INDEPENDENT MARKET STUDY

M E L B O U R N E

Melbourne industrial market

Large corporations have always viewed Melbourne as a

strategic location for national or regional distribution centres.

Overall real estate costs are generally lower in Melbourne

than in other states due to its lower relative land costs, while

distance to the shipping port, as well as links to road and rail

to interstate and national networks make Melbourne an ideal

location for distribution centres.

The Melbourne industrial market also benefits from the Port

of Melbourne being the busiest containerised, automotive

and general cargo shipping port in Australia with the highest

TEU volume per year.

Supply

Approximately 451,300 sqm of new supply was completed

in Melbourne in 2015, only slightly below the 10-year annual

average. Approximately 45% of total new supply was in the

West precinct, followed by the North at 32%, and the South

East at 21%. Overall, more than 82% of new supply in 2015

had a known pre-commitment.

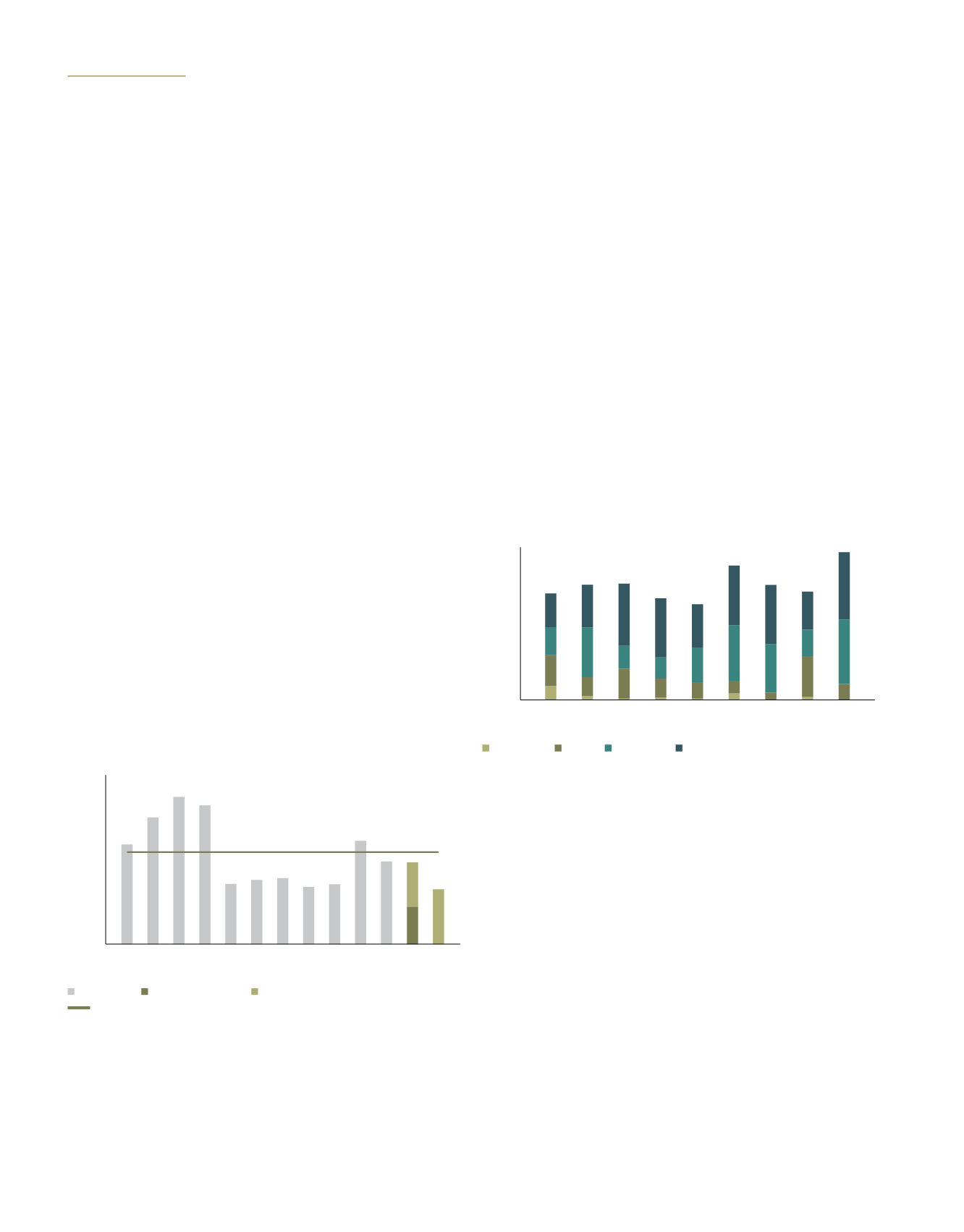

The forward pipeline indicates that 207,200 sqm of new

supply is under construction and expected to be delivered

to the market in 2016, and another 240,500 sqm is at the

planning stages (Figure 7). Currently, more than 95% of the

space under construction in Melbourne has a known tenant

commitment.

Figure 7: Melbourne industrial supply pipeline

The average development size was 14,900 sqm in 2014 and

14,600 sqm in 2015. However, based on the current supply

pipeline the average scale of developments across Melbourne

will increase to 19,500 sqm in 2016 due to a number of very

large, purpose-built facilities that were committed in 2015.

Demand

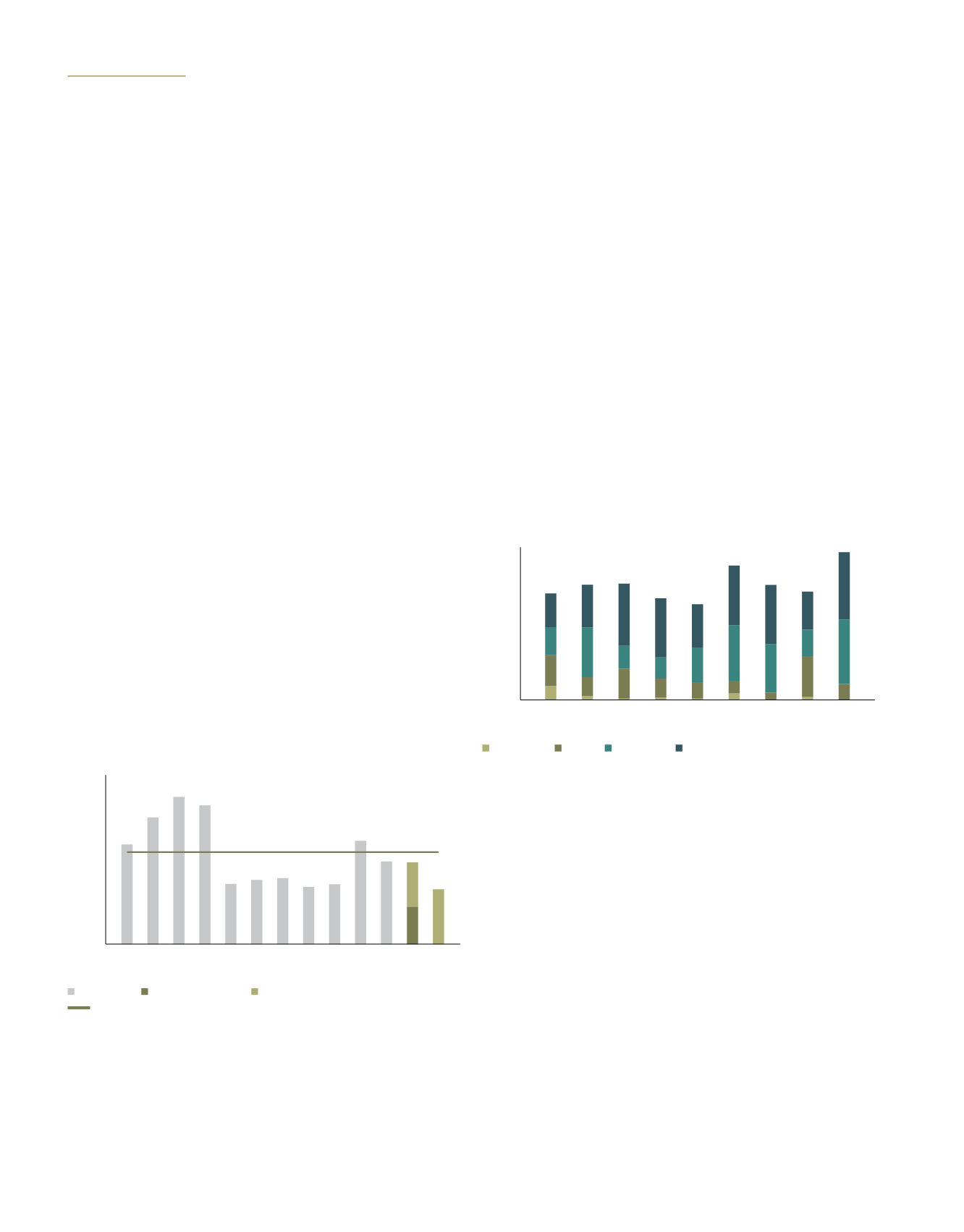

Melbourne continues to have one of the most stable

environments for industrial occupier take-up. Occupier gross

take-up in 2015 reached 694,900 sqm, the highest annual

figure recorded since 2006 and 20% ahead of the 10 year

annual average of 577,000 sqm (Figure 8). Prelease and

design and construct activity continues to be a driving factor

with 87% of gross take-up in 2015 negotiated in the new

build market, emphasising the preference of tenants to be

located in core markets and in modern space.

Figure 8: Melbourne industrial occupier gross take-up by

precinct

The West precinct of Melbourne has captured 45% of

major occupier take-up since 2007, owing to its cheaper

development land base and more readily available

development land supply. Over the same period 34% of

take-up was in the South East precinct.

Take-up in the North declined somewhat during 2011-2013

due to an inactive development market. However, recent

activity around Tullamarine Airport has lifted occupier activity

in this precinct. Overall, the North precinct has accounted for

18% of gross occupier take-up since 2007. Meanwhile, the

City Fringe precinct accounted for only 3% of major occupier

take-up over the same period.

The transport and storage sector has accounted for 36%

of occupier take-up in Melbourne between 2013 and 2015,

followed by the manufacturing industry (26%), retail trade

(21%) and wholesale trade with 8% (Figure 9).

* As at Q4/2015

Source: JLL Research

0

200

500

800

300

600

900

SQM (‘000s)

100

400

700

Completed Under Construction Plans approved/submitted

10 year annual

2008

2005

2006

2010

2012

2009

2007

2011

2013

2015

2016*

2017*

2014

10 year annual average

* As at Q4/2015

Source: JLL Research

600

700

SQM (‘000s)

500

400

300

200

0

100

2008

2010

2012

2009

2007

2011

2013

2015*

2014

City Fringe North South East

West

.86

A-REIT ANNUAL REPORT

2015/2016