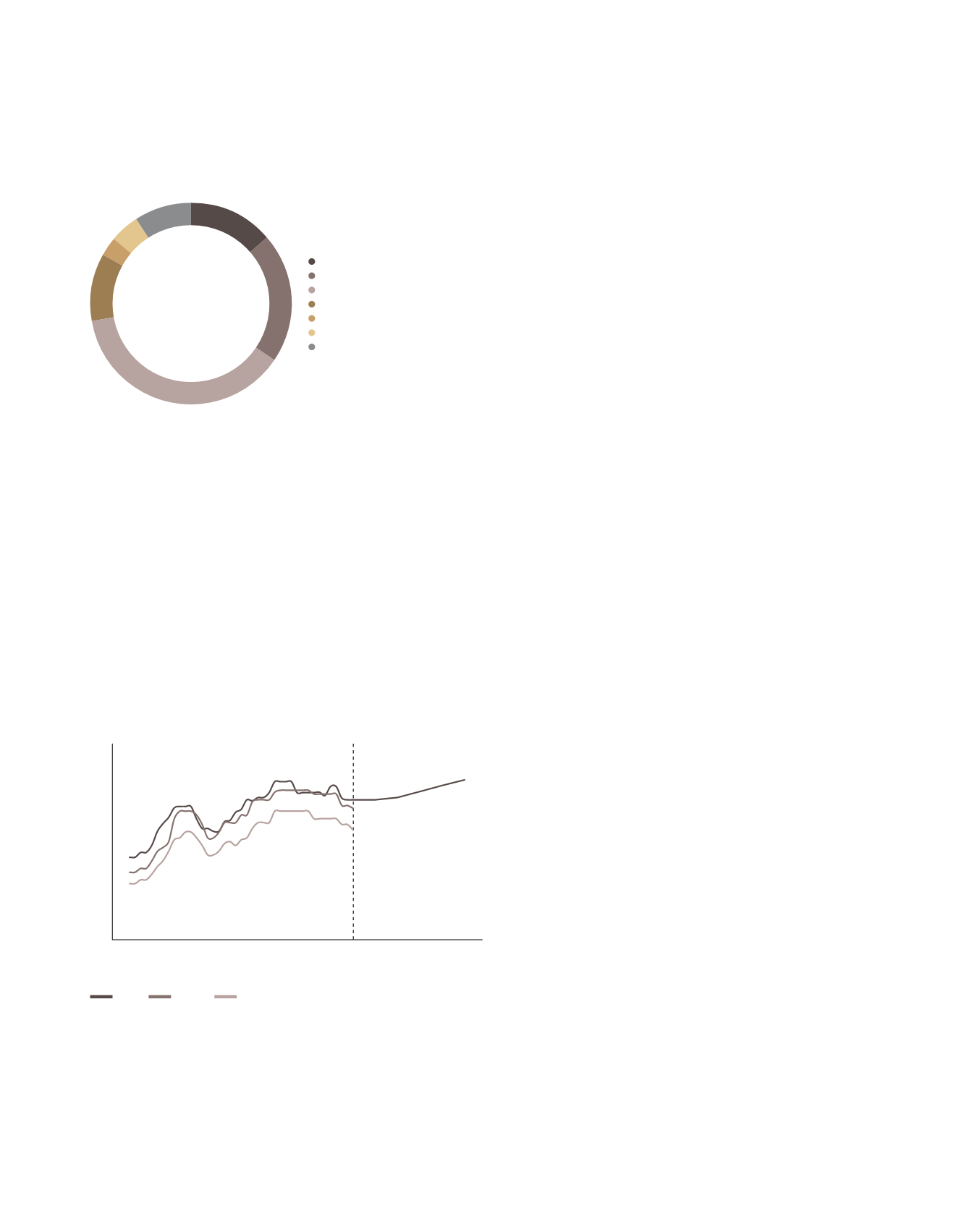

Figure 17: Perth gross take-up by industry sector:

2013 to 2015

The transport and storage sector has accounted for 38%

of gross take-up in Perth between 2013 and 2015. This is

consistent with other markets. Similarly, retail trade (21%),

manufacturing (14%) and wholesale trade (11%) are the

major users in the Perth market (Figure 17).

Rents

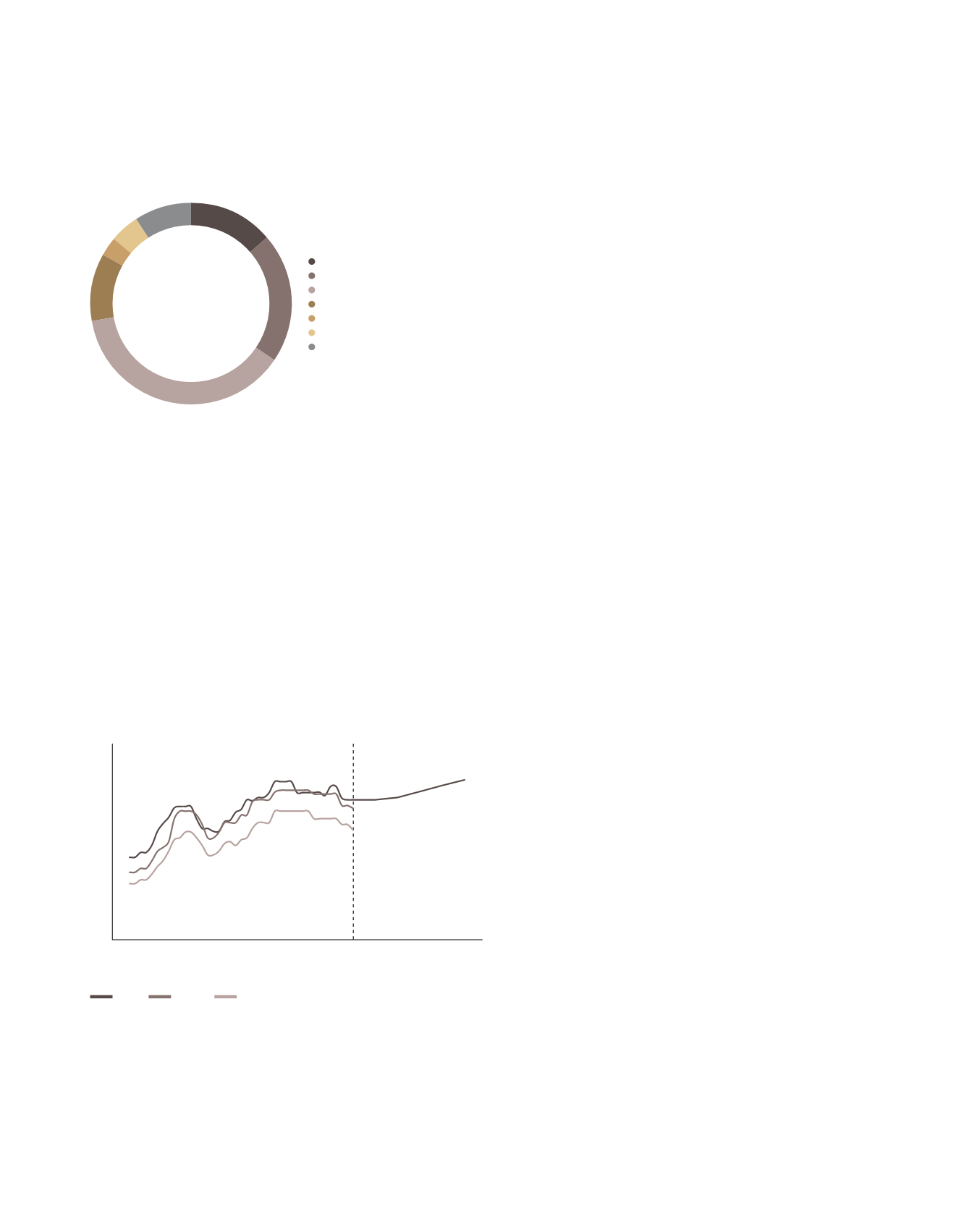

As Figure 18 shows, prime net rents have increased by 2.8%

p.a. in the East precinct, 3.1% p.a. in the South and 3.4% p.a.

in the North in the 10 years to December 2015.

Figure 18: Perth prime grade net rents

Average rents in the East precinct are forecast to remain

steady in much of 2016 and 2017. Over the five years to

2020, prime rents are forecast to grow by only 1.6% p.a. in

the Perth East market.

Outlook – Fundamentals

Looking ahead, housing construction is expected to be one

positive driver of activity in Perth. Low interest rates, strong

growth in household net wealth and more stable consumer

confidence are also expected to stimulate a recovery in retail

spending growth in the medium term and flow on to demand

from traditional industrial occupiers.

Leasing enquiry for prime space remains steady, though

occupiers are taking extended periods to make relocation

decisions. Drawn out negotiating periods are expected to

continue as occupiers adopt a “wait-and-see” approach given

the uncertainty in the economic environment. Encouragingly,

demand from new sources such as the pharmaceuticals and

medical equipment groups have emerged. Furthermore,

demand for hardstand space may increase as mining

construction projects complete and machinery returns

to Perth from construction sites in the North of Western

Australia. Other sources of new activity are groups looking

to consolidate multiple operations and 3PL’s that have been

awarded new contracts.

* As at Q4/2015

Source: JLL Research

Manufacturing

Retail Trade

Transport and Storage

Wholesale Trade

Construction

Mining

Other

14%

21%

38%

11%

3%

5%

9%

Source: JLL Research

* As at Q4/2015

50

75

100

125

150

Prime grade existing

net face rents $/sqm p.a.

Dec-05

Dec-10

Dec-14

Dec-08

Dec-12

Dec-16

Dec-19

Dec-07

Dec-11

Dec-15

Dec-18

Dec-09

Dec-13

Dec-17

Dec-20

East

North

South

Forecast

Dec-06

.91

A-REIT ANNUAL REPORT

2015/2016