INDEPENDENT MARKET STUDY

A U S T R A L I A

Australian economy and outlook

The Australian economy has expanded for 24 consecutive

years without recession. Gross Domestic Product (GDP)

expanded by 0.6% in the December 2015 quarter to be

up 3.0% over the year. This was above the 10-year annual

average growth rate of 2.8% p.a. As the mining investment

boom slows down, the consumer and public sectors are

gaining healthy momentum and are supporting Australian

GDP growth.

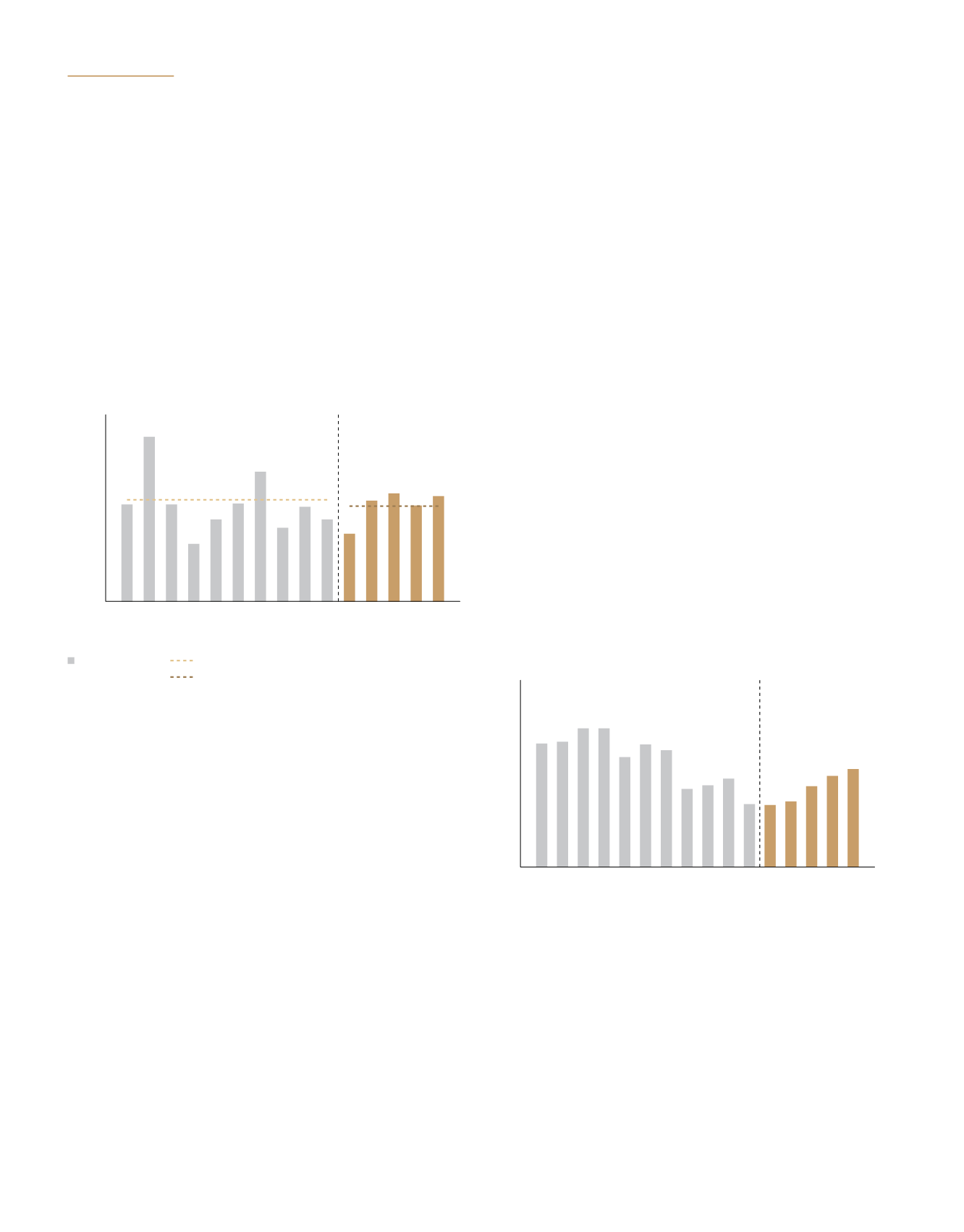

Figure 1: Australian Real GDP Growth Forecast to 2020

The outlook is for further steady growth outcomes in the

near term. Real GDP is forecast to grow 2.6% p.a. in the

five years to 2020 (Figure 1). Growth is projected to be

supported by steady household consumption growth and

ongoing residential housing construction activity.

Population Growth

Population growth is a major underlying driver of consumption

spending and supports demand for retail goods (both traditional

and e-Commerce). Australia continues to benefit from relatively

strong population growth for a developed country.

Over the ten years from June 2005 through June 2015

Australia’s population increased by 3.6 million people, an

average growth rate of 1.6% p.a. and is expected to grow at

1.3% p.a. over the five years to 2020.

Inflation, Interest Rates and Bond Yields

Australian Consumer Price Index (CPI) inflation at 1.5%

headline in December 2015 remains below the Reserve Bank

of Australia (RBA) target band of 2.0% to 3.0% p.a. Forecasts

have inflation remaining benign at 1.9% in 2016, before

rising moderately and averaging 2.3% p.a. over the 2015-

2020 forecast period.

The RBA last cut the official interest rate by 25 basis points

to 2.00% in May 2015. In total, rates have been cut 275 basis

points since the easing cycle began in November 2011.

Recent policy decision statements have adopted a further

easing bias.

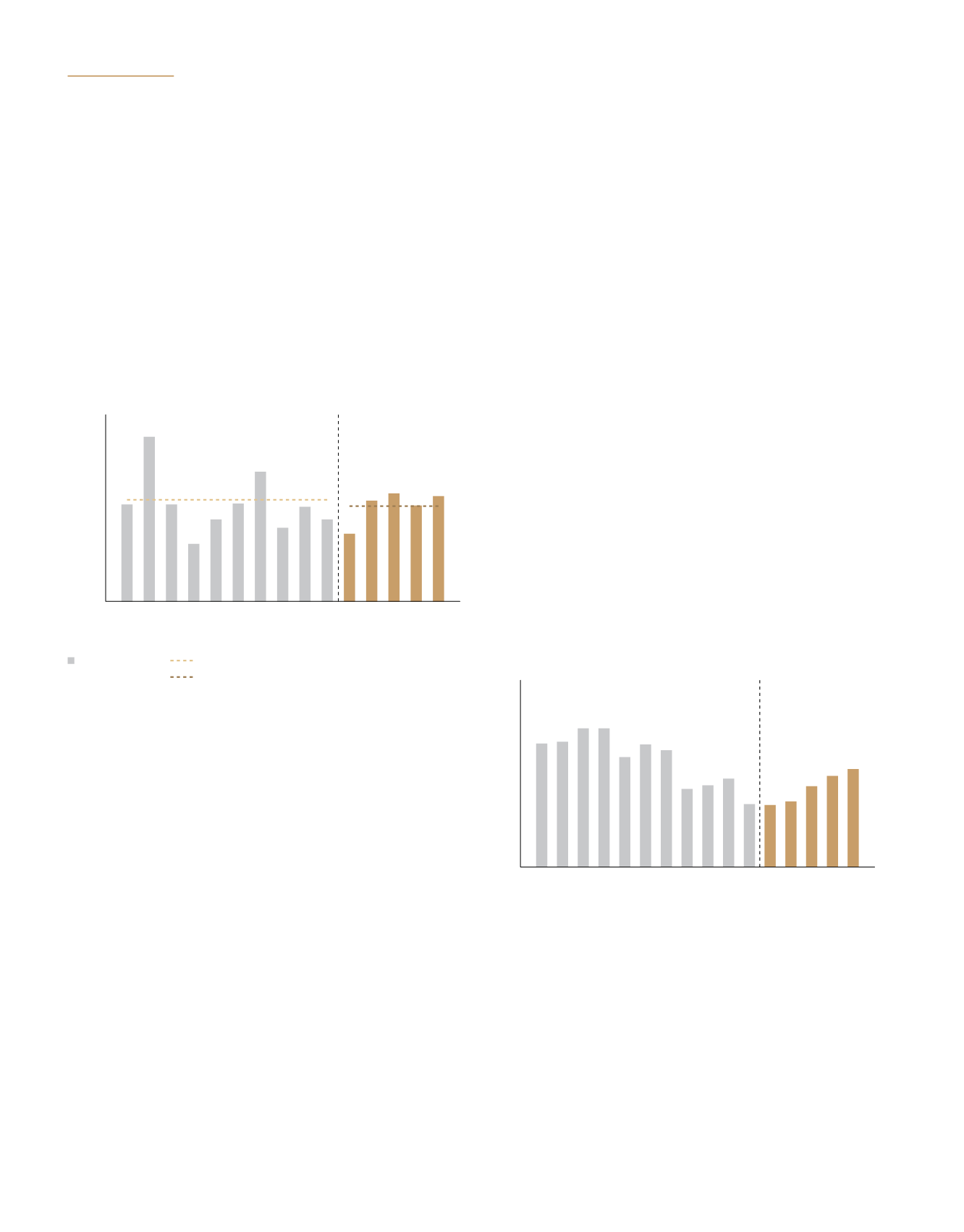

According to the RBA, the Commonwealth Government 10-

Year Bond rate averaged 2.73% in January 2016 and 2.72%

over the year to January 2016. Deloitte Access Economics

forecast the Australian Government 10-Year Bond Yield to

remain low over the next year, averaging 2.73% in 2016

(Figure 2). Bond yields are then forecast to rise gradually as

economic growth is expected to improve, resulting in tighter

monetary policy settings being adopted by the RBA, and

as global interest rates begin to rise, initially in the United

States, and eventually more widely.

Figure 2: Australian Government 10-Year Bond Yield

Source: Deloitte Access Economics Business Outlook December 2015, JLL Research

0.0%

3.0%

4.0%

5.0%

(Annual % change)

2.0%

Real GDP Change

10 Year Average (2005-2014)

Forecast 5 Year Average (2015-2020)

2008

2006

2010

2012

2009

2007

2011

2013

2015

2016

2017

2019

2018

2020

2014

2.8%

2.6%

Forecast

Source: Deloitte Access Economics Business Outlook December 2015, JLL Research

0.0%

4.0%

5.0%

6.0%

8.0%

7.0%

(Period Average)

3.0%

2.0%

1.0%

2008

2005

2006

2010

2012

2009

2007

2011

2013

2015

2016

2017

2019

2018

2020

2014

Forecast

By Jones Lang Lasalle (NSW) Pty Limited

.82

A-REIT ANNUAL REPORT

2015/2016