INDEPENDENT MARKET STUDY

P E R T H

Perth industrial market

Perth has undergone a transformation in the last decade as

a result of the mining investment boom. Population growth

has been among the strongest in the country, while wages

and household asset values have also grown strongly during

this time.

The impact on the Perth industrial sector has been profound.

Major retail brands, third-party logistics providers and other

corporates have grown strongly in the Perth market during this

time. Despite the mining investment booms, take-up in the

direct market by mining industry occupiers in Perth was only

7% of the total between 2007 and 2015 (> 3,000 sqm spaces).

The Perth market is not heavily institutionalised and the land

market is tightly held by private developers. As a result,

speculative construction is scarce and market rents have

grown strongly in the last decade.

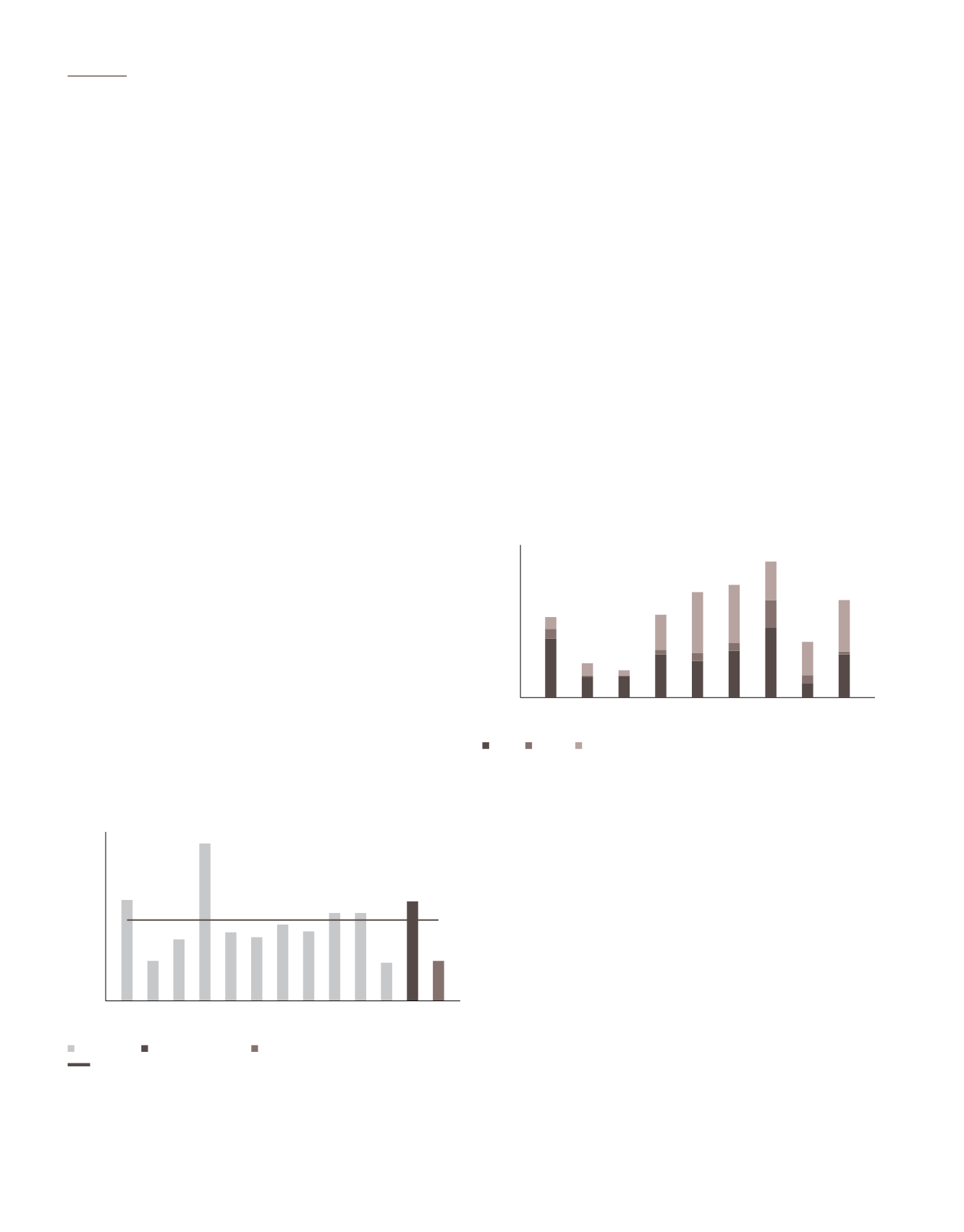

Supply

Approximately 71,700 sqm of supply was completed in

2015, well below the 10 year annual average of 149,000

sqm. However, there is a stronger pipeline of industrial

supply expected in 2016. There is currently 181,800 sqm

under construction and due to complete in 2016 (Figure 15).

Approximately 97% of these projects are pre-committed

and are led by major retail and wholesale groups moving

to purpose-built facilities, including ALDI, CEVA Logistics,

Mainfreight, Kmart and Hitachi. As a result, the average

development size in 2016 is expected to increase to 22,700

sqm, more than double the five year average of 9,000 sqm.

Figure 15: Perth industrial supply pipeline

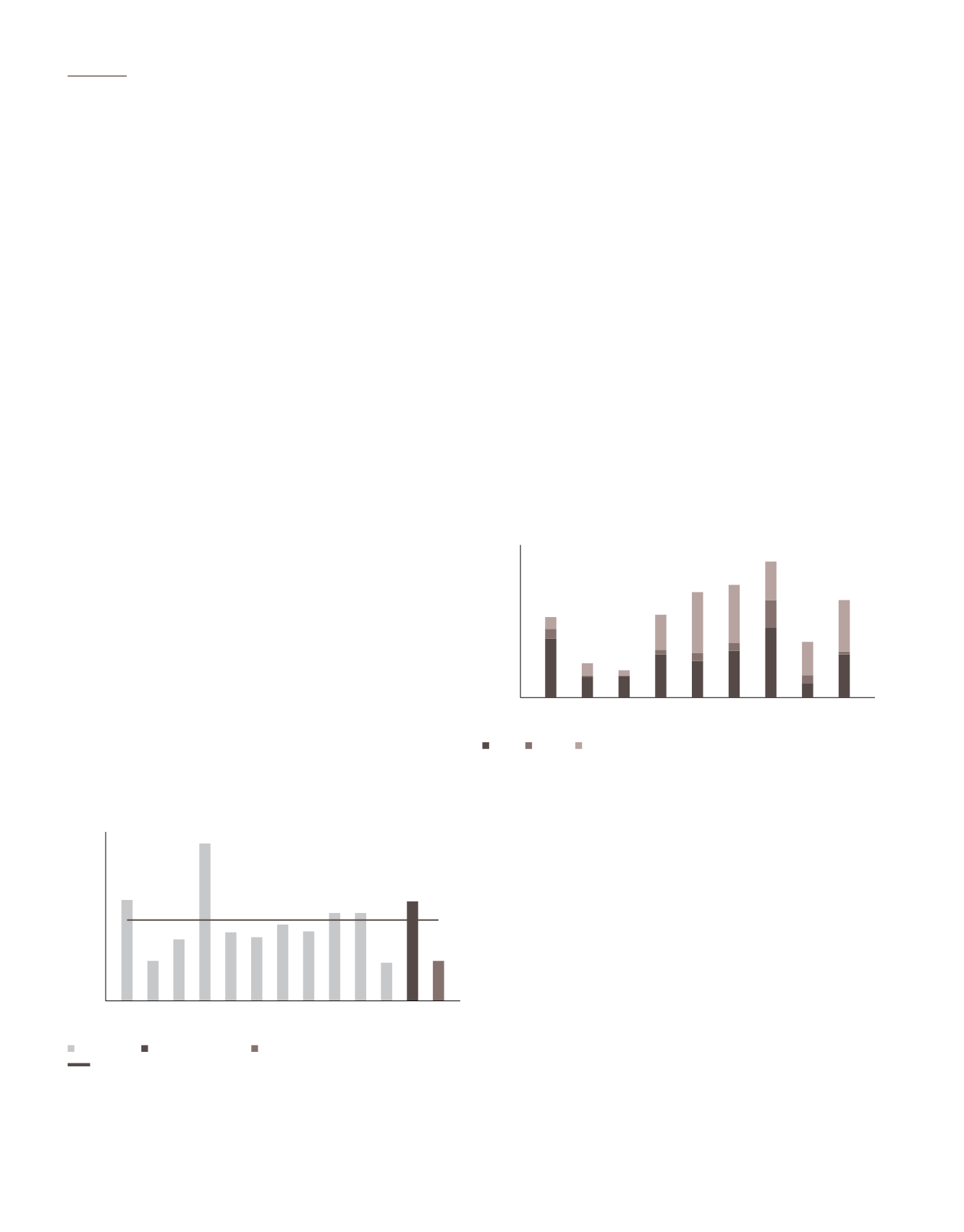

Demand

The Perth market has undergone an above average demand

cycle since around 2010 as a result of commitments to new

facilities as businesses have grown their operations and

required new warehouse and distribution facilities. After a

subdued tenant environment in 2014, occupier gross take-

up reached 262,700 sqm in 2015 (> 3,000 sqm deals), which

is 29% above the 10 year average of 203,000 sqm p.a.

(Figure 16).

Vacancy has reportedly increased in the past year or two due

to some engineering and mining services related businesses

downsizing and rising backfill opportunities. Active tenants

in Perth now have more options than in previous years, while

some tenants that had previously located in the East are now

assessing cheaper land/rent options in the South in an effort

to reduce costs.

Figure 16: Perth industrial occupier gross take-up by precinct

The East precinct has captured 49% of major occupier take-

up in Perth since 2007, having been one of the more active

land development markets since 2006 and its strategic

proximity to the Airport and access to the Port and Perth

CBD. Less development sites in the East going forward

should be positive for owners of modern existing stock.

Take-up in the South has improved since 2010 due to new

land releases. As a result, the South precinct has accounted

for 42% of gross take-up since 2007.

* As at Q4/2015

Source: JLL Research

350

400

SQM (‘000s)

300

250

200

150

0

100

50

2008

2010

2012

2009

2007

2011

2013

2015*

2014

East

North South

* As at Q4/2015

Source: JLL Research

0

50

200

100

250

300

SQM (‘000s)

150

Completed Under Construction Plans approved/submitted

10 year annual

2008

2005

2006

2010

2012

2009

2007

2011

2013

2015

2016*

2017*

2014

10 year annual average

.90

A-REIT ANNUAL REPORT

2015/2016