INDEPENDENT MARKET STUDY

S Y D N E Y

Sydney industrial market

The Sydney industrial market fundamentals are among the

best of all industrial markets at present. Sydney is benefiting

from urban renewal and infrastructure development projects

being coordinated by the government to increase the

population density of inner ring suburbs and the efficiency

of the Sydney transport and freight network. As such, many

mature industrial markets are being rezoned to allow for

mixed use or residential projects.

This activity is creating a cascade of occupier activity that

will impact the market for some time, creating immediate

demand for existing stock, decreasing vacancy and placing

upward pressure on market rents. This will also result in

demand for larger distribution facilities in the Western

Sydney growth precincts as existing market rents increase

and larger users look to grow into more modern facilities.

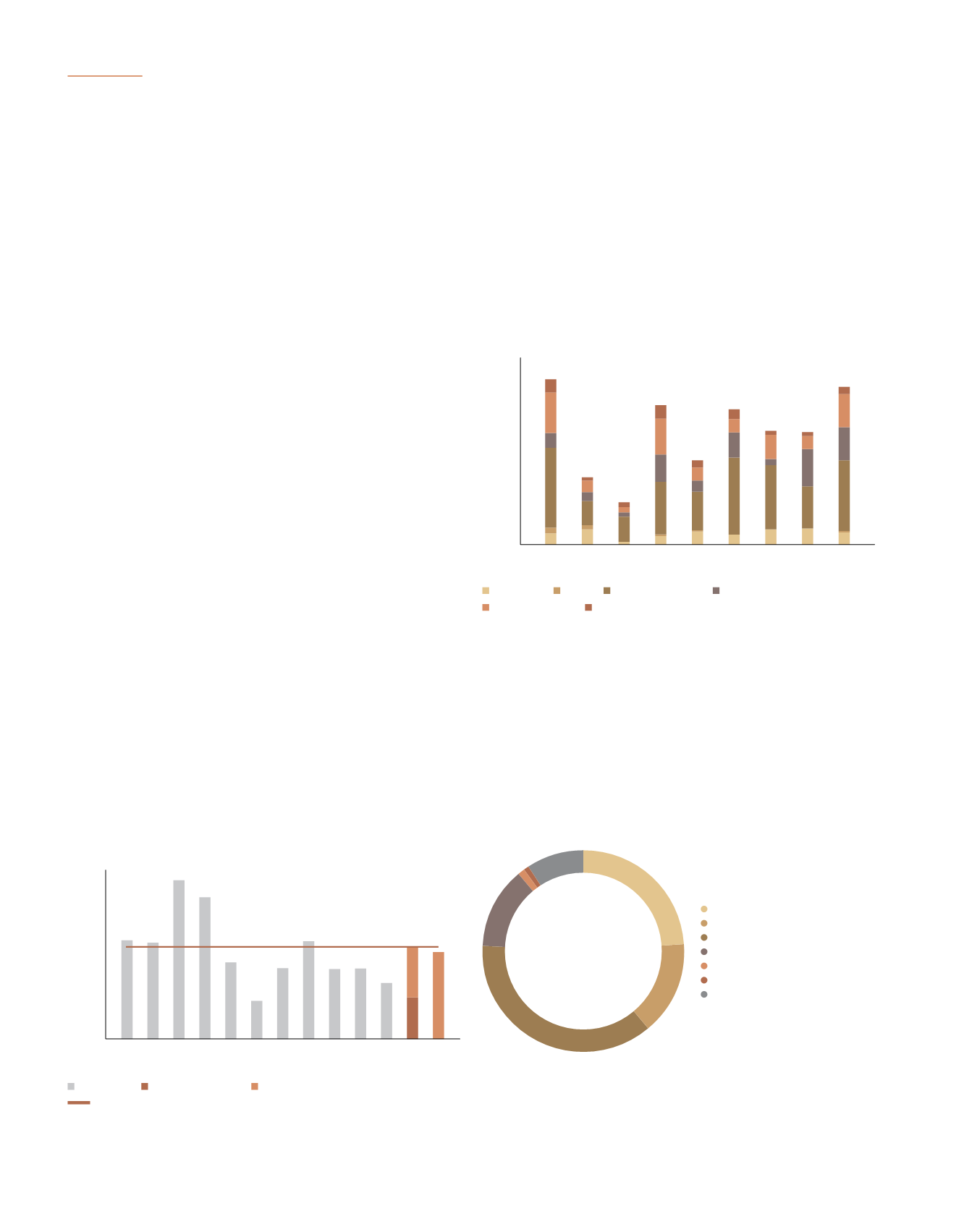

Supply

Around 342,300 sqm of new supply was completed across

Sydney in 2015, significantly below the 10 year annual

average of 557,000 sqm. Only approximately 9% of new

supply (by area) in 2015 was completed without known

tenant commitments.

The forward pipeline indicates that supply will increase over

the next 12 months. There is currently 255,200 sqm of new

supply under construction and another 301,500 sqm at

the planning stages for 2016 (Figure 3). More than 68% of

this supply has a known tenant commitment. Based on the

current projects in the 2016 supply pipeline, the average

development size is expected to increase to 19,200 sqm,

above the 5 year average of 16,300 sqm.

Figure 3: Sydney industrial supply pipeline

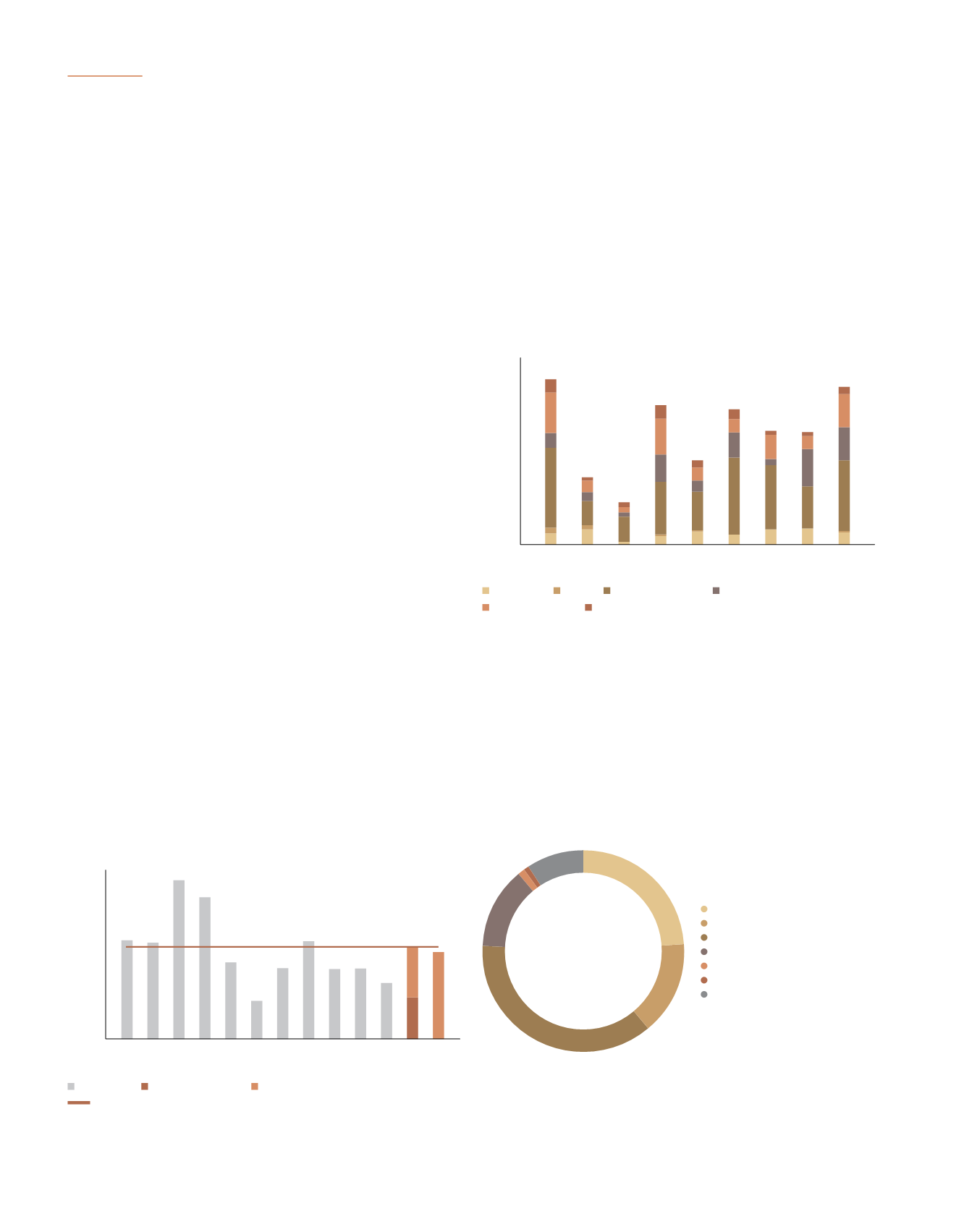

Demand

Occupier demand improved significantly in 2015 with gross

take-up reaching 859,500 sqm, well above the 10 year annual

average of 607,000 sqm (Figure 4). Major storm cell activity in

May 2015 damaged multiple Outer Central West buildings,

resulting in more than 125,000 sqm of occupier relocations.

Vacancy tightened significantly in western Sydney as a result.

Figure 4: Sydney industrial occupier gross take-up by precinct

The outer western precincts of Sydney have captured the

majority of occupier take-up since 2007, with the Outer Central

West accounting for 47% of gross take-up since 2007, much

of which has been developed in this period. The Outer South

West has accounted for 19% of take-up, while the Outer North

West has accounted for 16% of take-up since 2007.

Figure 5: Sydney gross take-up by industry sector:

2013 to 2015

* As at Q4/2015

Source: JLL Research

0

200

500

800

300

600

900

1,000

SQM (‘000s)

100

400

700

Completed Under Construction Plans approved/submitted

10 year annual

2008

2005

2006

2010

2012

2009

2007

2011

2013

2015

2016*

2017*

2014

10 year annual average

Source: JLL Research

* As at Q4/2015

0

600

700

800

1,000

900

SQM (‘000s)

500

400

300

200

100

2008

2010

2012

2009

2007

2011

2013

2015*

2014

Inner West

Outer South West

South Sydney

North Outer Central West

Outer North West

* As at Q4/2015

Source: JLL Research

Manufacturing

Retail Trade

Transport and Storage

Wholesale Trade

Construction

Mining

Other

24%

15%

37%

13%

1%

1%

9%

.84

A-REIT ANNUAL REPORT

2015/2016