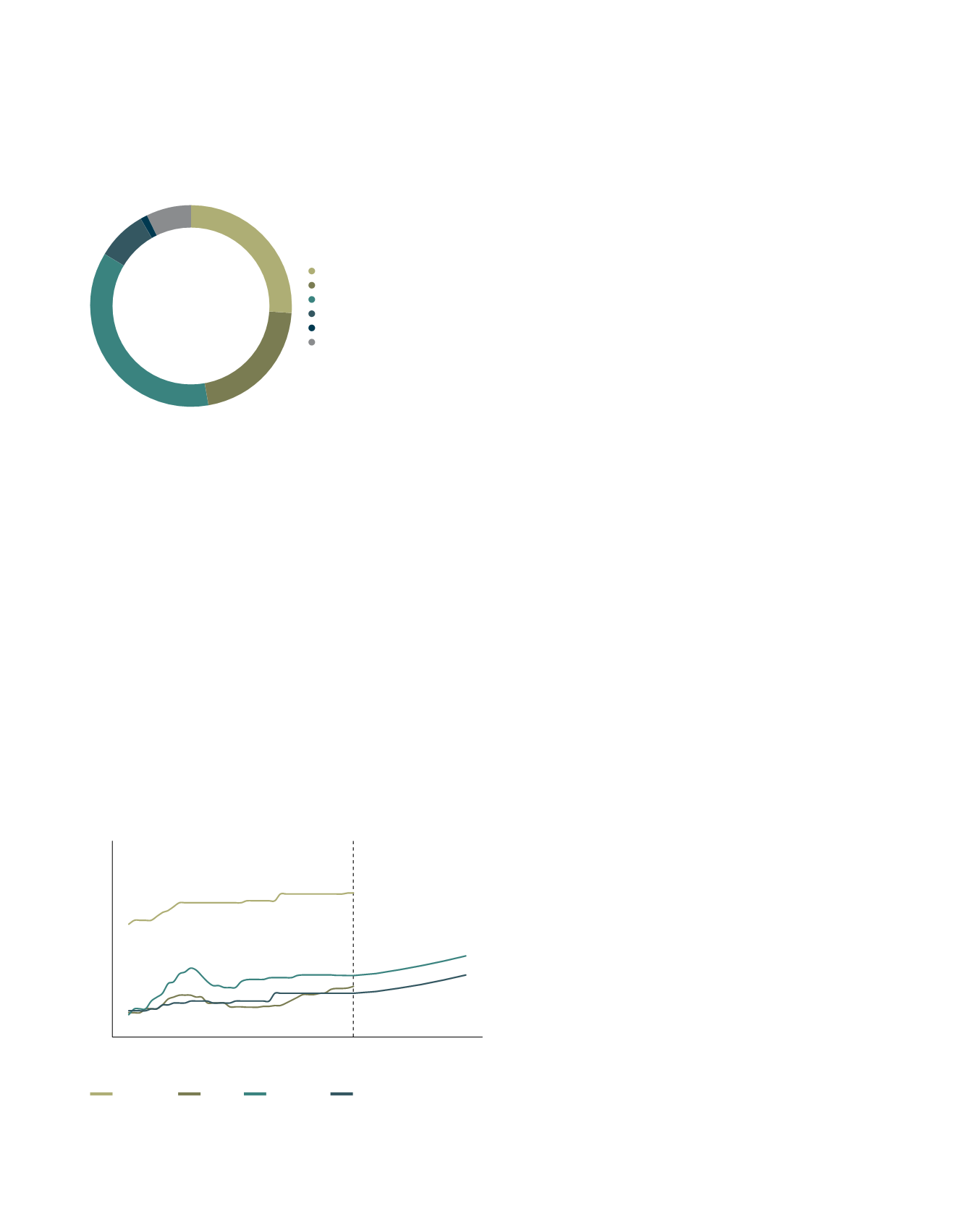

Figure 9: Melbourne gross take-up by industry sector:

2013 to 2015

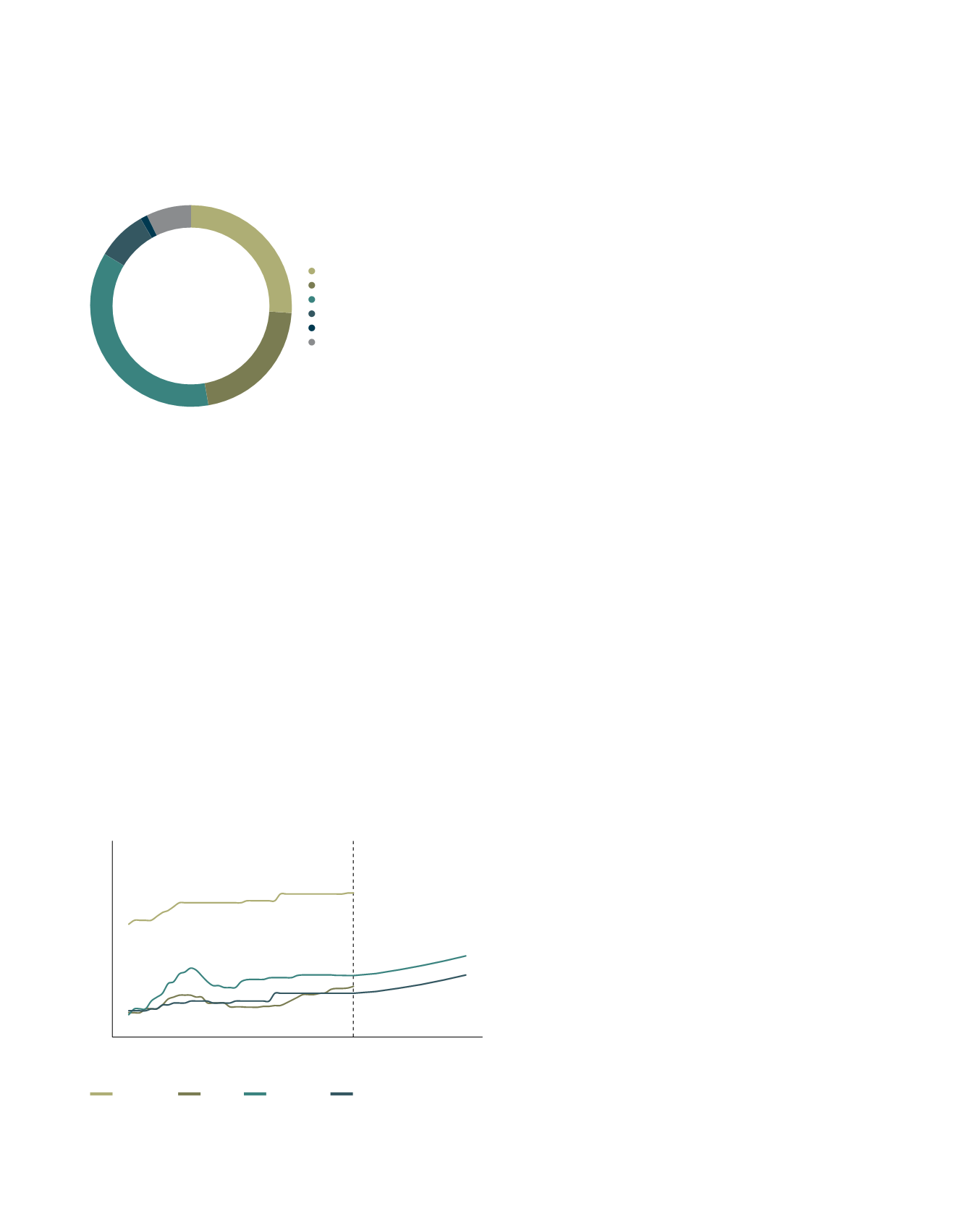

Rents

In the 10 years to December 2015, prime net rents increased

by 1.3% p.a. in the West, 2.9% p.a. in the South East, 2.0%

p.a. in the North and 1.4% p.a. in the City Fringe precinct

of Melbourne in the 10 years to December 2015. Given the

lower land supply in the South East, occupier fundamentals

are more positive and rental growth has been stronger in this

sub-precinct.

As evident in Figure 10, rental growth has been more subdued

in the most recent five years, attributable to a competitive

development environment and a higher rate of speculative

development activity in Melbourne. For example, prime

rental growth was 0.8% p.a. in the South East and 1.1% p.a.

in the West in the five years to December 2015.

Figure 10: Melbourne prime grade net rents

Over the five years to 2020, rental growth is expected to

average 2.3% p.a. in the South East precinct and 2.4% p.a.

in the West.

Outlook – Fundamentals

Indications are that tenant demand continues to improve

and that known tenant briefs in the market will see further

solid take-up outcomes in the near term. Occupier activity is

expected to continue to be driven by the new build market

through pre lease and Design & Construct transactions, with

significant zoned land competing for tenants.

There is expected to be some ongoing shift from the South

East to the West precinct where tenants are not required to

be in the South East, as well as some shuffling of location

by car component and aftermarket manufacturers when

domestic vehicle manufacturing plants cease operating in

the next two years.

Retailers and 3PL operators are expected to drive demand,

while some manufacturing users may relocate from

manufacturing space to distribution focused space. New

supply is likely to remain broadly steady in the short term and

be driven by tenant demand rather than speculative activity.

Outlook – Investment

Strong investment volumes are expected to continue into

2016 as the strong level of supply added to the market over

the past 18 months provides opportunities for investors

looking for prime grade, large format assets with strong

lease covenants as some owners (particularly developers)

look to decrease allocations to Melbourne.

* As at Q4/2015

Source: JLL Research

Manufacturing

Retail Trade

Transport and Storage

Wholesale Trade

Construction

Other

26%

21%

36%

8%

1%

7%

Source: JLL Research

* As at Q4/2015

50

75

100

125

150

Prime grade existing

net face rents $/sqm p.a.

Dec-05

Dec-10

Dec-14

Dec-08

Dec-12

Dec-16

Dec-19

Dec-07

Dec-11

Dec-15

Dec-18

Dec-09

Dec-13

Dec-17

Dec-20

City Fringe

North

South East

West

Forecast

Dec-06

.87

A-REIT ANNUAL REPORT

2015/2016