The transport and storage sector (37%) has accounted for

the major share of occupier take-up in Sydney since 2013

(Figure 5). Wholesale trade (13%) and retail trade (15%) have

accounted for a further 28% of take-up combined, followed

by the manufacturing sector with 24%.

Rents

1

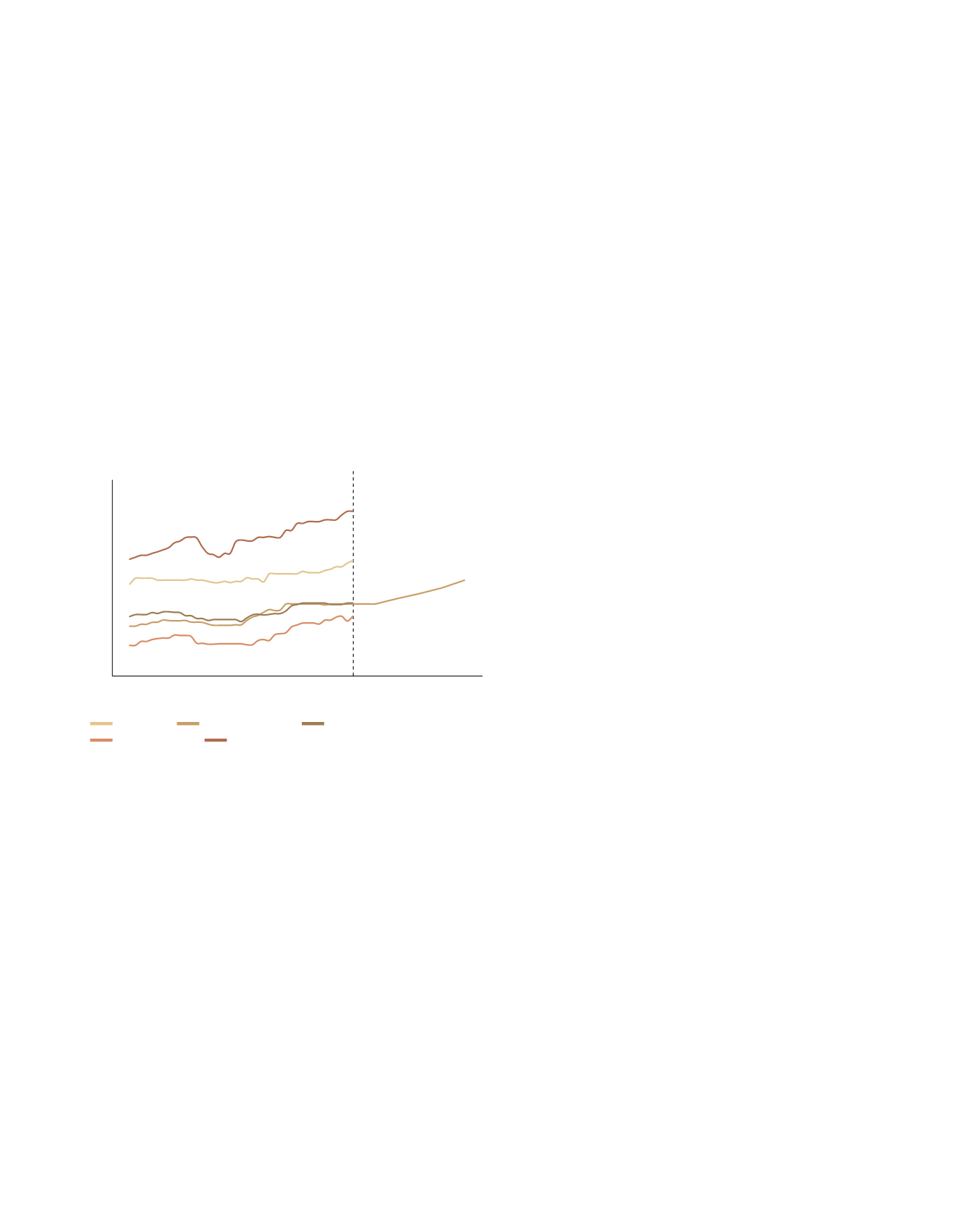

Figure 6 shows that existing prime net rents in the Outer

Central West of Sydney have increased by 1.1% p.a. in the

10 years to December 2015. Growth in the last five years has

been stronger at 2.0% p.a. Meanwhile, prime rents in the

Outer North West have increased 0.6% p.a. and 1.8% p.a. in

the last 10 and 5 years respectively.

Figure 6: Sydney prime grade net rents

Increased occupier activity in the Outer West precincts and

a diminishing stock base in the Inner West and South are

expected to support rents over the short term. Over the next

five years, prime grade net rents are expected to grow 2.1%

p.a. in the Outer Central West.

Outlook – Fundamentals

Demand for prime grade space is expected to remain

relatively strong, driven by organic growth, lease expiry, the

consolidation of operations and new 3PL contracts. Strong

activity recorded in the new build market in 2015 signified

the demand for prime industrial space, which is expected to

continue over the next 12-24 months. Occupier demand for

secondary space is expected to be supported by the ongoing

withdrawal of older stock for residential development in

urban activation precincts.

The supply pipeline over the next two years has been

enhanced by occupiers committing to purpose built

facilities. Developers have a number of new or extended

estates for 2016, expanding the variety of participants in the

development market.

Infrastructure projects will also have a significant impact on

Sydney’s industrial precincts. The WestConnex motorway

will provide increased connectivity to the port for existing

occupiers in the outer west via this major arterial road upgrade.

Outlook – Investment

Strong investment activity is expected to continue into 2016 in

Sydney as current investor demand outweighs the investment

opportunities. Sydney is the largest market in Australia and a

large number of investors continue to seek assets in the Sydney

industrial market, particularly domestic fund managers that

retain underweight allocations to the Sydney market. Sydney

properties are also highly sought after by offshore groups and

offshore mandates through third parties.

Source: JLL Research

* As at Q4/2015

75

100

125

150

175

Prime grade existing

net face rents $/sqm p.a.

Dec-05

Dec-10

Dec-14

Dec-08

Dec-12

Dec-16

Dec-19

Dec-07

Dec-11

Dec-15

Dec-18

Dec-09

Dec-13

Dec-17

Dec-20

Inner West

Outer Central West

Outer North West

Outer South West

South Sydney

Forecast

Dec-06

1 JLL Research produces an average net rent for each industry market. The rents quoted in this report do not account for tenant incentives. Leave incentives

are typically expressed as a percentage of the net rent and generally average around 10% for existing buildings. Industrial lease incentives are typically taken

as rent free periods.

.85

A-REIT ANNUAL REPORT

2015/2016