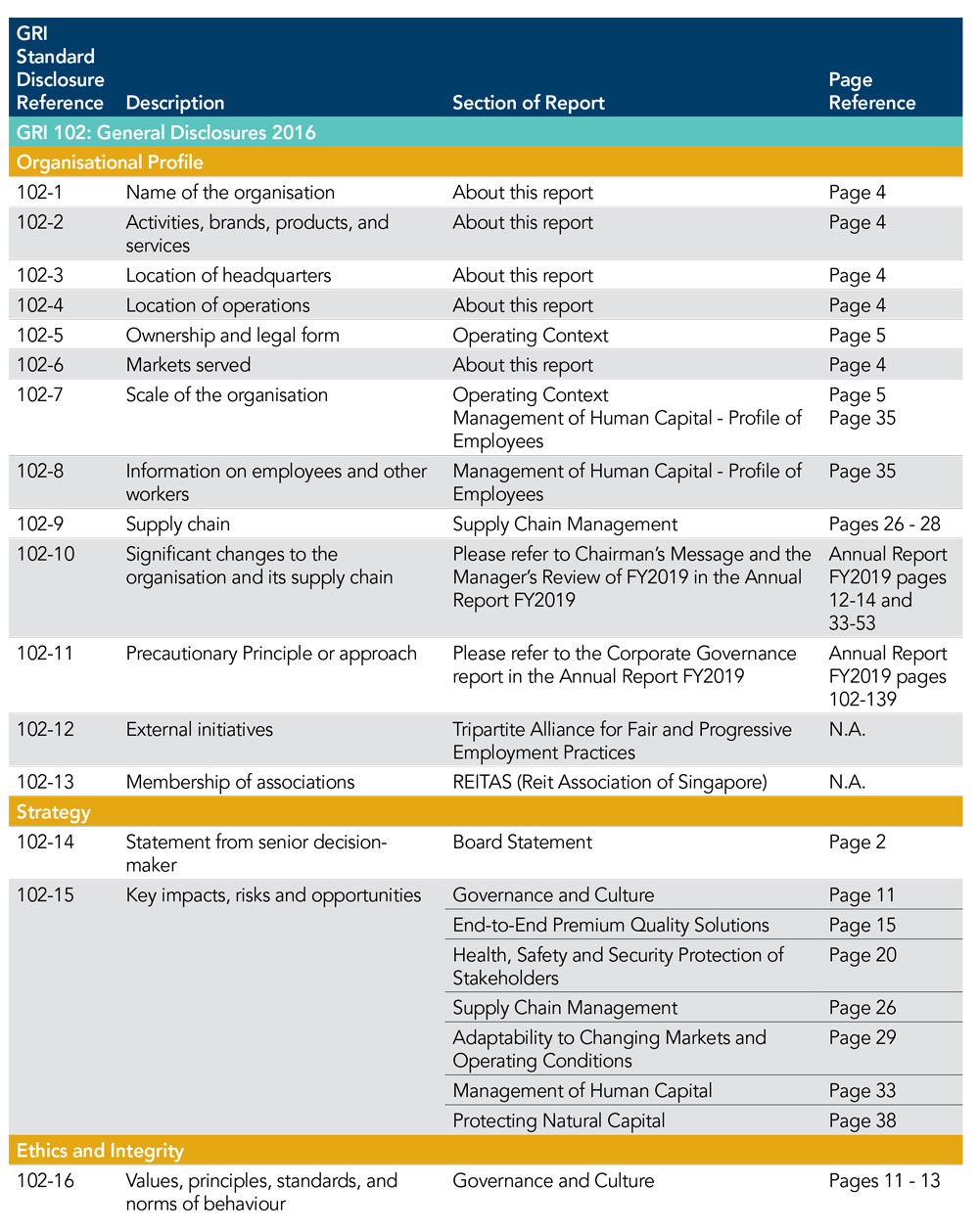

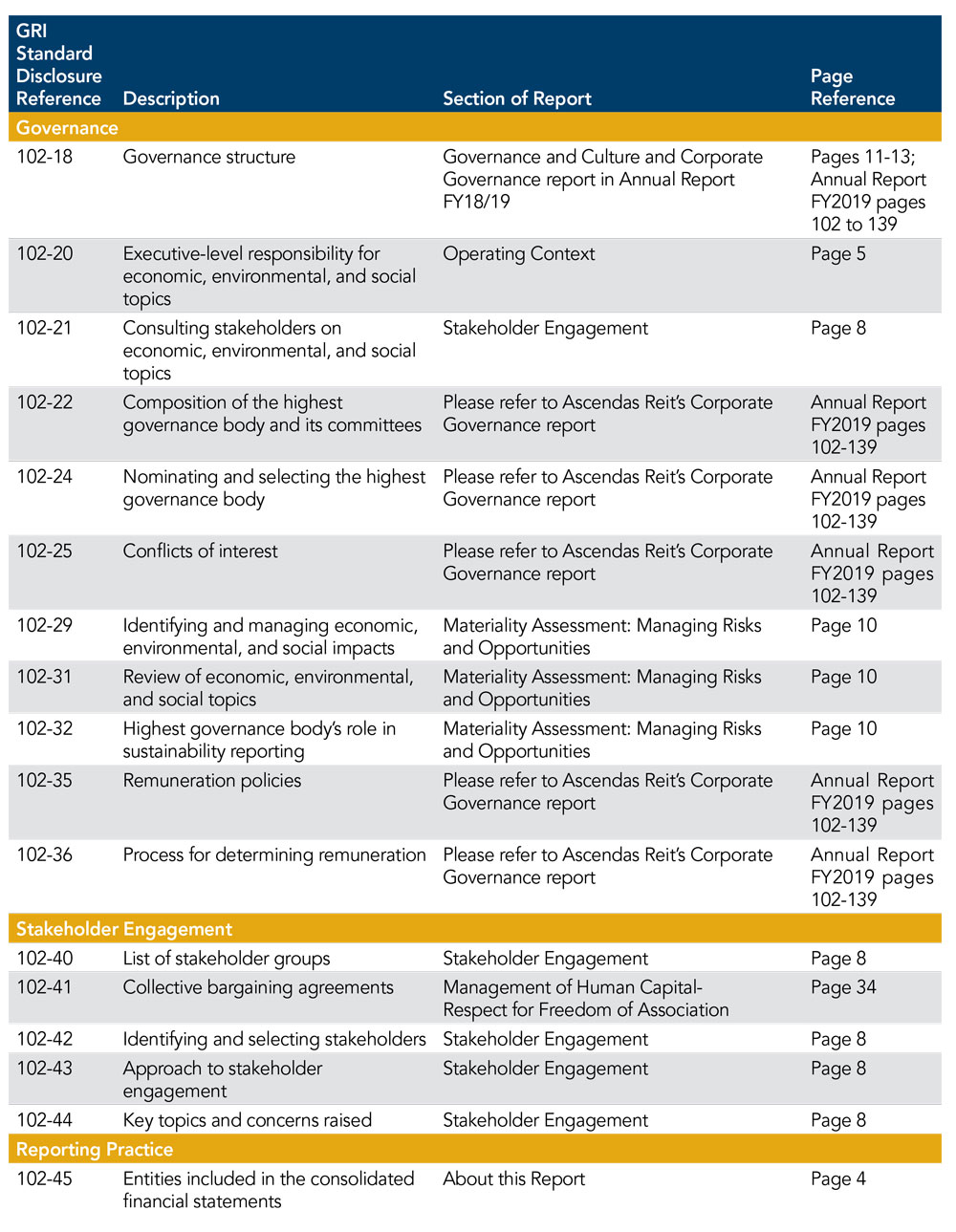

This report has been prepared in accordance with the SGX-ST Listing Manual Rule 711(B), Global Reporting Initiative (GRI) Standards: Core option, and GRI’s Construction & Real Estate Sector Supplement (CRESS). The GRI Standards have been selected as it is an internationally recognised reporting framework that covers a comprehensive range of sustainability disclosures that is relevant to Ascendas Reit’s business. This report has also incorporated elements of the Integrated Reporting (IR) Framework of the International Integrated Reporting Council, and Sustainable Development Goals (SDGs) of the United Nations.

The report focuses on the sustainability performance of Ascendas Reit’s core activity as a business space and industrial Real Estate Investment Trust (REIT). Its scope covers Ascendas Reit’s business operations and properties in Singapore and Australia from 1 April 2019 to 31 December 20193 (FY2019), in alignment with the change to its Financial Year4.

As at 31 December 2019, Ascendas Reit’s portfolio comprised 200 properties across Singapore, Australia, the United Kingdom (UK) and the US, up from 171 properties the year before. There are 70 logistics properties in Australia and the UK that are not managed by the Manager, and therefore excluded from this report. The 28 business park properties in the US as well as two properties in Singapore that were only acquired on 11 December 2019 are also excluded from this report given the short holding period. One Singapore property was divested during the financial year.

Taking into account the above exclusions and taking guidance from the operational control approach5 as defined by the Greenhouse Gas Protocol Corporate Standard, environmental performance of 72 properties (including one property divested during the financial year) under operational control have been covered in this report. As at 31 December 2019, about 48% of Ascendas Reit’s portfolio was directly under the operational control of the Asset/Property Managers, in terms of Gross Floor Area.

The multi-segmented6 portfolio comprised 71% and 29% of multi-tenant and single-tenant properties respectively. Please refer to pages 58 to 99 of the Annual Report FY2019 for the full list of Ascendas Reit’s properties.

The Manager has not sought external independent assurance for this reporting period. Feedback on the report can be directed to a-reit@capitaland.com.

- Data for the period of 1 January 2019 to 31 March 2019 is covered in Ascendas Reit’s Integrated Sustainability Report FY18/19.

- In July 2019, Ascendas Reit announced that it changed its financial year end from 31 March to 31 December. Therefore, FY2019 is a nine month period from 1 April 2019 to 31 December 2019.

- Ascendas Reit’s Manager and its Asset/Property Managers did not have operational control of 129 properties in its portfolio during FY2019; hence emissions associated with fuel combustion and purchased electricity are scope 3. Details can be found on page 4 of the GHG Protocol Corporate Standard (Appendix F: Categorising GHG emissions associated from leased assets): www.ghgprotocol.org/corporate-standard

- Ascendas Reit owns properties across the following segments – Business & Science Parks/Suburban Offices, Integrated Development, Amenities & Retail (IDAR) Properties, High-Specifications Industrial Properties and Data Centres, Light Industrial Properties and Flatted Factories, and Logistics & Distribution Centres.

-

Delivering Sustainable Value

Operating Context

Ascendas Reit is Singapore’s first and largest listed business space and industrial REIT, and has presence in Singapore, Australia, the UK and most recently, the US. The REIT is managed by Ascendas Funds Management (S) Limited (the Manager), a wholly-owned subsidiary of CapitaLand. Please refer to page 17 of the Annual Report FY2019 for more details on Ascendas Reit’s Structure.

As at 31 December 2019, Ascendas Reit had a tenant base of around 1,490 international and local companies across a wide range of industries.

Figure 1. Ascendas Reit’s Portfolio in Singapore, Australia, the UK and the US (as at 31 December 2019)

Creating Value

Ascendas Reit leverages on six Capitals whilst considering its operating context and enhance these capitals to generate value. Material EESG issues are grouped into these six Capitals and mapped against Ascendas Reit’s efforts in creating and delivering value, together with the relevant United Nations Sustainable Development Goals (UN SDGs) supported.

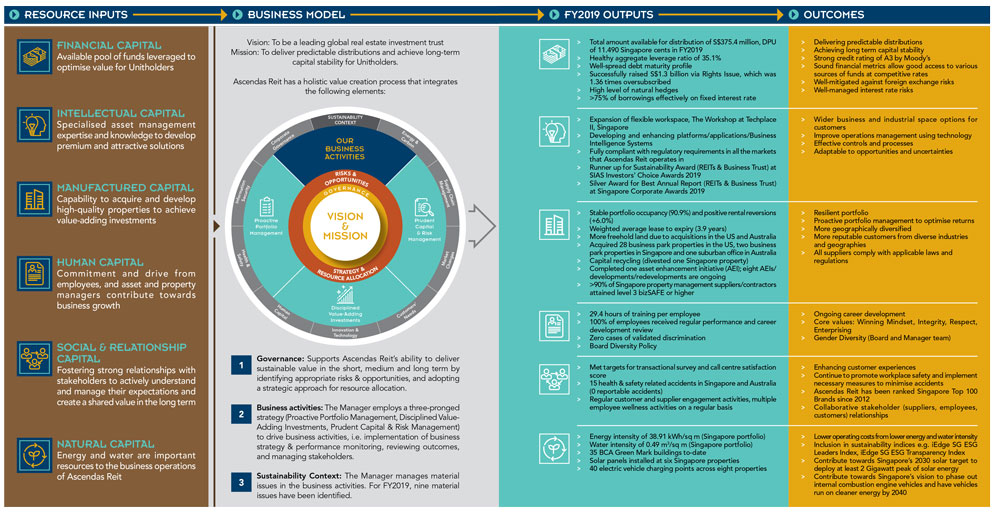

Figure 3. Ascendas Reit’s Value-Creating Business Model

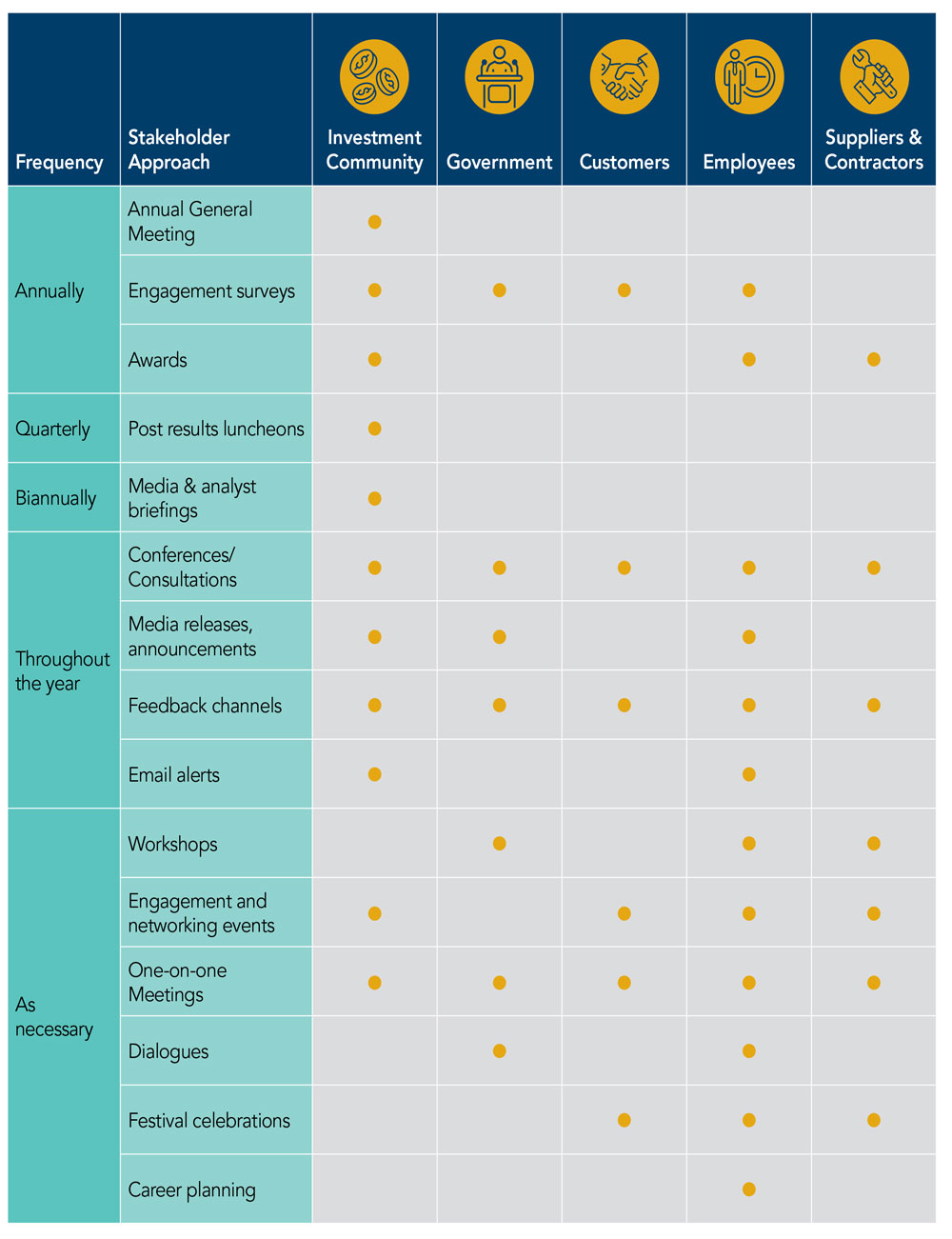

Stakeholder Engagement

To facilitate continuous improvement, the Manager and Asset/Property Managers engage with stakeholders regularly throughout the year to understand their needs. These stakeholders have been identified to have long-term relationships with, and high level of influence and interest in Ascendas Reit. Ascendas Reit seeks to address their concerns through various engagement channels.

Figure 4. Stakeholder Engagement

Table 1. Engagement Channels and Modes with Key Stakeholders

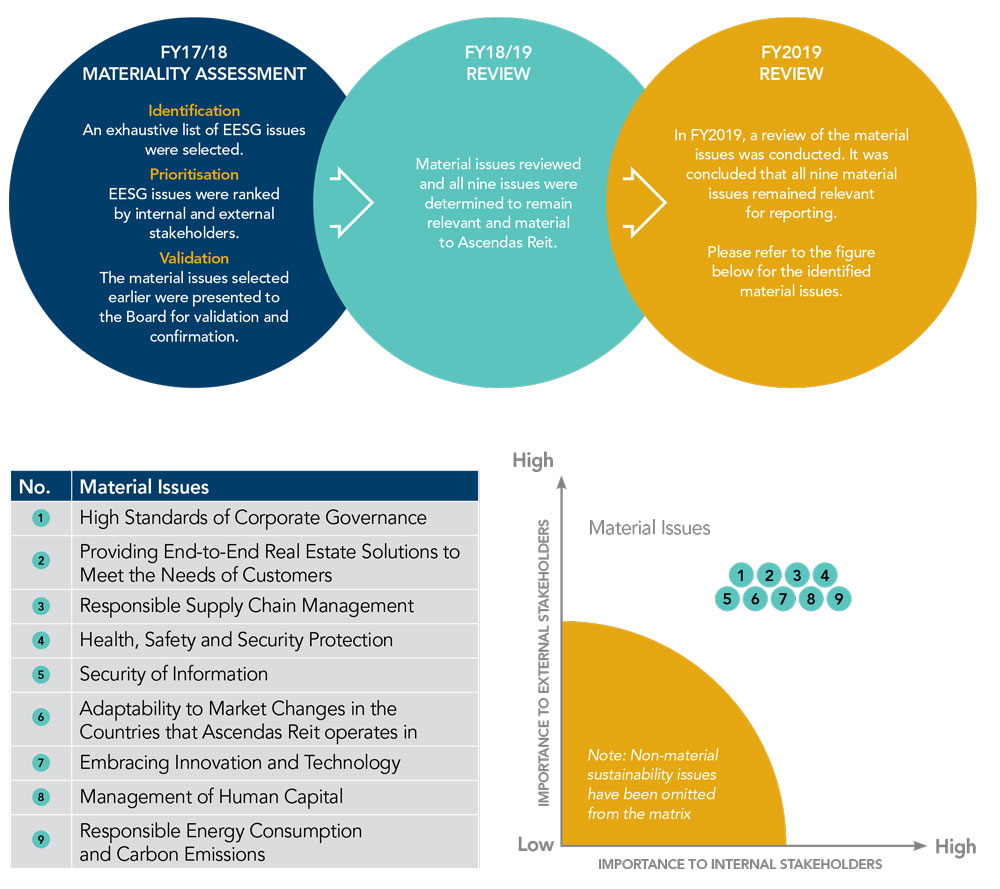

Materiality Assessment: Managing Risks and Opportunities

Ascendas Reit has identified and assessed material issues with the most significant impact to business operations and stakeholders. Following the last materiality assessment in FY17/18, the Manager and Asset /Property Managers conducted a review for the reporting year 2019 and determined that all nine issues remain relevant to Ascendas Reit. Following the integration of Ascendas-Singbridge and CapitaLand, these issues will be reassessed in the next reporting period. The assessment process and materiality matrix are as follows:

Figure 5. Materiality Assessment Process and Matrix

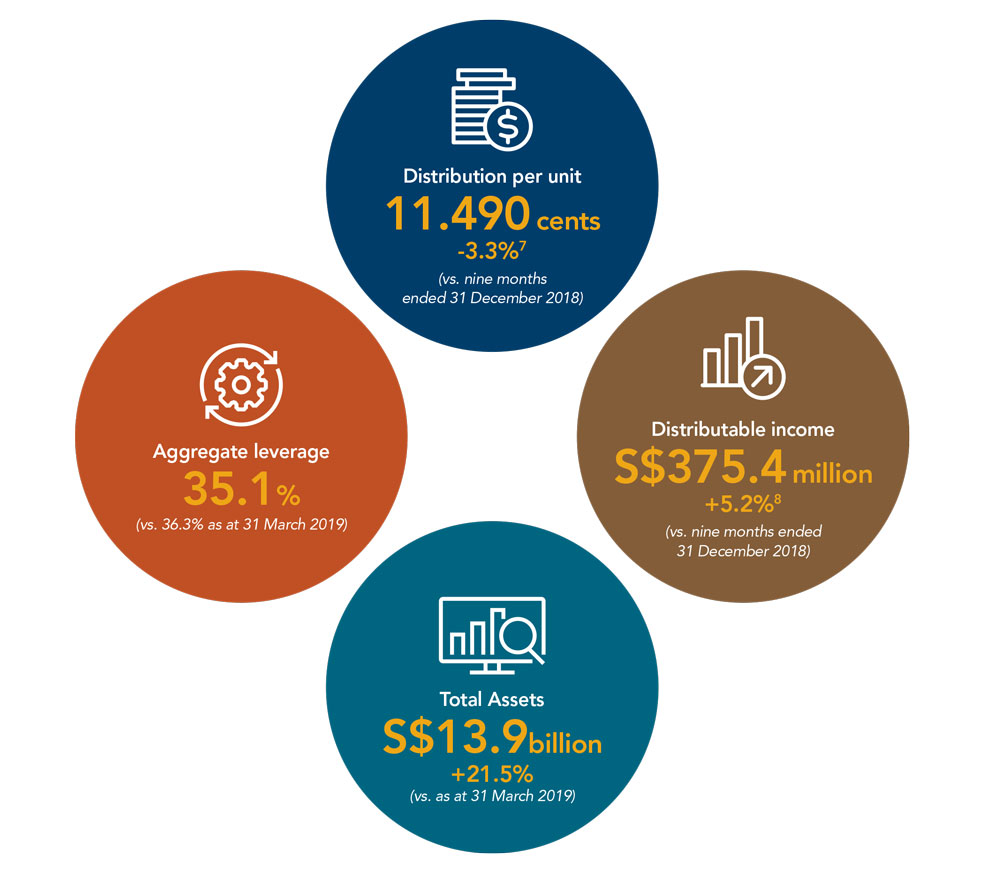

Financial Capital

Ascendas Reit draws on its available pool of funds to invest in properties, carry out asset enhancements and redevelop properties to optimise value for its Unitholders. In FY2019 (nine months ended 31 December 2019), it delivered a Distribution per Unit of 11.490 Singapore cents. This was 3.3% lower than the comparative period a year ago due to an enlarged number of applicable units in issue as a result of Ascendas Reit’s Rights Issue in December 2019. For a detailed breakdown on Ascendas Reit’s financial performance and management of financial capital, please refer to page 33 to 46 of the Annual Report FY2019.

Figure 6. Ascendas Reit’s FY2019 Performance Highlights

- Due to the mismatch in timing between the contributions from the newly acquired business parks in the US and Singapore (i.e. 11 December 2019 to 31 December 2019) and the additional number of Units issued which were entitled to the full distributions for the final quarter of FY2019 (1 October 2019 to 31 December 2019).

- Mainly attributable to newly acquired properties in the UK, the US and Singapore.

-

Governance and Culture

The Manager is committed to the highest level of corporate governance and transparency in the execution of policies and processes as this is fundamental to the management and operational protocols of Ascendas Reit. This is founded on the belief that good governance is essential in building trust and confidence with stakeholders which ultimately determines the success of the business.

To guide employees in making the right business decisions, Ascendas Reit builds and maintains a strong organisational culture, guided by CapitaLand’s Core Values.

Material Issue

- High Standards of Corporate Governance

Key Risk

- Regulatory Compliance Risks

- Operational Risks

Our Approach

Manage business and commercial strategy guided by an adequate and effective system of internal controls and risk management practices

High Standards Of Corporate Governance

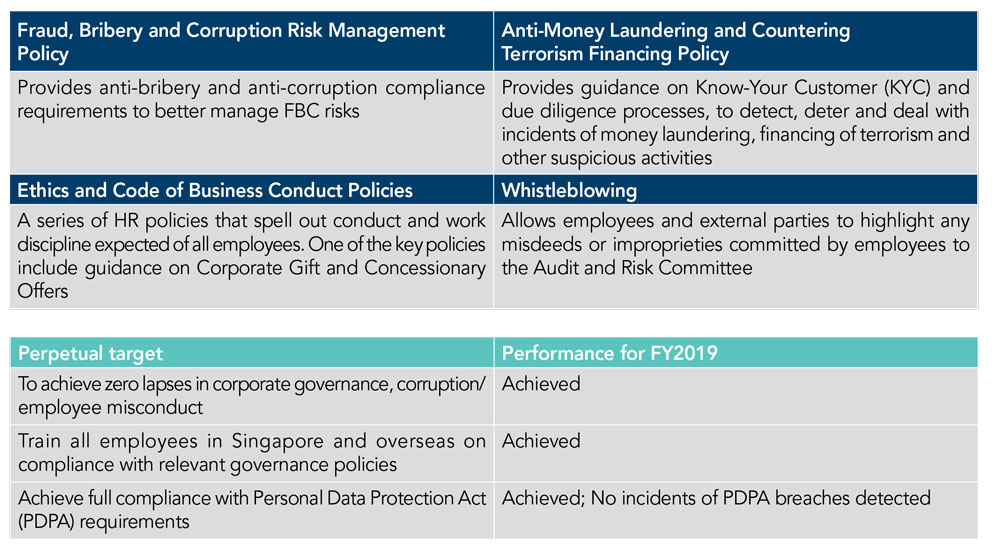

Business Ethics and Employee Conduct

All employees are expected to adhere to a comprehensive suite of policies and guidelines relating to business ethics and work discipline, some of which are described in Table 2. These policies apply to all Ascendas Reit’s operations in Singapore and overseas, and are communicated to all new and existing employees. Where applicable, training is organised for employees to familiarise themselves with the relevant policies.

The Group adopts a strict zero-tolerance stance towards Fraud, Bribery and Corruption (FBC). The FBC Risk Management Policy, together with the Ethics and Code of Business Conduct policies, provide standards for the ethical conduct of business and apply to all employees. To help employees comply, an FBC guide is made available via CapitaLand’s intranet and all employees are required to undertake an e-learning programme on Managing FBC Risks.

In addition to employees, contractors and suppliers are also kept apprised of the Group’s strict FBC stance. FBC clauses are included in service contracts and agreements with suppliers and partners.

Table 2. Policies and Practices Relating to Governance at Ascendas Reit

More details on Ascendas Reit’s practices can be found from pages 102 to 139 of the Corporate Governance Report in the Annual Report FY2019, which takes reference from the Code of Corporate Governance 2018.

Culture and Enablers

Guided by CapitaLand’s Core Values, the Manager and Asset/Property Managers are committed to high standards of governance. Employees are encouraged to adopt good business conduct and ethical values in line with CapitaLand’s Core Values.

Figure 7. CapitaLand’s Core Values

Risk Management and Controls

The Manager maintains an adequate and effective system of risk management and internal controls that enables the Manager to manage risks in an integrated and structured manner. The Board is responsible for the governance of risks across the Group. Their role includes overseeing the Group’s Enterprise Risk Management (ERM) Framework; determining the Group’s risk appetite; regularly reviewing the Group’s risk profile, material risks and mitigation strategies; and ensuring the adequacy and effectiveness of the risk management framework and policies. It is assisted by the Audit and Risk Committee (ARC), which provides dedicated oversight of risk management at the Board level. Material EESG findings are reported on a quarterly basis or as necessary, and recommendations are made to manage or mitigate such risks. Since FY12/13, the Manager has taken active steps in disclosing the EESG performance of Ascendas Reit by publishing an annual Sustainability Report.

The Manager regularly assesses its operations, such as procurement of goods and services and engagement with managing agents for risks related to corruption in all the countries where it operates in.

The risk management process consists of the following steps:

- Establishing corporate goals and context

- Identifying risks

- Analysing risks

- Evaluating risks

- Treating risks

- Monitoring and reviewing risks

For further details on the risk management process, please refer to pages 140 to 145 of the Enterprise Risk Management Report in the Annual Report FY2019. There were no cases of material non-compliance with laws and regulations in the financial year, a record the Manager endeavours to uphold.

-

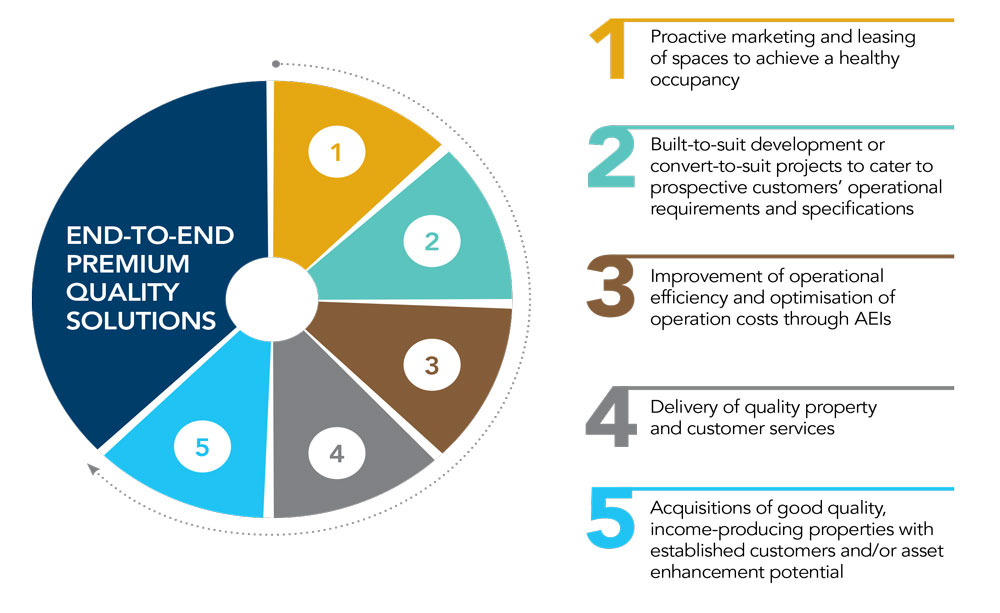

End-to-End Premium Quality Solutions

Ascendas Reit offers customer-centric end-to-end premium quality solutions with value-added real estate solutions.

At a time where customer expectations are ever growing. Ascendas Reit strives to cater to customers’ different needs and expectations, and constantly look for ways to improve the quality of experience for its customers and visitors.

Material Issue

- Providing End-to-End Real Estate Solutions to Meet the Needs of Customers

- Customer Satisfaction

Key Risk

- Operational Risks

- Sustainability Risks

Our Approach

Provide end-to-end real estate solutions, such as space solutions, planning and development, property management, integrating business, lifestyle and rental spaces to create human-centric work-live-play environments to meet the needs of customers and increase customer satisfaction

Providing End-To-End Real Estate Solutions To Meet The Needs Of Customers

The Manager adopts a multi-pronged approach to deliver value to its customers (Figure 8). This includes value-adding investments through acquisitions, developments and asset enhancement initiatives (AEIs), as well as delivering quality spaces and good customer services.

Further details on acquisitions and developments can be found on pages 36 to 41 of Ascendas Reit’s Annual Report FY2019.

Figure 8. Ascendas Reit’s Strategy Towards End-to-End Premium Quality Solutions

AEIs and redevelopments are continuously undertaken to deliver end-to-end premium quality real estate solutions for Ascendas Reit’s customers. These projects include providing community spaces as public gathering points, ensuring accessibility in the built environment for different age groups and varying mobility, promoting sustainability features to improve customers’ work experience and creating live-work-learn-play environments.

Recent projects include:

More information on the on-going asset enhancement projects undertaken by the Manager can be found on page 42 to 43 of Ascendas Reit’s Annual Report FY2019.

As a commitment to its stakeholders, 31 properties within Ascendas Reit’s Singapore portfolio have achieved the BCA9 Green Mark certifications (6 Platinum, 11 GoldPLUS, 6 Gold awards and 8 certified as at 31 December 2019.

To-date, an additional four properties have achieved Green Mark certifications (2 Platinum, 1 GoldPlus and 1 certified), including LogisTech which received the Platinum award for Super Low Energy10, for being a best-in-class energy efficient building. The Manager will continue to work towards obtaining Green Mark certifications for its other Singapore properties.

- Building and Construction Authority, Singapore

- 10 BCA Green Mark for Super Low Energy was newly introduced on 5 September 2018

Customer Satisfaction

The Manager does not stop at meeting customers’ immediate needs and strives to always deliver an exceptional customer experience that also enriches lives and communities. It has in place a customer experience vision that seeks to deliver excellent service as well as provide high-quality and well-maintained spaces. It also helps to build communities through holistic programmes, events and activities (i.e. festive, health and fitness, mass community events) across Ascendas Reit’s properties, which were well-attended by tenants, visitors and employees alike in FY2019. To improve vibrancy and create a conducive work-live-play environment, the Manager also implements customer care programmes.

Figure 9. Ascendas Reit’s Customer Experience Vision

-

Health, Safety and Security Protection of Stakeholders

The Manager works closely with its stakeholders to understand their key concerns and develop long-term, lasting relationships built on a foundation of trust. These stakeholders are those affected by Ascendas Reit’s operations and business activities, and include employees, contractors, customers, and visitors.

In caring for the well-being of its stakeholders, Ascendas Reit has in place stringent measures to provide a healthy, safe and secure environment in its high-quality spaces. This includes ensuring that investors’ and customers’ information and data privacy are always protected.

Material Issue

- Health, Safety and Security Protection

- Security of Information

Key Risk

- Operational Risks

- Information Technology (IT) / Cyber Security Risks

Our Approach

Minimise safety risks, secure properties from threats of criminal activity and terrorism and uphold information security, safeguarding against cyber threats.

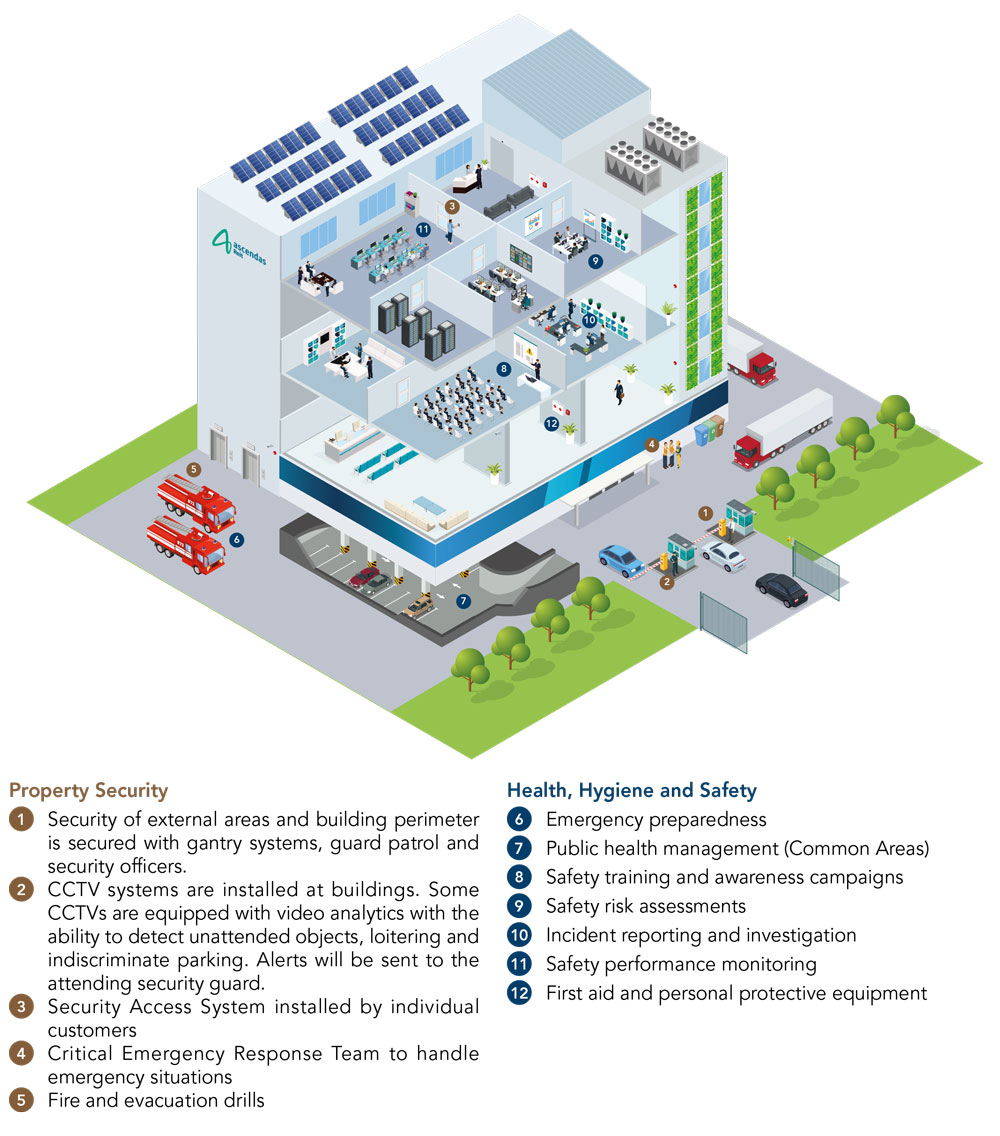

Health, Safety And Security Protection

Besides providing high-quality spaces, Ascendas Reit is committed to ensuring the individual and collective well-being of its stakeholders – by implementing all necessary measures on health, hygiene, safety and security at its properties. Figure 10 provides an overview of the health, safety and security management practices.

Figure 10. Overview of Health, Safety and Security Management Practices at Ascendas Reit

Operating in an environment with rising threats of terrorism, fire incidents and pandemic flu outbreaks, the Manager ensures that appropriate emergency preparedness and crisis management plans are in place. The Manager has a Business Continuity Plan (BCP) that puts in place the prevention, detection, response and business recovery and resumption measures to minimise the impact of adverse business interruptions or unforeseen events on Ascendas Reit’s operations.

Employees, as well as tenants and suppliers (e.g. security, cleaning contractors) receive training on emergency response. One example was a simulated terrorism exercise conducted at Aperia by one of Ascendas Reit’s security contractors in November 2019.

In the situation of a pandemic flu outbreak such as Coronavirus Disease 2019 (COVID-19), additional measures taken by the Manager include:

- Controlled building access to enable temperature screening for all persons entering the building.

- Set up of isolation areas near or within the building for persons with high temperature or have flu-like symptoms to facilitate transfer to the hospital.

- Targeted and increased frequency of disinfecting the premises.

- Employees will be segregated into teams and will work from separate areas to minimise contact.

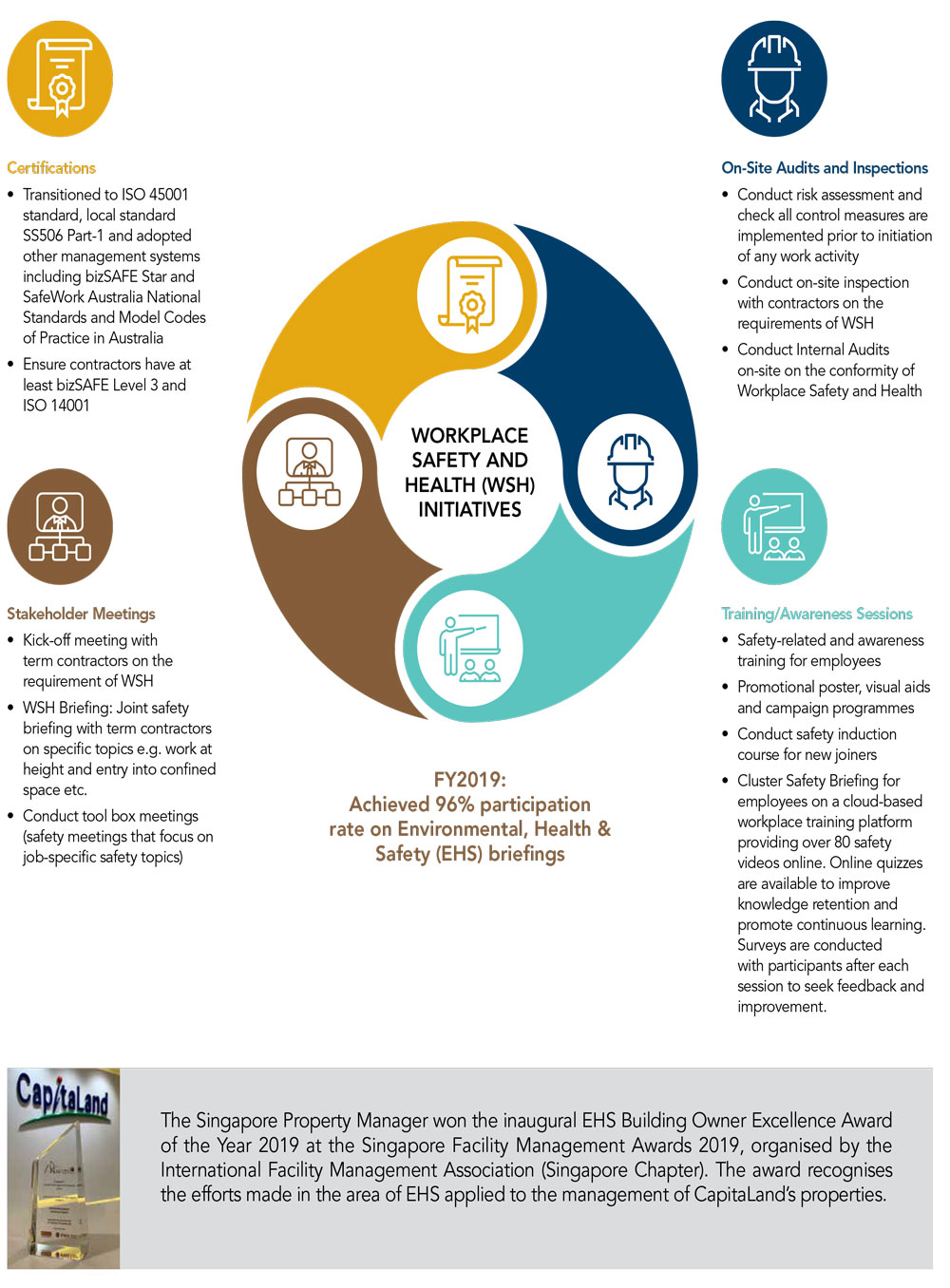

The Property Manager has in place an Integrated Management System (IMS) certified to the requirements of ISO 9001 (quality management), ISO 14001 (environmental management) and the newly implemented ISO 45001 (occupational health and safety). This is governed by an IMS policy and accompanying IMS manual that is communicated to all employees. The manual includes provisions for the consultation and participation of workers, such as determining the mechanisms, providing time, training and resources, as well as prescribes processes for aspects/hazards identification, assessments of impacts, risks and opportunities and procedures relating to incident investigation, nonconformity and corrective action. Examples of hazards include poor ergonomics, fall from height, falling objects and working in an enclosed space. The detailed manual prescribes actions to minimise the occurrence of such hazards. There are also detailed control procedures relating to site specific fall protection and risk assessment in place.

To ensure that the IMS is effectively implemented and maintained, internal audits are conducted at least once a year, together with top management review. Results of the analysis and evaluation will be considered as part of continual improvement. In addition, the Property Manager is a member of the Workplace Safety and Health (WSH) Council Facilities Management (FM) Committee, which is responsible for WSH issues and concerns of the FM industry.

Occupational health services such as employee wellness programmes, health screenings and talks as well as physical fitness classes are provided to employees aimed at addressing physical and mental health risks among workers and ensuring their overall health and well-being. More details on the suite of employee engagement activities can be found in the Management of Human Capital section of this report.

Through a comprehensive suite of Workplace Safety and Health (WSH) initiatives, the Property Manager promotes the right safety culture to prevent or mitigate health and safety impacts (Figure 11).

Figure 11. Workplace Safety and Health (WSH) Initiatives

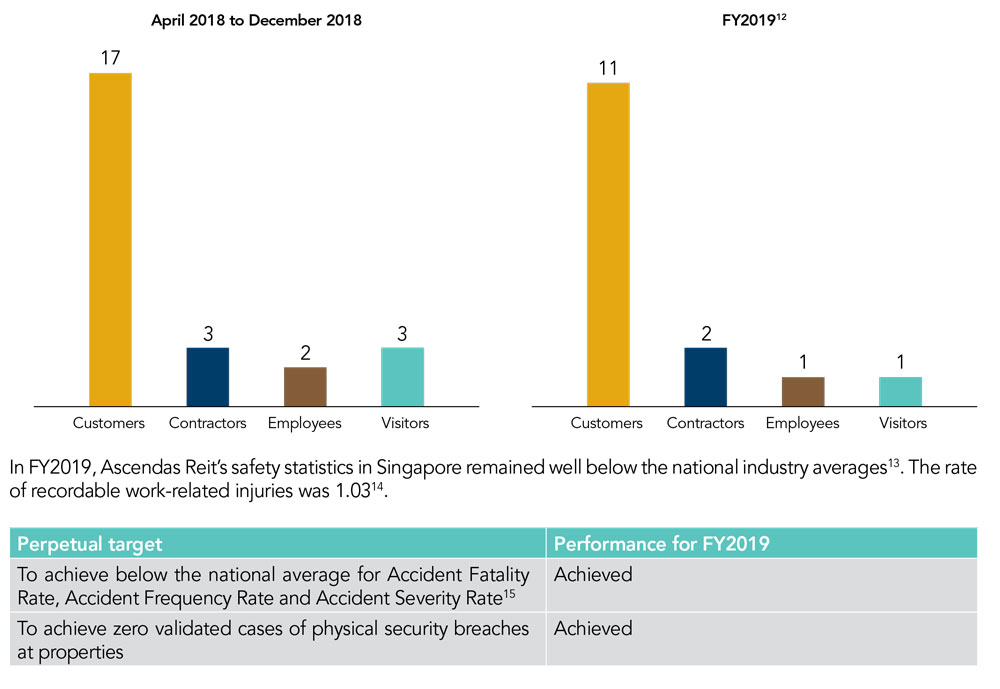

Performance Figures

In FY2019 there were zero work-related fatalities, high-consequence injuries11 and occupational diseases recorded. However, 15 accidents12 (14 in Singapore and one in Australia) across both common areas and tenanted areas were recorded. For accidents that resulted in injuries, these were not deemed to be severe. Formal Incident Reporting and Investigation guidelines and procedures put in place by the Manager stipulate that all incidents are recorded and thorough investigation carried out to prevent recurrence, along with the necessary follow up activities.

Figure 12. Number of Accidents

- A high-consequence injury is a work-related injury that results in a fatality or an injury from which the worker cannot, or does not, or is not expected to recover fully to pre-injury health status within six months.

- Accidents refer to all incidents, including those resulting in injuries and non-injury cases. All 15 accidents were not required to be reported to the local authorities.

- According to Singapore’s Ministry of Manpower Workplace Safety and Health Report 2018 for accident severity rate of 66 and accident frequency rate of 1.6, calculated per million manhours worked. These statistics only refer to employee injuries. The rate of recordable work-related injuries is calculated by the number of work-related injuries divided by number of man-hours worked, per million manhours worked. Employees here include those of the Manager and Property/Asset Manager.

- The rate of recordable work-related injuries is calculated by the number of work-related injuries for employees divided by number of man-hours worked, per million manhours worked. Employees here include those of the Manager and Property/Asset Manager.

- This target is only applicable to Singapore properties. The rates are defined by the Ministry of Manpower, calculated per million man-hours worked. The targets were benchmarked against the latest available national statistics at the start of the financial year.

Security Of Information

Securing of information asset is a top priority for the Manager with the increased integration of digital capabilities into its business.

CapitaLand has Group-wide IT Security Policies which set out the requirements in the management of Information Technology (IT) risks, including cyber risks. The focus on attaining cyber resilience is sharpened with the increase in efforts to strengthen the Cyber Security Strategy.

Appropriate measures are in put in place to ensure the confidentiality, integrity, and availability of CapitaLand’s IT assets, including those of the Manager. This includes imposing access controls, implementing data protection measures, raising employees’ IT security awareness through activities such as anti-phishing campaigns, e-learning programmes, and conducting an annual IT disaster recovery exercise to ensure business recovery objectives are met.

With these measures in place, there were zero cases of substantiated complaints from outside parties or regulatory bodies as well as zero cases of identified leaks, thefts and losses of customer and investors’ data.

- Performance on this target is omitted as the data recovery test has not been conducted due to the change in financial year.

-

Supply Chain Management

Ascendas Reit works closely with its contractors and suppliers to adhere to high quality, environmental, health and safety standards.

It is important to the Manager that it conducts its business in a responsible manner, but also to influence its supply chain to operate responsibly, with high standards of good governance and business integrity.

Material Issue

- Responsible Supply Chain Management

Key Risk

- Operational Risks

Our Approach

Encourage sustainable procurement, and manage contractors and service providers for responsible business conduct in areas of human rights, labour, anti-corruption, health and safety and the environment.

Responsible Supply Chain Management

The Manager adopts CapitaLand’s Supply Chain Code of Conduct, which incorporates principles from the United Nations Global Compact (UNGC). This ensures the suppliers or service providers are in compliance with local regulations and only appointed upon meeting a set of criteria, including quality management, financial standing and sustainability policies and certifications.

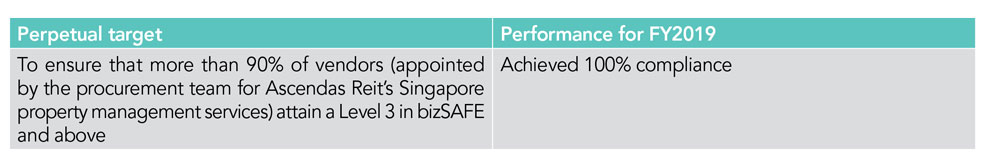

Depending on the nature of their services, suppliers appointed by the procurement team for Ascendas Reit’s Singapore property management services are required to meet sustainability standards which include ISO 9001 and ISO 14001, minimum bizSAFE Level 3 or the National Environment Agency Clean Mark Silver (for cleaning service providers), attaining a minimum B grade licence issued by the Police Licensing and Regulatory Department (for security guards services); and adopting Progressive Wage Model (for cleaning, security and lift maintenance services).

Zycus, an online Procure-to-Pay supplier management platform, allows the Manager to monitor the track record and sustainability performance of suppliers. The platform also allows employees to access the ‘scores’ of past, present and new suppliers, while providing suppliers with information on how they could improve on their services. Surprise site inspections also allow the Manager to monitor suppliers’ performance, which is subsequently reflected in the suppliers’ performance rating.

In FY2019, all new Property Management suppliers, appointed for Ascendas Reit’s Singapore property management services, were screened using social and environmental criteria under Zycus.

The rollout of Zycus and expansion of property management software has been fully implemented and aligned with other systems such as Property Management, Lease Operations, Asset Management, Customer Relationship Management and ERP Finance system. This integrated end-to-end system provides operational efficiencies and seamless tracking across different functions.

To tighten standards and controls in screening contractors and suppliers, new clauses were introduced in tender calling and acceptance letters from last quarter of 2019. Vendors who are awarded contracts are required to acknowledge and comply with the CapitaLand Supply Chain Code of Conduct and ensure adherence to the PDPA. An Anti-Corruption clause was also included in the Conditions of Contract.

In view of the tightened controls, a series of training programmes were organised for relevant employees. For example, the team attended a training on data analytics to help identify abnormalities in purchasing behaviour to reduce non-compliance issues as well as Data Protection Training by CapitaLand’s Data Protection & Compliance Department.

- H.O.S.T represents service values – Hassle-free, Operational Excellence, Serve with Passion, Trustworthy.

-

Adaptability to Changing Market Conditions and Operating Conditions

Intellectual capital, or the value of knowledge created, acquired and repositioned for application, is integral to the Manager’s strategy formulation.

It provides Ascendas Reit with a competitive edge to achieve success in a competitive marketplace.

Material Issue

- Adaptability to Market Changes in the Countries that Ascendas Reit Operates In

- Embracing Innovation and Technology

Key Risk

- Strategic Risks

- External Risks

- Operational Risks

- Financial Risks

- IT/Cyber Security Risks

- Sustainability Risks

- Investment and Development Risks

- Regulatory Compliance Risks

Our Approach

Demonstrate resilience and adaptability to uncertainties or opportunities that may arise in Singapore, Australia, the UK and the US, which may be related to geopolitics, regional and global developments.

Embrace and leverage technology (including digital) to enhance performance and competitive advantage, and safeguard against potential disruption to the business.

Adaptability To Market Changes In The Countries That Ascendas Reit Operates In

Remaining resilient and adaptable to changes in the markets that Ascendas Reit operates in ensures it always remains competitive. This involves assessing all relevant risks, and adopting a proactive approach towards managing these risks.

Overseen by the Board (specifically the Audit and Risk Committee), the Management designs and formulates its risk management policies and processes to ensure that all key risks to Ascendas Reit are identified and evaluated, and that the necessary controls are in place to mitigate those risks. Controls include periodic macro market studies, monitoring of industrial and office vacancy, capital value movement, leading economic indicators (such as gross domestic product, consumer price indices, non-oil domestic exports), monitoring of political and social development and conducting independent studies on the markets that it operates in (refer to the Independent Market Study Report FY2019 available online at ir.ascendas-reit.com/ar.html). More information on the Risk Management process and key risks identified can be found in pages 140 to 145 in the Enterprise Risk Management section of the Annual Report FY2019.

Regulatory Compliance has been identified as a key risk for Ascendas Reit. It is crucial that the Manager complies with all applicable laws and regulations in the countries it operates in, as well as stay abreast of regulatory updates. In FY2019, there were no breaches identified during Ascendas Reit’s periodic internal and external compliance audits.

Embracing Innovation And Technology

In anticipation of future challenges, the Manager embraces innovation in managing its environmental performance and differentiating Ascendas Reit from its competitors, while staying responsive to the needs of its stakeholders. To this end, the Manager’s approach focuses on leveraging technology to deliver premium quality real estate solutions and lowering the environmental footprint of its buildings.

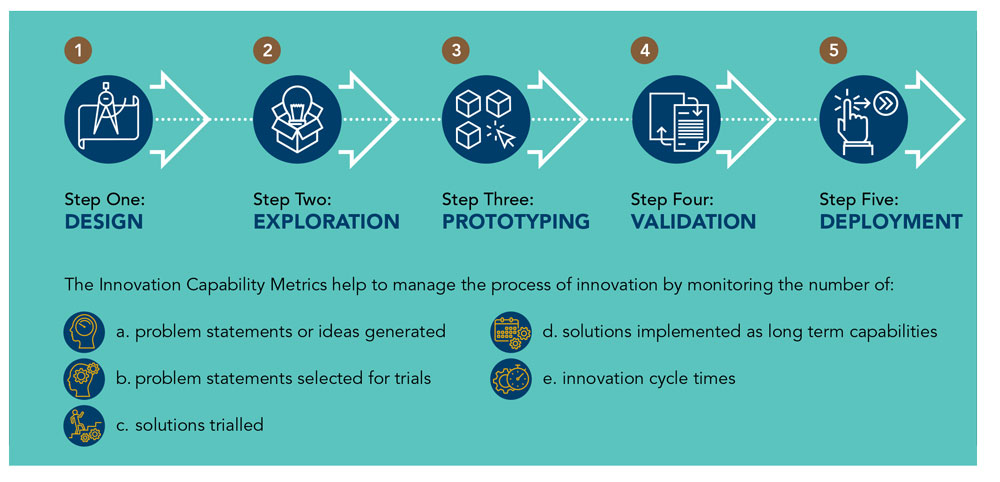

In building a culture of innovation, Ascendas Reit continues to be guided by its Innovation Framework, which comprises five phases, and its complementary Innovation Capability Metrics as shown below in Figure 13.

Figure 13. Ascendas Reit’s Innovation Framework and Innovation Capability Metrics

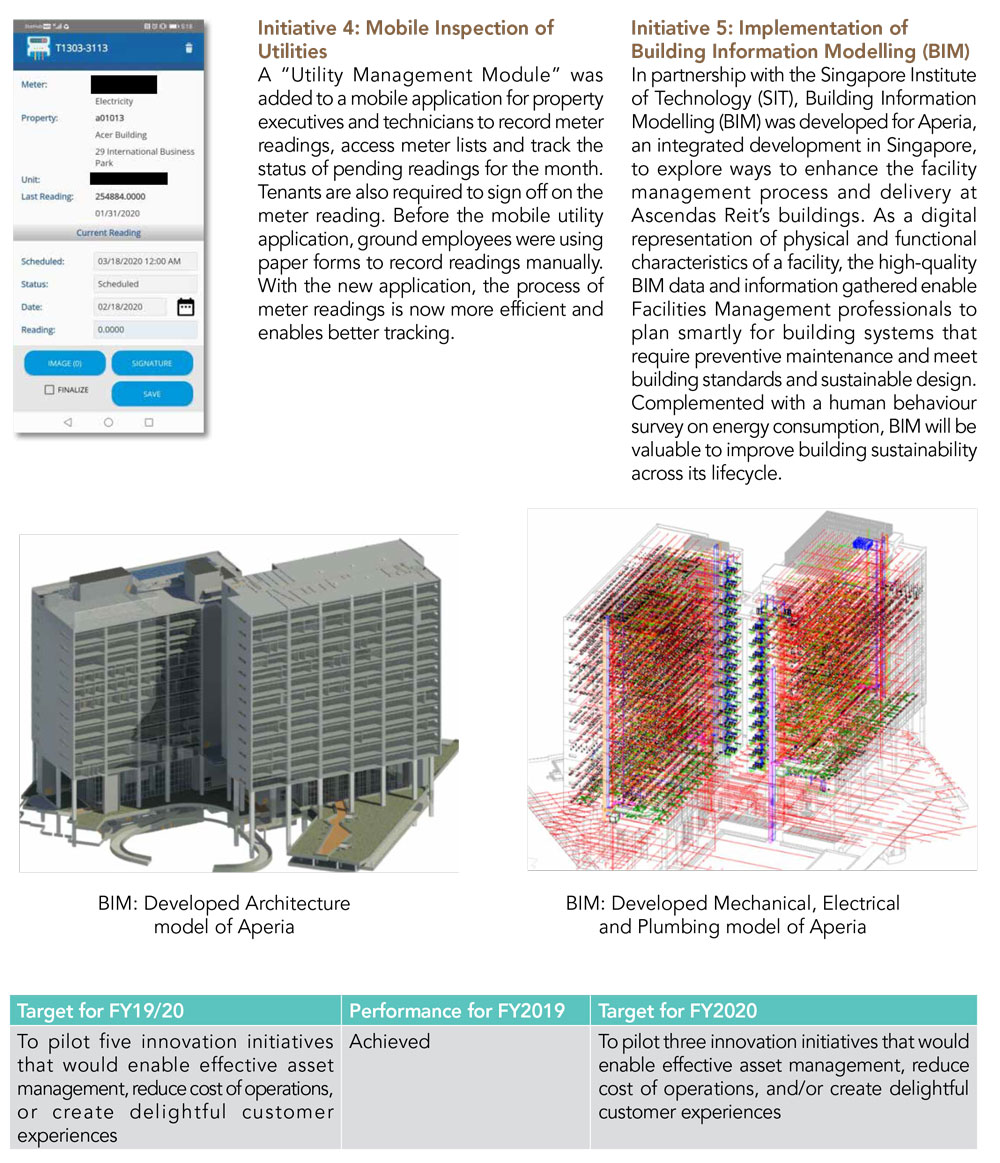

Some of the innovative initiatives that were piloted in FY2019 include:

Initiative 1: Smart Urban Co-Innovation Lab

Supported by the Infocomm Media Development Authority (IMDA) and Enterprise Singapore, the Smart Urban Co-Innovation Lab was announced in May 2019 to catalyse co-innovation of smart urban solutions in Singapore. This is the first such developer-led initiative in Southeast Asia, strategically located in Singapore Science Park for technology providers to have easy access to relevant infrastructure and resources.

With a focus on key areas of intelligent estates, smart mobility, digital wellness and agritech, the platform aims to develop the capabilities of technology providers and produce innovative proof-of-concepts and prototypes for smart urban technologies. This is in line with the Group’s innovation approach and future-ready mindset, in promoting technology to enhance customer experience, drive operational excellence and achieve environmental sustainability.

Initiative 2: Largest 5G trial at Singapore Science Park

As part of the commitment to leverage technologies and test new ideas to bring innovative real estate products and services to customers in Singapore, CapitaLand has partnered with NavInfo DataTech and TPG Telecom to set up Singapore’s largest 5G smart estate trial at the Singapore Science Park.

5G enabled Cellular Vehicle-to-Everything (C-V2X) technologies will be developed and tested, for smart mobility assets like autonomous vehicles, smart mobility infrastructure technologies and in-car experience solutions. Industry players and Singapore Science Park customers can also leverage on the 5G infrastructure to develop and trial innovative solutions such as drones and augmented reality/virtual reality applications.

Initiative 3: Chiller Plant Analytics and Optimisation

A pilot project to study chiller plant usage was carried out at the Ascendas Operations Centre to identify potential energy saving points. Using data exploratory analytics, millions of records were analysed through visualisation and machine learning to track the occurrence of chiller switching throughout the day, over one year. This would help determine optimal chiller switching as well as the correlation of equipment within the chiller system to reduce energy use as a significant source of an entire building’s electricity consumption.

The learnings from this study will be valuable when it is progressively rolled out at Ascendas Reit’s properties that are being monitored by the Ascendas Operations Centre.

-

Management of Human Capital

Employees of the Manager and Asset/Property Managers are vital to contributing to the sustainable growth of Ascendas Reit.

The quality of its people help differentiate Ascendas Reit from its competitors. There is a concerted effort to invest in staff engagement and development as well as provide a conducive environment to allow them to reach their fullest potential.

Material Issue

- Management of Human Capital

Key Risk

- Operational Risks

Our Approach

Provide equal opportunities, fair remuneration and treatment, and regular engagement with all members of the Board, employees and contractors, regardless of gender, age, race, religion etc.

Management Of Human Capital

CapitaLand has an integrated human capital strategy to recruit, develop and motivate employees. Key performance indicators (KPI), both for the business as well as for people development, are in place to ensure that employees’ performance goals are aligned with the Group’s business objectives. Employees are provided with appropriate development opportunities to perform well in their job.

Anti-Child Labour and Anti-Forced Labour

CapitaLand is a signatory of the United Nations Global Compact and is committed to the 10 principles in the areas of human rights, labour, environment and anticorruption. It is against any form of coerced labour and discrimination, and adheres to international human rights principles including the Universal Declaration of Human Rights and the International Labour Organisation (ILO) Conventions.

In FY2019, there was no reported incident relating to discrimination, child labour or forced labour in the Manager and Asset/Property Managers, and there were no employees below the age of 16.

Fairness and Diversity

CapitaLand embraces diversity and inclusivity regardless of gender, race, nationality and family status. The Manager believes that all employees can make strong contributions based on their diverse talent, expertise and experience. Ascendas Reit, as a CapitaLand-sponsored Reit, upholds this commitment and complies with the five key principles of fair employment as a signatory of the Employers Pledge with the Tripartite Alliance for Fair and Progressive Employment Practices (TAFEP).

In FY2019, 2 new hires18 joined the Manager while 7 employees left the Manager.

Re-employment Opportunities

Programmes are also in place to facilitate the continued employability of employees such as pre-retirement planning for intended retirees, re-training for those intending to continue working after retiring, severance pay, job placement services, as well as training and counselling on transitioning to a non-working life.

Respect for Freedom of Association

CapitaLand abides by the Industrial Relations Act that allows employees to be represented by trade unions for collective bargaining. This allows an avenue for employees to seek redress in cases of industrial disputes.

Fair Remuneration

All employees sign employment contracts with clearly stated employment terms and conditions for employees to understand. This includes employment terms on salary and allowances, (statutory) contributions/deductions, leave entitlements, insurance and medical benefits etc.

To ensure that CapitaLand remains competitive and able to attract and retain talent, it engages external consultants to benchmark its compensation packages against relevant talent markets. Beyond base salaries, other components of the compensation packages encompass short-term cash bonuses and long-term equity-based reward plans.

In Singapore, the Central Provident Fund (CPF) is a comprehensive social security savings plan introduced by the Singapore Government to enforce savings by salaried workers for a more secure retirement. As part of the CPF scheme, CapitaLand and its employees make monthly contributions to the employee’s CPF account in accordance with the prevailing regulations.

Positive Work Environment

Compensation and benefits programmes are in place to promote a positive work environment, including group medical insurance, personal accident insurance, health screenings, employee engagement initiatives, flexible work arrangements, flexible medical plan and subsidised rates for employees staying at Ascott’s serviced residences.

All employees are entitled to parental leave. In FY2019, three male employees went on paternity leave with all returning to work in the same period.

- The two new hires comprised one male less than 30 years old and one female between 30-50 years old. Rates of new hires and turnover have not been calculated due to the employee movement arising from the organisational restructure.

Profile of Employees

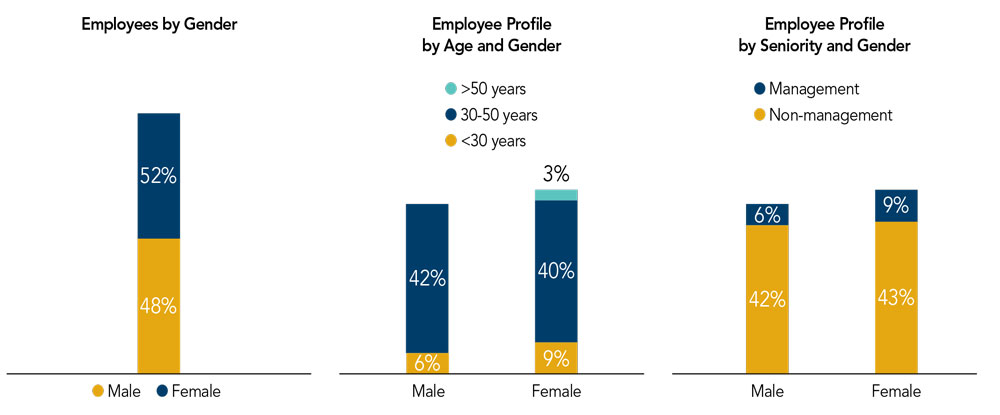

As at 31 December 2019, the Manager had a total employee strength of 33 full-time permanent employees in Singapore, comprising 16 male and 17 female. This was a drop from 65 employees in Singapore as at 31 March 2019 due to organisational restructuring and internal transfers following the integration of Ascendas-Singbridge and CapitaLand. The employees from the asset management function for Ascendas Reit’s Singapore and Australia portfolios have been transferred to CapitaLand as at 1 July 2019.

Figure 14. Employee Charts for FY2019

Employee Well-being

CapitaLand seeks to provide not only a safe working environment, but one that contributes to the general well-being of its employees. In Singapore, this is carried out through a Total Well-being Programme. Wellness Day is held every Wednesday on an ongoing basis to promote physical and mental well-being. Employees of the Manager are also encouraged to participate in weekly group wellness activities such as group runs, pilates, crossfit classes, health talks and bazaars and monthly corporate social responsibility events.

Through the flexible work arrangement policy, employees may apply for flexible work hours, work from home or part-time work arrangements depending on their needs.

Employee Engagement

The Manager recognises the importance of a highly engaged workforce in contributing to positive business outcomes and organisational excellence. Employee engagement is carried out through regular CapitaLand Group Employees Communication Sessions and the CapitaLand intranet, which updates employees on the Group’s latest development, employment policies, benefits, corporate governance and ethics. With the integration of CapitaLand and Ascendas-Singbridge, a Celebration Event & Annual Dinner was held on 25 October 2019 at Marina Bay Sands for over 2,300 employees which was well received.

The CapitaLand Family Night was held on 6 September 2019 at Universal Studios Singapore with a sustainability theme. More than just a family day, green initiatives were incorporated into the event, which was also held in conjunction with Mid-Autumn Festival celebrations. In the lead-up to the event, employees and their family members were invited to participate in an eco-friendly lantern making contest, while a fair was held during ticket collection with sustainable products for sale and tips for employees on ways to lead a sustainable lifestyle.

Recognition and performance activities such as a branding slogan contest and long-service awards serve to recognise employee contribution and service to the company. Under CapitaLand’s robust performance management system, performance and career development reviews are conducted annually for all full-time employees, involving open discussions on the employee’s performance, developmental needs, career plans and areas for improvement.

In FY2019, an employee engagement survey was conducted Group-wide and achieved a participation rate of more than 90%. The Manager will be identifying key areas for enhancement and build a conducive workplace for employee development and well-being.

Learning and Development

Appropriate training is provided to employees to improve their knowledge and expertise to contribute meaningfully and effectively to Ascendas Reit’s performance. CapitaLand has an in-house training hub, CapitaLand Institute of Management and Business (CLIMB), which supports the training and development needs of employees. Besides on-the-job exposure, there are many opportunities for job rotation, mentoring and coaching to allow employees to reach their full potential.

Employees attended an average of 29.4 hours of training during FY2019. This was a decrease from 47 hours from the previous reporting period (12-month period) due to the shorter time period for reporting (nine-month period). These programmes include CapitaLand Onboarding Programme, Data Protection Training, Managing Fraud, Bribery and Corruption, CapitaLand-Ascendas-Singbridge Integration: Investment Process & Investment Risk Management Workshop, among others.

In compliance with Monetary Authority of Singapore (MAS) regulations, Capital Markets Services (CMS) license holders also attend REIT Management courses organised by REITAS on an ongoing basis, contributing to Continuing Professional Development (CPD) training hours.

Figure 15. Average Training Hours by Employee Category and by Gender

-

Protecting Natural Capital

Natural Capital refers to Ascendas Reit’s access to natural resources such as energy and water, which are required for its business operations.

The Manager strives to develop and implement environmentally-friendly features in its properties and improve overall energy efficiency. It believes that the efficient use of resources such as energy and water reduces operational costs, mitigates regulatory and physical risks, and creates value for its stakeholders.

Material Issue

- Responsible Energy Consumption and Carbon Emissions

Key Risk

- Regulatory Compliance Risks

- Sustainability Risks

Our Approach

Efficient use and management of energy to minimise carbon emissions, through the design, construction and operation of the properties.

Responsible Energy Consumption And Carbon Emissions

Given that the building sector is a major contributor to global energy use and carbon emissions, improving energy efficiency and exploring the use of renewable energy are key ways to mitigate carbon emissions and align with national and global agendas.

While waste and material use has not been identified as a material issue for Ascendas Reit, the Group remains committed to minimising its environmental impact. This year, CapitaLand embarked on an initiative for its offices to go ‘paperless’, that is, removing any need for printed documents and digitising all documents by end 2020. Representatives from various departments were required to identify opportunities and track paper usage reduction, with timely updates to the working committee.

Singapore

The total energy consumption in the Singapore operations declined from 73.06 million kWh in the comparative period a year ago (April 2018 to December 2018) to 71.07 million kWh in FY2019. Energy intensity also improved from 40.14 kWh/sq m to 38.59 kWh/sq m in FY201919. Correspondingly, carbon emissions and carbon emissions intensity improved by 2.72% and 3.86% respectively.

When comparing like-for-like energy performance of its portfolio (i.e. using the same set of properties), electricity consumption in the Singapore operation fell from 72.83 million kWh in the comparative period a year ago (April 2018 to December 2018) to 70.89 million kWh in FY2019. Energy intensity similarly improved from 40.67 kWh/sq m to 38.91 kWh/sq m in FY2019. Correspondingly, carbon emissions and carbon emissions intensity improved by 2.67% and 4.34% respectively.

- On a 12-month basis, total energy consumption in the Singapore operations fell from 95.56 million kWh for the period January 2018 to December 2018 to 94.42 million kWh for the period January 2019 to December 2019. Energy intensity improved from 52.14 kWh/sq m to 51.31 kWh/sq m respectively.

Australia

Energy consumption (which includes electricity, diesel and gas usage) in the Australian operations fell substantially from 12.03 million kWh in the comparative period a year ago (April 2018 to December 2018) to 9.04 million kWh in FY2019. Energy intensity improved from 259.31 kWh/sq m to 194.39 kWh/sq m22. At 197-201 Coward Street in Sydney, there was reduced diesel usage from a shorter time period for routine annual testing. At 100 and 108 Wickham Street in Brisbane, a change in operating hours of the tenants resulted in reduced demand for energy.

Total carbon emissions (Scope 1 and 2) decreased from 8,365 tonnes in the comparative period a year ago (April 2018 to December 2018) to 5,777 tonnes in FY2019, and carbon emissions intensity improved from 180.24 CO2/sq m to 124.28 CO2/sq m in FY2019.

- Average annual consumption of a four-room HDB household is based on Singapore’s Energy Market Authority’s (EMA) 2018 Singapore Energy Statistics, Page 34 https://www.ema.gov.sg/cmsmedia/Publications_and_Statistics/Publications/SES18/Publication_Singapore_Energy_Statistics_2018.pdf

- CO2 emissions avoided is calculated based on EMA’s grid emission factor.

- On a 12-month basis, total energy consumption in Australia fell from 17.18 million kWh for the period January 2018 to December 2018 to 12.61 million kWh for the period January 2019 to December 2019. Energy intensity improved from 370.09 kWh/sq m to 271.28 kWh/sq m respectively.

Responsible Water Consumption

The reduction of total water consumption and overall water intensity are also key sustainability goals of the Manager. This is especially pertinent for water-stressed areas like Singapore and Australia, where growing pressures of climate change will continue to pose greater threats.

While water consumption was not identified as a material issue, the Manager actively monitors its water consumption and water intensity.

Singapore

The Manager recorded an increase in water consumption in Singapore operations from 869 thousand m3 (April 2018 to December 2018) to 896 thousand m3 in FY2019 and an increase in water intensity from 0.48 m3/sq m to 0.49 m3/sq m23. This was mainly attributable to the re-opening of Aperia Mall in 2019. The Manager will continue to work towards the efficient consumption of water at its properties.

When comparing like-for-like water performance of its Singapore portfolio (i.e. using the same set of properties), water consumption increased from 860 thousand m3 to 894 thousand m3. Like-for-like water intensity also increased by 2.2% from 0.48 m3/sq m to 0.49 m3/sq m.

Australia

In Australia, the Manager recorded an increase in water consumption from 42.5 thousand m3 (April 2018 to December 2018) to 44.9 thousand m3 in FY2019 and water intensity from 0.91 m3/sq m to 0.97 m3/sq m24.

- On a 12-month basis, water consumption in Singapore operations increased from 1,152 thousand m3 (January 2018 to December 2018) to 1,190 thousand m3 (January 2019 to December 2019). Water intensity increased slightly from 0.63 m3/sq m to 0.65 m3/sq m.

- On a 12-month basis, water consumption in Australia increased from 59.07 thousand m3 (January 2018 to December 2018) to 64.10 thousand m3 (January 2019 to December 2019). Water intensity increased from 1.27 m3/sq m to 1.38 m3/sq m.

-

Appendix

Appendix A: Environmental Data Quantification Methodology

This section explains the calculation boundaries, methodologies and assumptions used in the computation of Ascendas Reit’s energy, greenhouse gas (GHG) emissions and water.

Reporting Scope and Period

Ascendas Reit adopts the Operational Control Approach, as outlined in the GHG Protocol Corporate Standard, to determine organisational boundaries. This attributes accountability for 100% of the GHG emissions from operations over which the organisation has control. There were three properties within the Australia portfolio under Ascendas Reit’s operational control.

Data for environmental indicators (energy, GHG emissions and water consumption) from the following reporting periods have been included in the Sustainability Report FY2019:

- FY2019: 1 April 2019 to 31 December 2019

- Corresponding FY2019 period in 2018 for comparability: 1 April 2018 to 31 December 2018

Energy consumption and energy intensities for Australian operations in 2019 are based on estimates.

Energy Consumption Within the Organisation

Energy consumption is consumed from purchased electricity in Singapore and Australia, as well as diesel and natural gas in Australia. The total energy consumption is expressed in million kilowatt hours (kWh).

Energy and Carbon Intensity

Energy consumption and carbon emissions is calculated for the common areas (chillers, corridors, perimeter lightings and centralised building facilities under Ascendas Reit’s direct control). Intensity metrics are calculated relative to effective Gross Floor Area (GFA), expressed as kWh/sq m. Effective GFA is calculated considering total GFA and occupancy rate. Effective GFA has been selected as the metric for intensity ratios as a large proportion of energy consumed is attributed to shared services such as the building’s chiller system.

GHG Emissions

Scope 1 emissions are calculated from the consumption of natural gas and diesel in Australia, expressed in tonnes of CO2. There is negligible Scope 1 emissions for Ascendas Reit’s properties in Singapore.

Scope 2 emissions are calculated from the consumption of grid electricity in Singapore and Australia, expressed in tonnes of CO2.

Emission Factors

Scope 1: Emission factors for direct energy consumption are taken from the Intergovernmental Panel on Climate Change (IPCC) emission factor database (i.e. 74.1 tCO2/TJ for diesel and 56.1 tCO2/TJ for natural gas)

Scope 2: Emission factors for the calculation of electricity consumption are taken from the Singapore Energy Statistics 2019 published by the Energy Market Authority in Singapore (0.4188kg CO2/kWh), as well as the National Greenhouse Accounts Factors published in August 2019 for New South Wales and Australian Capital Territory (0.81 kg CO2-e/kWh), and Queensland (0.81kg CO2-e/kWh).

Water Consumption

Sources of water withdrawn by Ascendas Reit properties include municipal water utilities and NEWater, which is highgrade reclaimed water from treated used water supplied by Singapore’s national water agency. Any wastewater is also discharged responsibly through municipal water utilities.

Water Intensity

Water intensity ratio is calculated by the total volume of water consumed, relative to effective GFA, expressed as m3/sq m.

Like-for-Like

The like-for-like portfolio includes properties for which comparable consumption data is available for April 2018 to 31 December 2018 and 1 April 2019 to 31 December 2019 (FY2019), i.e. it does not include any assets that were acquired or disposed during these reporting periods.

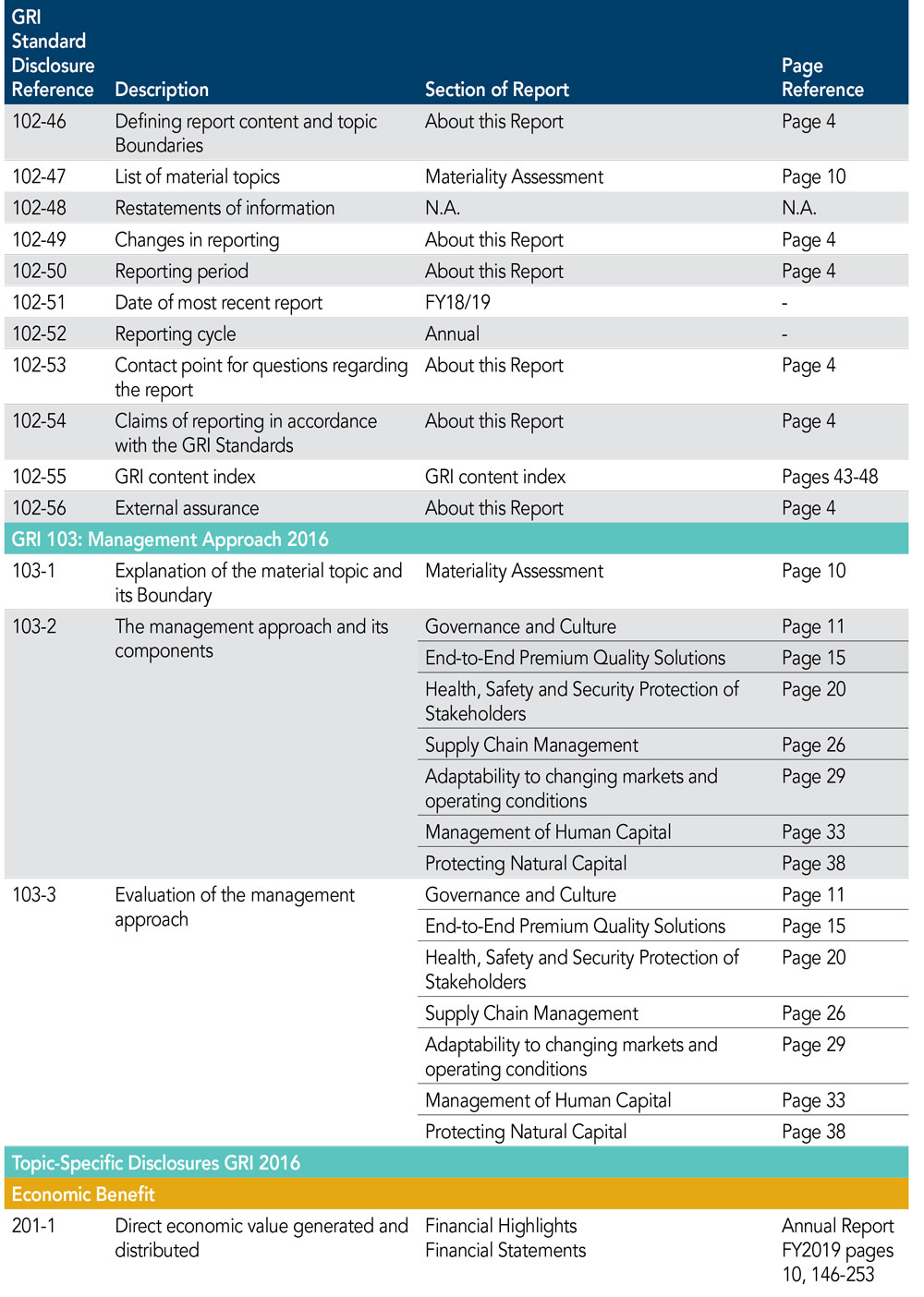

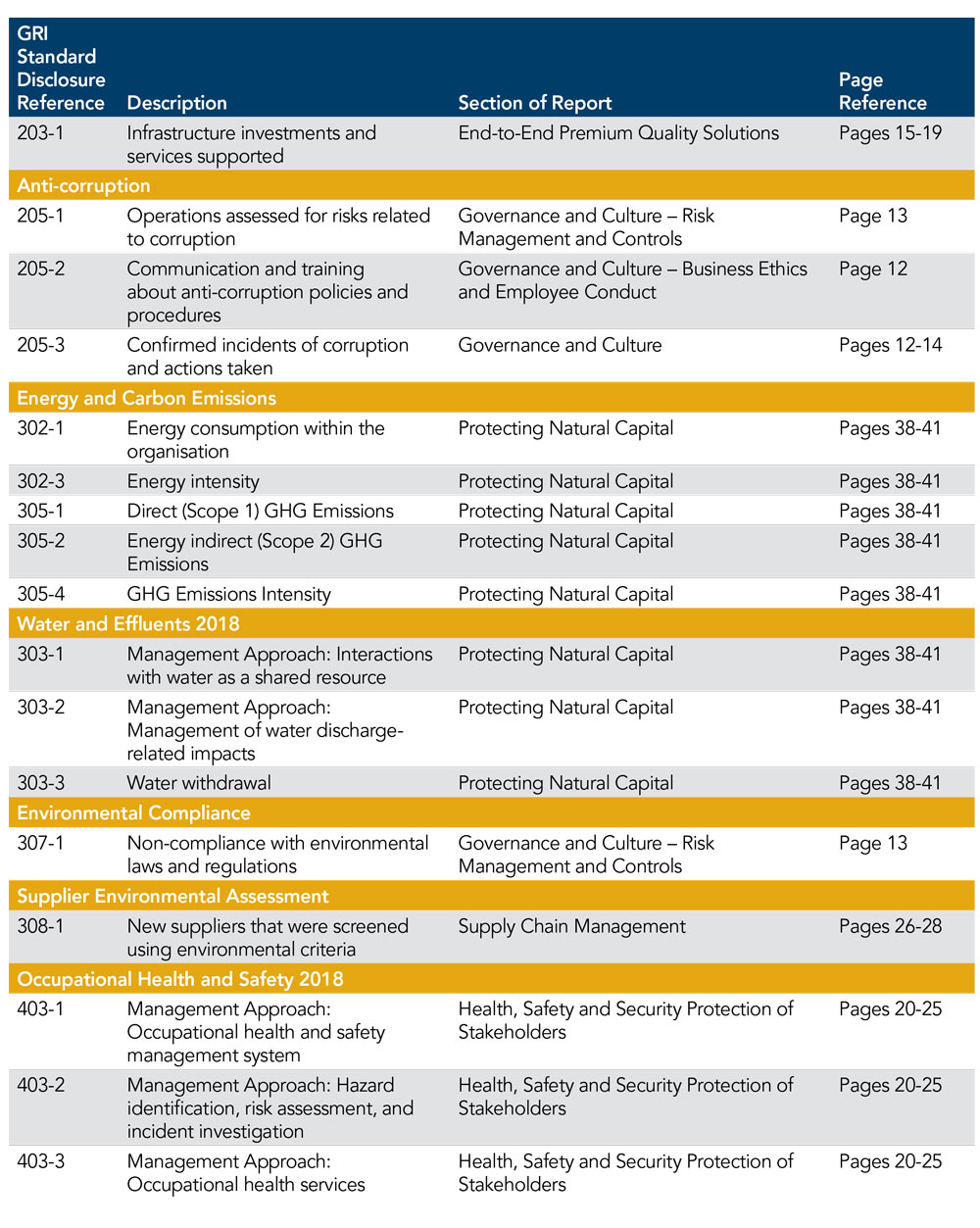

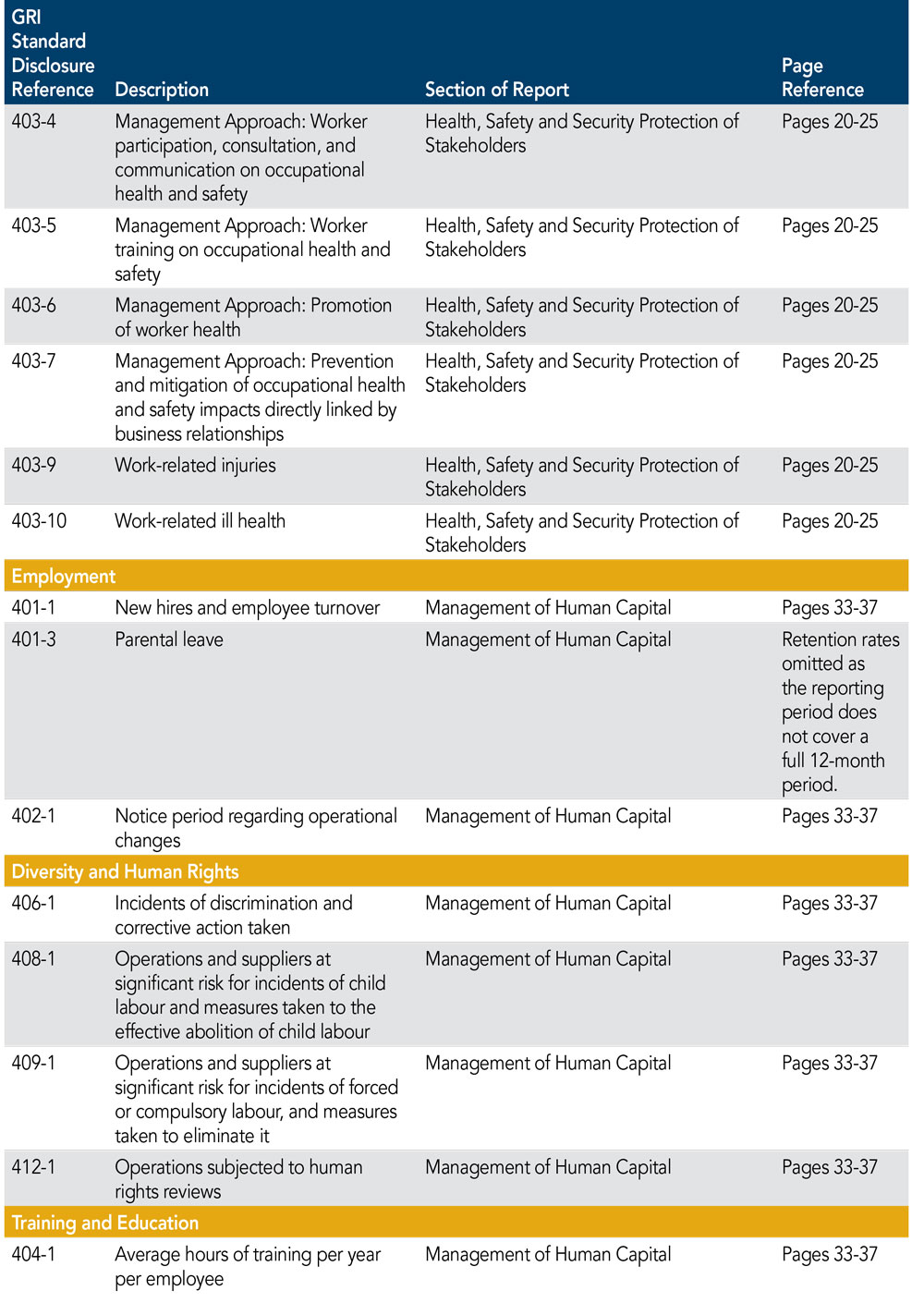

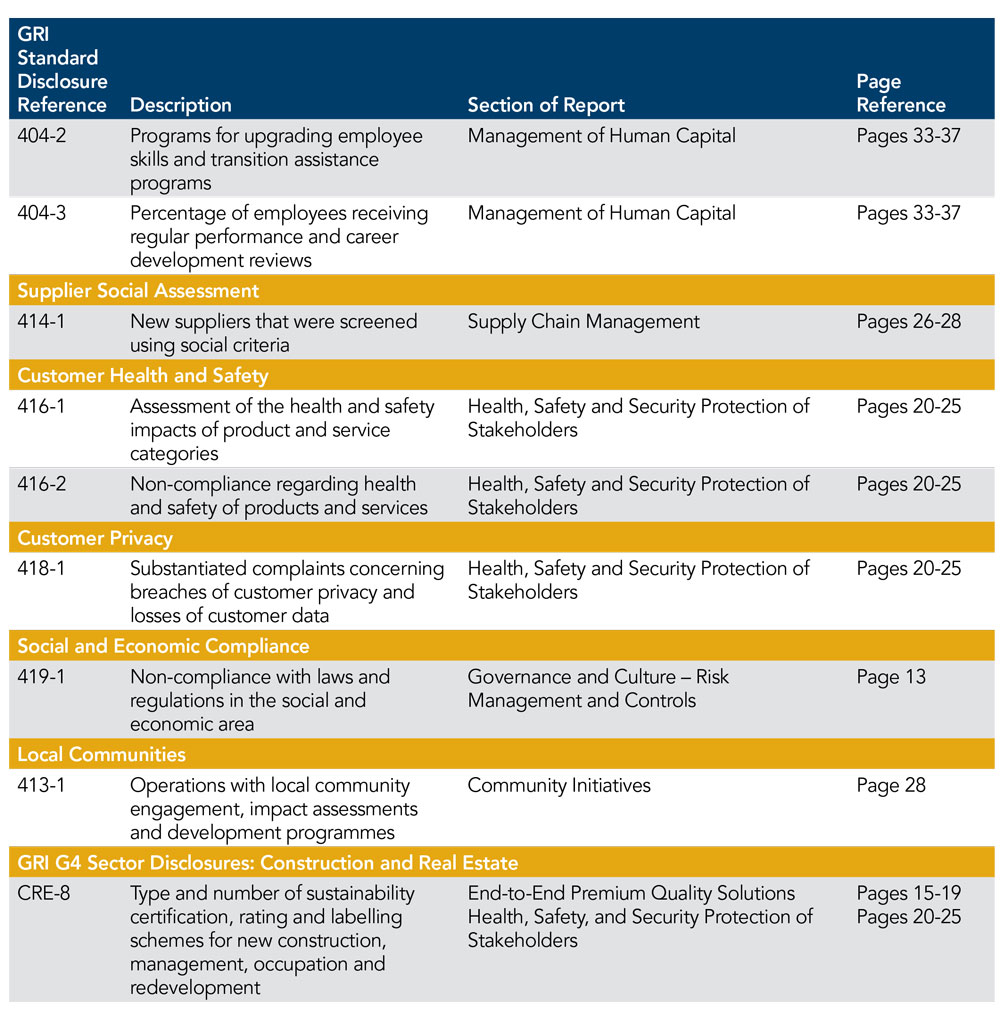

Appendix B: GRI Content Index

.png)

.png)