As Figure 13 highlights, the transport and storage sector has

accounted for 25% of gross take-up in Brisbane between

2013 and 2015. This is relatively consistent with the occupier

mix in both Sydney and Melbourne. The manufacturing

industry accounted for 30% of take-up, followed by retail

trade with 21% and wholesale trade with 10%. Meanwhile,

the mining sector accounted for only 1% of total gross take-

up, indicating that the industrial property sector’s direct

exposure to the mining and resource sector is minimal.

Rents

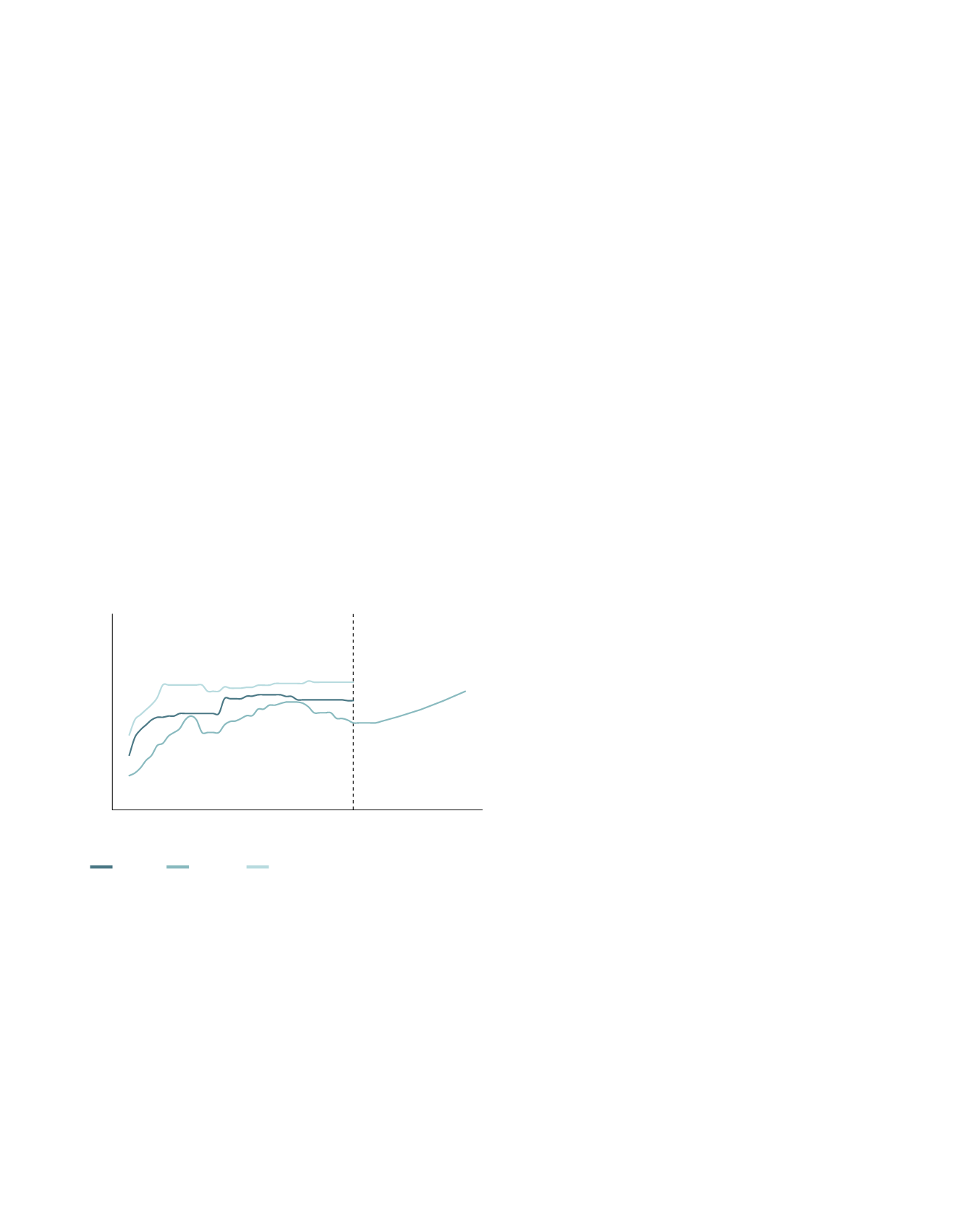

In the 10 years to December 2015, prime net rents have

increased by 2.1% p.a. in the Southern precinct, 2.0% p.a.

in the Northern precinct and 1.8% p.a. in the Trade Coast

precinct of Brisbane (Figure 14). Rental growth has declined

somewhat in the Southern precinct in the last two years due

to greater development competition, higher speculative

development and a moderately higher vacancy level. As a

result, rental growth over the last five years has averaged

-0.3% p.a.

Figure 14: Brisbane prime grade net rents

Upward pressure on rents is expected from 2017 in line

with the projected recovery in the broader economy. Rental

growth in the Southern precinct of Brisbane is forecast to

average 2.2% p.a. over the five years to 2020.

Outlook – Fundamentals

While in recent years the economic growth profile of

Queensland has been below trend, the market is poised for

a recovery with demand supported by the early stages of a

housing investment cycle, improvement in tourism and net

exports as the LNG cycle moves from the investment to the

production stage.

Manufacturers linked to the housing sector along with

logistics providers are leading demand for industrial space

across the Brisbane market. Manufacturers of household

goods and housing construction materials are benefitting

from the growth of residential development in South East

Queensland. Meanwhile logistics companies are being

supported by the continual growth of retailers and third

party logistic providers. Logistic providers are also aiming to

improve operational efficiencies by securing newer facilities

in strategic locations while leasing conditions are favourable.

New estates have been activated along the Logan Motorway

corridor in the last 12 months and strong competition for

tenants has ensued. The leasing market is expected to remain

competitive for landlords in the short term due to a weaker

economy and the take-up of speculative space. This may result

in elevated tenant incentives or longer letting up periods.

Outlook – Investment

Interest in Brisbane core industrial assets remains very strong

with well-leased assets continuing to achieve excellent

sale outcomes. However, a lack of opportunities is forcing

investors to look further up the risk curve, expecting that an

improvement in the economy will support leasing demand

across the asset quality spectrum.

Source: JLL Research

* As at Q4/2015

50

75

100

125

150

Prime grade existing

net face rents $/sqm p.a.

Dec-05

Dec-10

Dec-14

Dec-08

Dec-12

Dec-16

Dec-19

Dec-07

Dec-11

Dec-15

Dec-18

Dec-09

Dec-13

Dec-17

Dec-20

Northen

Southern

Trade Coast

Forecast

Dec-06

.89

A-REIT ANNUAL REPORT

2015/2016