INDEPENDENT MARKET STUDY

B R I S B A N E

Brisbane industrial market

Brisbane has undergone a steady occupier recovery in recent

years led by large corporate occupiers upgrading facilities,

consolidating operations or creating a major Brisbane

distribution centre for the first time. The Brisbane market has

had favourable underlying dynamics due to the very strong

population growth in Queensland in the last two decades

and the strong economic expansion in regional Queensland

related to resource investments. As a result, the South East

Queensland resident population base has grown considerably,

creating a strong case for industrial occupiers to grow.

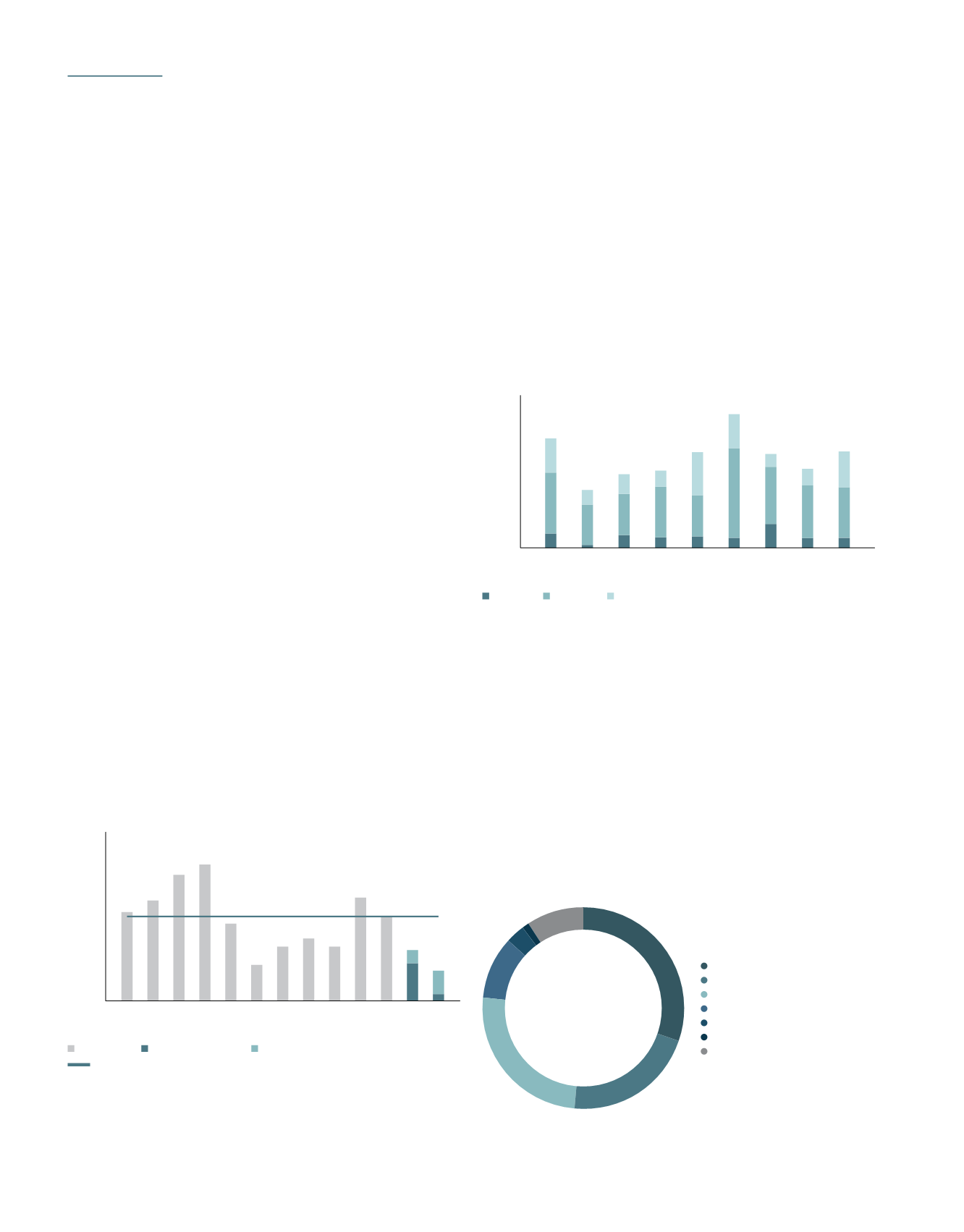

Supply

Approximately 354,400 sqm of new supply was completed

in Brisbane in 2015, in line with the 10 year annual average

of 357,000 sqm (> 3,000 sqm projects). Higher levels of

speculative development have occurred recently, with more

than 33% of supply completing speculatively in 2015. Large

corporates, particularly in logistics and manufacturing,

continue to drive pre lease and design and construct projects

due to their somewhat specialised space requirements.

The forward pipeline indicates that supply will be more

subdued in 2016 with only 163,100 sqm under construction

and a further 52,700 sqm at the planning stages (Figure

11). Almost 27% of supply currently under construction

is speculative. Over the past five years, the average

development size in Brisbane has ranged between 10,000

sqm and 12,500 sqm. Based on the current supply pipeline,

this trend is expected to continue in 2016 with the average

development size sitting at 11,400 sqm.

Figure 11: Brisbane industrial supply pipeline

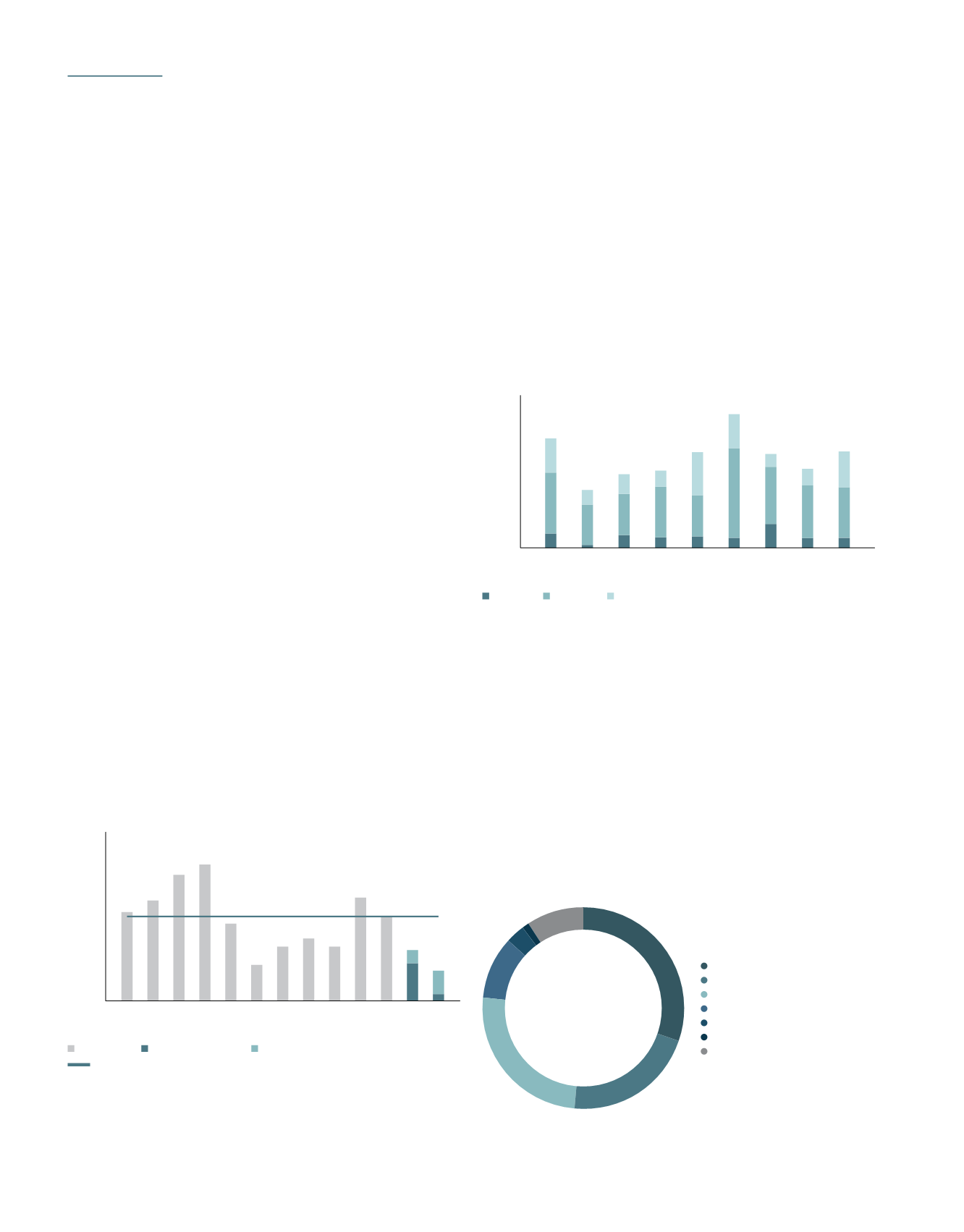

Demand

Gross occupier take-up in Brisbane was 453,700 sqm in 2015

(> 3,000 sqm deals), slightly above the 10 year average of

446,000 sqm p.a. (Figure 12). Occupier activity in 2015 has

been concentrated in the new build market with more than

54% of take-up by area reflecting a pre-lease or a design and

construct deal.

Figure 12: Brisbane industrial occupier gross take-up

by precinct

The Southern precinct has captured the largest proportion

(59%) of major occupier take-up in Brisbane since 2007, owing

to its larger geographical coverage, more development land

and strategic exposure to the Logan Motorway. The Trade

Coast precinct followed, with 28% of take-up over the same

period. Land supply has been constrained in the Trade Coast,

particularly freehold land, resulting in lower construction activity

in this period. Meanwhile, the Northern precinct has only

accounted for 14% of major gross occupier take-up since 2007.

Figure 13: Brisbane gross take-up by industry sector:

2013 to 2015

* As at Q4/2015

Source: JLL Research

0

200

500

300

600

700

SQM (‘000s)

100

400

Completed Under Construction Plans approved/submitted

10 year annual

2008

2005

2006

2010

2012

2009

2007

2011

2013

2015

2016*

2017*

2014

10 year annual average

* As at Q4/2015

Source: JLL Research

600

700

SQM (‘000s)

500

400

300

200

0

100

2008

2010

2012

2009

2007

2011

2013

2015*

2014

Northen Southern Trade Coast

* As at Q4/2015

Source: JLL Research

Manufacturing

Retail Trade

Transport and Storage

Wholesale Trade

Construction

Mining

Other

30%

21%

25%

10%

3%

1%

9%

.88

A-REIT ANNUAL REPORT

2015/2016